In a recent study by a U.S. business group, American businesses' optimism toward China has reached a record low.

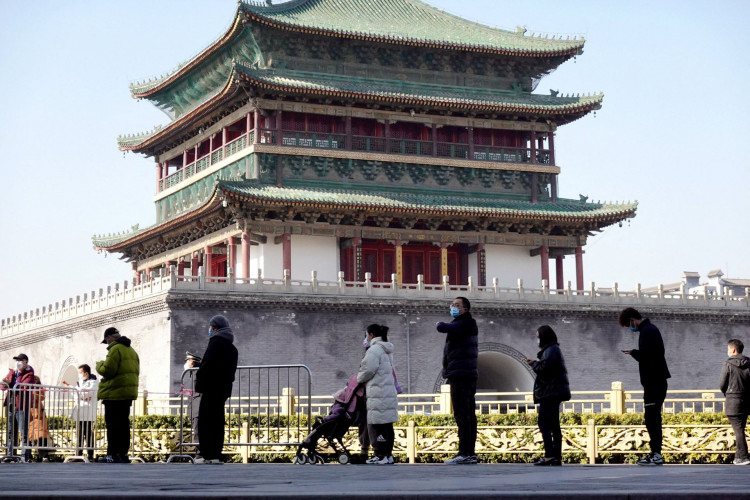

President Xi Jinping's Zero-COVID-19 policy has led more than half of them to postpone or cancel investments.

According to a survey by the U.S.-China Business Council, pandemic-related shutdowns cause American businesses in China more trouble than deteriorating relations between Beijing and Washington.

In the second-largest economy in the world, only 51% of respondents indicated some confidence about their five-year company outlook, a significant decline from 69% the year before.

The report claims that local limitations on consumer demand and the "looming threat" that enterprises would once more be compelled to suspend operations owing to lockdowns partially have "eroded trust" in the business environment.

According to the council, a private association of more than 270 American corporations, 96% of businesses were adversely affected by China's pandemic prevention measures, with more than half suspending, delaying, or altogether cancelling their investment plans in the nation.

The virus controls and other Chinese policies, such as those relating to data and cybersecurity, making it more challenging to sell to the government, and concerns about intellectual property protection, are expected to cause a slowdown in new investment by U.S. companies in China in 2023, the report disclosed.

Around 17% of businesses claimed that the COVID-19 control measures had impacted assets worth more than $50 million.

USCBC President Craig Allen said, it is uncertain if this delay in future capacity increase is another transient blip or one point in a longer trend.

Allen explained that raising the possibility of a tech decoupling "would not be in anyone's interest."

Multinational corporations reportedly struggle to retain existing staff in China and find new ones.

Worries about the state of the market have been made worse. It was since most U.S.-based CEOs have been prohibited from visiting their company, employees, and customers in China for the past 2.5 years.

Nearly 90% of the companies under investigation claimed that their activities in China were profitable the previous year, which is probably no longer the case.

Foreign industrial enterprises' profits dropped 14.5% from a year earlier in the first seven months of this year, a more significant drop than the 13.8/% reduction seen through June.

The competitiveness of U.S. enterprises in the market continues to be threatened by Chinese clients' actual and perceived worries about continued access to U.S. technology due to U.S.-China tensions, the paper claims.