The symbiotic relationship between China and the U.S. will prevent any complete economic decoupling of the world's top economic powers - although both appear to want it, according to a leading China official.

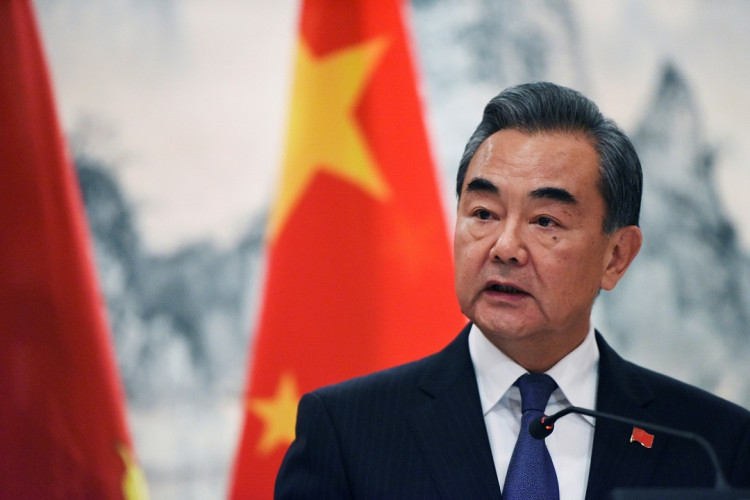

China's Foreign Minister Wang Yi said this week it was "unfeasible and unreasonable" for the U.S. to decouple from China. He said efforts by the administration of U.S. President Donald Trump to decouple go against market norms and against the interest of companies. Any action to do so will boomerang and hurt the U.S. He said China would become the world's largest economy.

"The so-called 'decoupling' argument is unfeasible and unreasonable," Wang said. "It is a dead-end doomed to go nowhere. Any attempt to decouple from China is to decouple from the future largest economy in the world."

Wang called the Trump administration's claim it wanted to decouple "unilateral bullying." He asked the world, especially Europe, to resist Trump's bullying. Wang said China and Europe shouldn't allow talk of decoupling to disturb existing international industrial chains.

"As independent countries, of course, we must protect our economic sovereignty - including digital network sovereignty - but this doesn't mean we should close off our markets to one another," Wang said.

He promised to defend multilateralism in the face of "the constant challenge of unilateralism against the international order" by the Trump administration.

In a similar view Wednesday Indian economist Eswar Prasad, the former head of the International Monetary Fund's China division, said an economic decoupling of the U.S. and China was "a long way away." He said both economies were closely tied. "After all, it's very hard for the two largest economies in a way to stop bumping into each other in various dimensions."

China, however, sees some merit in breaking away from the U.S. dollar-denominated international financial system. Its desire to increase the importance of the yuan in world financial markets is an important reason China has been pushing for its greater use in trade and financial transactions.

China is also opening up its capital markets to foreign investors and liberalizing its foreign-exchange rate regime to some extent. Prasad said China realized domestic capital market development was crucial for China's sustained economic growth - especially in the time of COVID-19.