SoftBank's failed gambles made through its $100 billion Vision Fund is expected to drive the company into its first annual loss in over 15 years. According to the Japanese conglomerate, its tech-focused fund is expected to book a loss of around 1.8 trillion yen.

In a statement released on Monday, Softbank revealed that the Saudi-backed fund has pushed it to its third consecutive quarter of losses. Total annual operating losses have now reached over 1.35 trillion yen. Softbank attributes the fund's extremely poor performance to the "deteriorating market environment" exacerbated by the ongoing economic effects of the coronavirus pandemic.

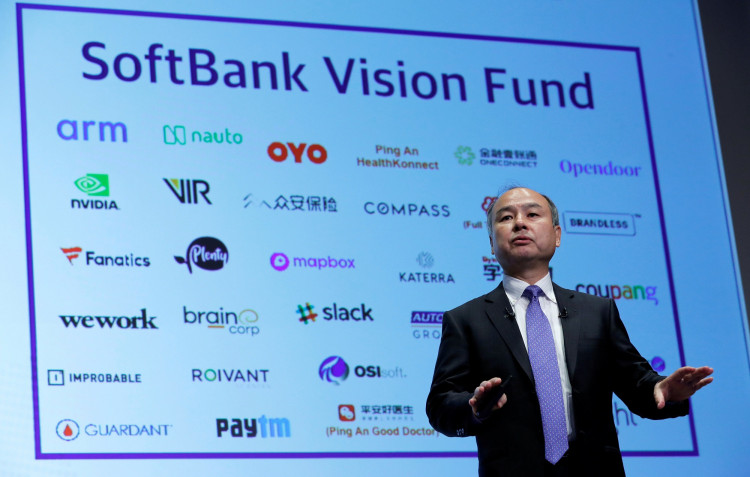

The dire market environment has made it difficult for the bank and its founder and CEO Masayoshi Son to redeem its reputation among global investors. The large bets made by the company in tech startups such as WeWork and Uber have mostly erased the gains made by Softbank on other investments over the past quarters.

The bad bets have placed massive pressure on the company's finances, draining its resources and reduced confidence in its portfolio. The overall outlook for the company in the coming quarters has also remained negative given the current health and economic crisis. Son was unable to predict the pandemic's effects on Softbank's business, which has already undermined his previous predictions.

Two months ago, Son had claimed that the company's prospects are now turning around and that it is now on the road to recovering. Softbank was forced to make major selloffs of WeWork's core assets to raise cash to cope with losses.

Following the WeWork fiasco, investors such as Elliott Management had clamored for the company to provide greater transparency when it came to transactions made by its Vision Fund. Softbank has so far not disclosed which of the Vision Fund's investments will be marked down for the fourth quarter, except for a number of obvious ones.

Softbank had stated that it would be booking an 800 million yen loss on investments it made in WeWork and satellite operator OneWeb. The later had filed for Chapter 11 bankruptcy last month after SoftBank had stopped providing capital. SoftBank's is estimated to have lost a net of around 750 billion yen in OneWeb.

Softbank's share prices had dipped by a further 3.4 percent ahead of its statement this week. Its shares have so far fallen by more than 11.7 percent since the start of the year. Last month, the company announced that it will be launching its biggest-ever buyback program to prop up its share prices.