As they did in the aftermath of the Great Recession from 2008 to 2009, U.S. corporations are again calling for the creation of a more inclusive society after the COVID-19 pandemic revealed they had done almost nothing to advance a lot of those "left behind" a decade ago.

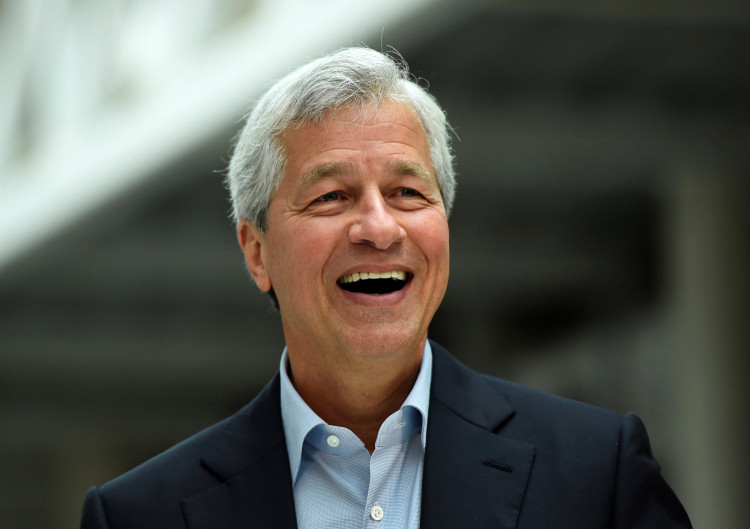

This time, the call to act on behalf of poor Americans is being made by JPMorgan Chase CEO Jamie Dimon. He sent a memo to company staff Tuesday, saying companies like JPMorgan should use the pandemic to build an economy with opportunities for "dramatically more people."

The last few months have laid bare the reality far too many people still live on the edge, wrote Dimon, a billionaire with a net worth of $1.2 billion. Based in New York City, JPMorgan is the largest bank in the U.S.

Dimon claims the bank has moved towards more inclusivity over the past few months. He revealed the steps the bank has taken to support customers and employees. He said it's his fervent hope the United States use the pandemic crisis to rebuild an economy that creates and sustains opportunity for larger numbers of people, especially those left behind for far too long. He defined an inclusive economy as one where there is widespread access to opportunity.

He also said the last few months have painfully confirmed that far too many Americans are living on the edge, or from paycheck-to-paycheck without enough money to handle sudden emergencies. Dimon said it's unfortunate low-income communities and people of color are being hit the hardest by the economic crisis. The pandemic is also worsening health and economic inequities already unacceptably high.

He emphasized an inclusive economy is a stronger, more resilient one. He also said the pandemic must serve as both a wake-up call and a call to action for business and government. These institutions must now think, act, and invest for the common good. They must also confront the structural obstacles hindering inclusive economic growth for many years.

But back in the real world, Dimon said JPMorgan had approved more than $45 billion in new credit for clients hit by COVID-19. This amount includes more than $6 billion to hospitals and healthcare companies, educational institutions, and state and local governments.

Dimon said the bank has made it easy to enroll in a payment assistance program to help customers struggling financially. JPMorgan has assisted with more than 1.5 million customer accounts, including delaying payments and refunding fees. It's also putting its capital and liquidity to work to help large and small clients survive the pandemic crisis, pay employees and bills, and provide the essential goods and services.

For hundreds of thousands of homeowners, JPMorgan has delayed their mortgage payments for at least three months. These clients also won't be charged a late fee or penalty during this time.

Dimon said JPMorgan's priority from the outset has been to continue providing uninterrupted service to clients and customers. At the same time, the bank was working to support and provide a safe work environment for its employees and helping communities badly hard by the pandemic.