For a company that makes equipment that tests diseases like cancer -- and the coronavirus -- such specialization should be easily heard about -- and attract the attention of other companies.

Thus, it didn't come as a surprise that another company - American laboratory equipment manufacturer Thermo Fisher Scientific Inc - became interested and now wants to buy Qiagen NV, the European diagnostics firm, for $10 billion.

The takeover proposition marks the biggest healthcare acquisition so far this year. The timing of the buyout makes a lot of sense for both companies, but the seller looks to be on the sweeter side of the deal.

The buyout will give investors 39 euros in cash for each Qiagen stock, Thermo Fisher disclosed on Tuesday. That equates to 24 percent higher compared to Monday's closing market price.

Qiagen also sells other products, like food and forensic testing equipment. Bloomberg earlier reported that the two companies were about to finalize an agreement after resuming talks that started late in 2019.

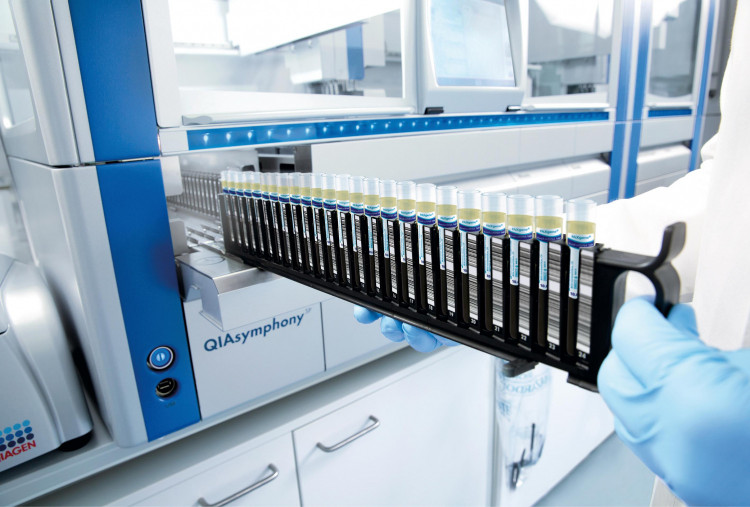

Qiagen analyzes DNA and proteins from biological samples and submits the results for further diagnostics. The novel coronavirus, and buyout speculation, has given the company's stock a good amount of boost.

Qiagen's stocks dropped in the final quarter last year, after news that its chief executive officer was leaving the company. An initial approach from Thermo Fisher sent its stock soaring the next month, but those meetings failed and the stock plunged at the end of the year.

The buyout would be one of Thermo Fisher's biggest investments after it shelled out more than $13 billion for Life Technologies Corp. to acquire DNA-testing capabilities in 2014.

Qiagen's latest figures show the company is capable of bringing sales and growth. Revenue is seen to rise at an average year rate of 6 percent in the next four years. What's even interesting is that Thermo Fisher has in the pipeline revenue synergies valued at $200 million after the signing of the deal, suggesting total operating profits would be around $780 million based on 2023 projections.

When the new virus emerged out of China in January, Qiagen quickly buckled down to work and detected the coronavirus in bodily secretions. The test is now being analyzed at four medical facilities in China, including one in France. The testing produces results in around one hour.

Thermo Fisher has tapped the services of Morgan Stanley and JPMorgan for guidance and advise on the acquisition, while Qiagen hired Barclays Bank and Goldman Sachs.