As domestic producers ramp up production, the White House confirmed last week that it would release one million barrels of oil per day from the nation's Strategic Petroleum Reserve (SPR) for the next six months.

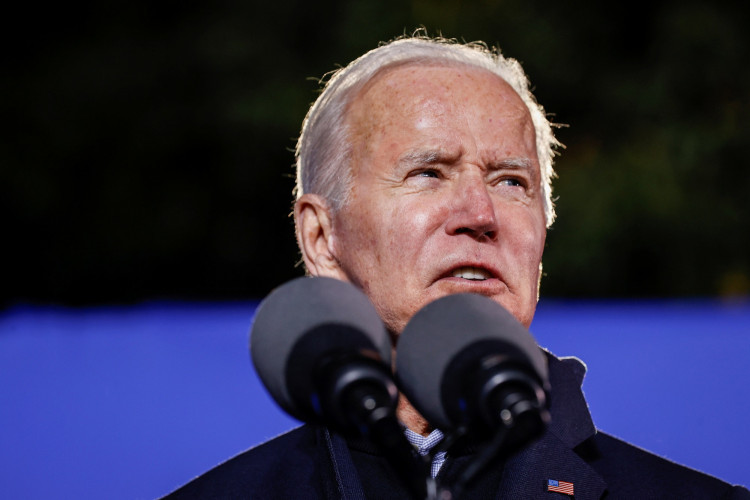

President Joe Biden looked optimistic that gas costs would fall as a result, albeit he couldn't say how much.

"It will come down, and it could come down fairly significantly," he said, adding that the drop in price could range from ten cents to thirty-five cents per gallon.

"The scale of this release is unprecedented: the world has never had a release of oil reserves at this 1 million per day rate for this length of time," the Biden administration said in a press release. "This record release will provide a historic amount of supply to serve as [a] bridge until the end of the year when domestic production ramps up," the release added.

Biden stated that he is waiting to see if other American allies will help to the release.

He predicted that it might range from 30 million to 50 million barrels, adding that "the higher the number, the more likely the prices to come down."

Despite the fact that it has been several days since the announcement, the national average price for a gallon of regular gas is still well above $4, and prices have even topped $6 in several parts of the country. Gas prices have risen by nearly seventy cents per gallon since Russia's invasion of Ukraine five weeks ago.

So, what went wrong? Americans will have to be patient, according to CNBC, as Biden's plan to lower gas costs could take weeks. Expect prices at the pump to drop "maybe a penny every day or two," according to Patrick De Haan, head of petroleum analysis at GasBuddy.

"We could see the national average price of gasoline fall back under $4 a gallon in the few weeks ahead. Diesel should fall back under $5 a gallon nationally, as well," he continued.

Gas prices could reduce by around 25 cents, according to Robert Weiner, a professor at George Washington University's business school.

"Based on past experience, we have some evidence on the effect of SPR releases on oil prices," Weiner told The Hill.

He cited supply interruptions a decade ago as a result of the Libyan civil conflict and the Obama administration's subsequent SPR release. However, according to AAA, there are still a number of unknowns that might cause the energy market to tremble.

"The global oil market remains highly volatile, so additional news that threatens supply could put upward pressure on oil prices," it said in a release.