SoftBank Group Corporation posted an overall operating loss of $12.7 billion (1.36 trillion yen) in the 12 months ended March. It also reported a net loss of $8.96 billion (961.6 billion yen) on Monday. Softbank admitted the losses for 2019 are the worst ever in the company's 39-year history.

SoftBank also took a $7.5 billion loss on other tech investments, which it mostly blamed on the economic shock caused by the COVID-19 pandemic. The outbreak quickly worsened underlying problems at many of SoftBank's bets on unproven startups.

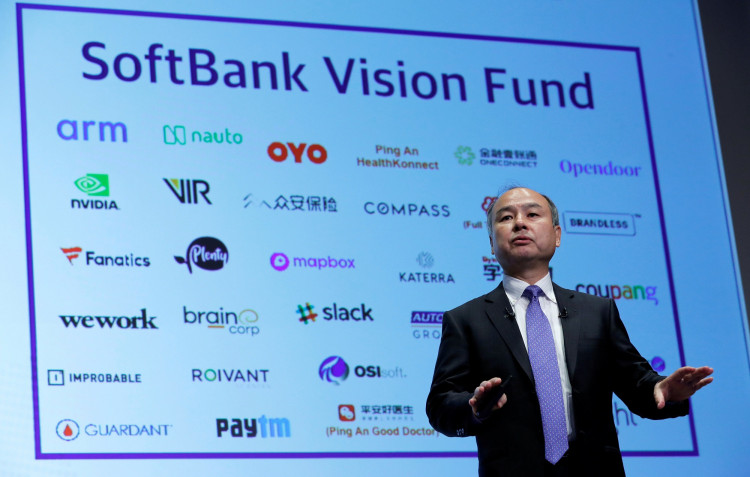

Vision Fund, the world's largest technology-focused venture capital fund, has reported an $18 billion (1.9 trillion yen) operating loss for the fiscal year ending March, helping push parent firm SoftBank to its largest-ever annual loss. It is capitalized at more than $100 billion.

SoftBank admitted it's been "adversely affected" by the global COVID-19 pandemic. It warned if the COVID-19 pandemic continues, it expects the uncertainty in its investment businesses will remain in the next fiscal year.

SoftBank's woes are, however, mostly being blamed on poor investment decisions by Masayoshi Son, its flamboyant billionaire founder and CEO. Son is being criticized by investors for pouring money into start-ups such as the WeWork, which lost $2 billion in 2018 and is considered Son's biggest investment failure.

In April, SoftBank scrapped a plan to buy up to $3 billion WeWork shares as part of a restructuring program. Despite this belated move, SoftBank Group and Vision Fund have already committed more than $14.25 billion to WeWork.

WeWork's valuation now stands at only $2.9 billion, down more than 90% from its peak. SoftBank has invested more than $10 billion in WeWork.

As a result of Son's missteps with WeWork, Vision Fund said it was working with firms in its portfolio to prepare them for a further deterioration in business conditions. In February, Son admitted he'd made "poor" investment decisions and expressed regret as he said net profit had plunged nearly 70% for the nine months to December.

With global stock markets plunging due to the coronavirus pandemic, SoftBank in March announced a plan to sell $41 billion in assets to finance a stock buy-back, slash debt and increase cash reserves. The WeWork debacle has his SoftBank hard. As a result of the fiasco, Softbank has struggled to raise funds for its second $100 billion Vision Fund.

Another failed investment being blamed on Son is Uber Technologies. Uber's disappointing public debut in May 2019 was followed by the WeWork fiasco in September. The drop in Uber's share price was responsible for $5.2 billion of Vision Fund's losses in the period.

WeWork contributed $4.6 billion and another $7.5 billion came from the rest of the portfolio, SoftBank said. The $75 billion the Vision Fund invested in 88 companies as of March 31 is now worth only $69.6 billion.