The exchange rates for different currencies in the world have their advantages the same way they can be disadvantageous, and if not well understood, it could lead to a financial crisis.

Better financial strategies need to be implemented now that businesses are evolving into multi-national companies. If you are looking to start a business in a foreign country, it is important to understand the value of the currency there.

For example, 1 USD is equivalent to 0.88 Euro while it is also equivalent to 6.27 Ghanaian Cedi. The difference in the rates at which these currencies are exchanged definitely gets confusing, and it can cause an increase in risks.

Multinational businesses require capital in different currencies, and the options by which the money is raised are limited to three. It is either loaned from the domestic country where the interest rate is possibly not favorable or loaned from the country where the business is based and well known.

The second option has its challenges because the exchange rates fluctuate, which in return affects the interest rate. Since these two options have high risks of loss, what else can be done? This is where the third option comes in, currency swap.

Table of Content

What is a Currency Swap?

How does Currency Swap work?

Advantages of Currency Swap

How to Hedge Risks Using Currency Swap?

Types of Currency Swaps

Conclusion

What is a Currency Swap?

A currency swap is a financial transaction that occurs between two parties with different currencies. It is a form of acquiring a loan, and it involves the exchange of the principal amount and interest in one currency for the equivalent principal amount and interest in another currency.

This financial strategy is not limited to business owners alone, but investors and the government are also employing it. This implies that it is a safe way of avoiding high risks. Two parties come to an agreement on the principal amount to be exchanged at the time of inception and at maturity; the same amount is also exchanged with the fixed or floating interest rate regardless of the difference in the exchange rate.

A swap bank sometimes helps with this exchange, especially if the two parties desire to remain anonymous. For greater expertise in exchanging currencies without using foreign banks, it is best to go through a swap bank to allow coordination of the agreement.

How does Currency Swap work?

The contract begins with two parties making an agreement on the principal amount to be exchanged and the currencies to be used. The agreement spans for a specific period, and it ends with the payment of both the principal amount and the interest agreed on. The interest can either vary or be fixed, but it depends upon the decision of both parties. These financial partners are obligated to make the exchange according to the determined rate regardless of the currency's local exchange rate. For example, a company based in the US can agree to make an exchange of 5,000,000 USD for 10,000,000 Euros, which means it is done at a rate of 1 USD to 2 Euros.

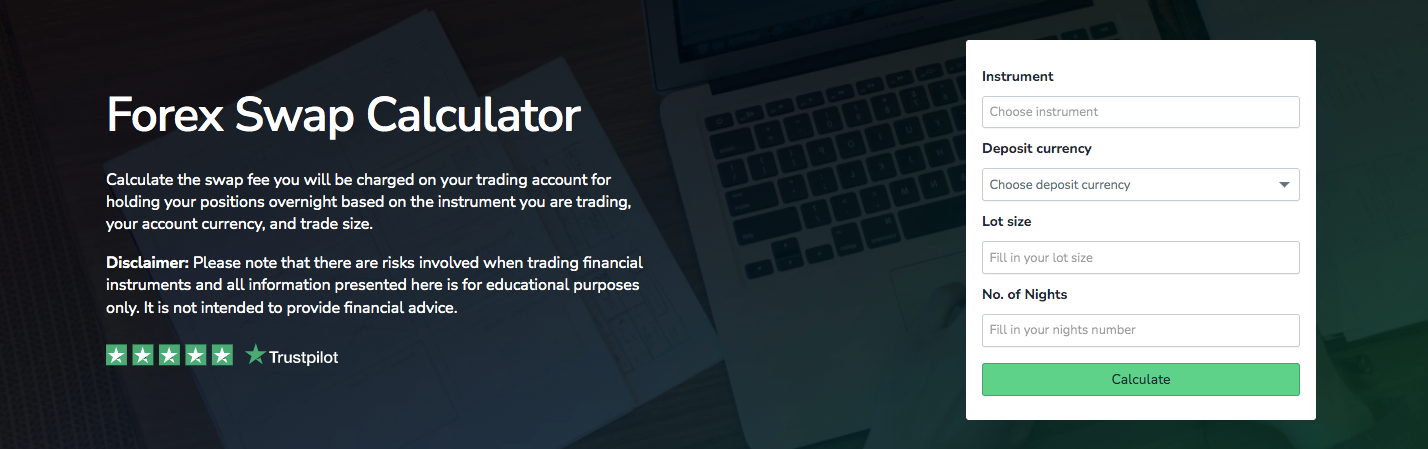

To avoid unforeseen fees towards the end of the agreement, a method to calculate the swap fee has been created. The swap fee is the amount charged by the swap banks for each transaction, and it is calculated according to the period of time. The swap rate is sometimes negative rather than it being positive, which leads to loss on one end.

How to Use Currency Swaps to Hedge Risk

Advantages of Currency Swap

Currency swap does a lot in helping a company run smoothly, and companies should be open to this strategy of trading because of the number of advantages it offers. The major advantage of a currency swap is the ability to hedge risks encountered in foreign currencies. These risks stem from the inconsistent exchange rates in the global market, which is a hindrance for multinational companies. The swap avoids exchange rates exposure provided by foreign banks by allowing a predetermined rate by the two parties.

A currency swap provides a lesser interest rate than what the banks offer, and both parties benefit from the agreement. The company's financial history can also be kept a secret from outsiders since it does not appear on the balance sheet. Loans have the tendency of discouraging investors, so keeping the swap transaction off the balance sheet puts these companies in a better light. It is not to deceive investors but avoid misjudgments and lack of trust.

Currency swap has a level of flexibility that allows investors to lock in fixed exchange rates for long-term purposes. This allows investors and corporations to make profits when using one currency while saving in another. Plus, currency swaps have high liquidity, and the risk inherent in performing currency swaps is minimal.

How to Hedge Risks Using Currency Swap?

Most investors who use currency swaps to hedge risks do so using currency forward contracts. A forward contract is an agreement between two parties on the date the transaction is made and at what rate. The global market is studied, and the contract is made towards the date that is most likely to favor the exchange rate. No company wants losses, and all the opportunities to avoid them should be tried. There is a possibility of loss at the time of maturity during currency swap; that is why it is best to work with a predicted future date.

Types of Currency Swaps

There are two main types of currency swaps:

- Fixed-for-fixed currency swap: This involves exchanging fixed interest rate payments in one currency for fixed interest rate payments in another currency

- Fixed-for-floating currency swap: This currency swap involves exchanging fixed interest payments in one currency for floating interest payments in another currency. In this type of currency swap, although the interest rate on one of the currencies is adjustable, the principal amount remains the same

Conclusion

Currency swaps are used by individual investors and organizations to reduce their exposure to price fluctuations, and it is a good way for you to take advantage of the present or future market conditions to manage your debts or make profits.