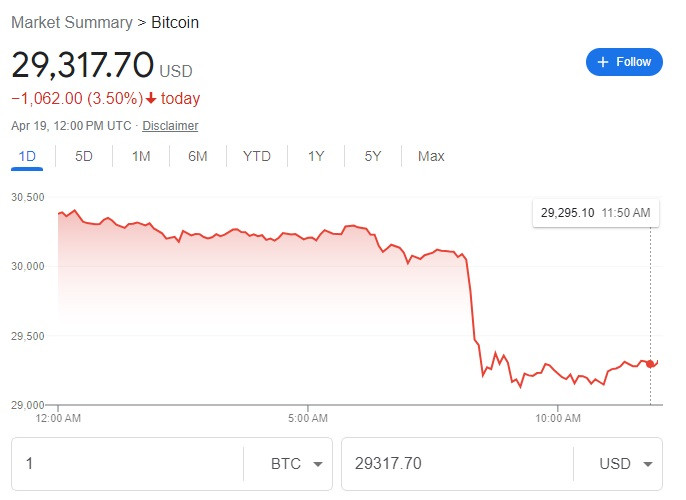

Bitcoin (BTC) experienced a sudden drop of over 3% within a 15-minute window during European morning trading on Wednesday, pushing the leading cryptocurrency below the $30,000 mark and reaching lows of $29,000, according to CoinDesk data. The sell-off did not seem to have an immediate fundamental cause, but factors such as an unusually large sell order on Binance, a crypto exchange, and an unexpectedly high UK inflation rate of over 10% in March may have affected market sentiment.

Adding to the situation, a long squeeze occurred with over $25 million in bitcoin futures liquidated, where longs, or bets on increasing prices, accounted for 98% of the positions.

Vetle Lunde, a senior analyst at K33 Research, commented on the situation to CoinDesk, stating, "The hotter-than-expected UK CPI may have weighed over risk assets, including BTC. But the gravity of the reaction has been far far more severe than in other asset classes." Lunde also mentioned the leverage washout, as Binance's open interest in BTCUSDT perps fell 5.1% within 15 minutes, with even more significant effects on ETH due to a larger liquidation volume than BTC.

Prominent Crypto Twitter trader @52kskew pointed out that a 16,000 bitcoin sell order, valued at over $467 million at current rates, preceded the dump, potentially triggering the long squeeze. "16K BTC is an unusual size to be market sold solely from Binance spot; usually, this kind of sale happens before bad news comes out," @52kskew added in a subsequent tweet.

Liquidation occurs when an exchange forcibly closes a trader's leveraged position due to a partial or total loss of their initial margin. This happens when the investor fails to meet the margin requirements for a leveraged position and lacks the funds to maintain the trade open. Significant liquidations can indicate the local peak or trough of a sharp price movement, allowing traders to adjust their positions accordingly.

The plunge led to a broader sell-off in the crypto market, with Ether (ETH), Polygon (MATIC), and Dogecoin (DOGE) falling 5.3% over the past 24 hours, and Solana (SOL) losing almost 9%.