First Republic Bank (FRC.N) saw its shares plummet following a CNBC report suggesting that the bank is likely to face receivership under the U.S. Federal Deposit Insurance Corporation (FDIC). This development has intensified a stock decline that has already erased 75% of the bank's value this week.

Should the San Francisco-based lender enter receivership, it would be the third U.S. bank to collapse since March. First Republic announced earlier this week that its deposits had decreased by over $100 billion in the first quarter.

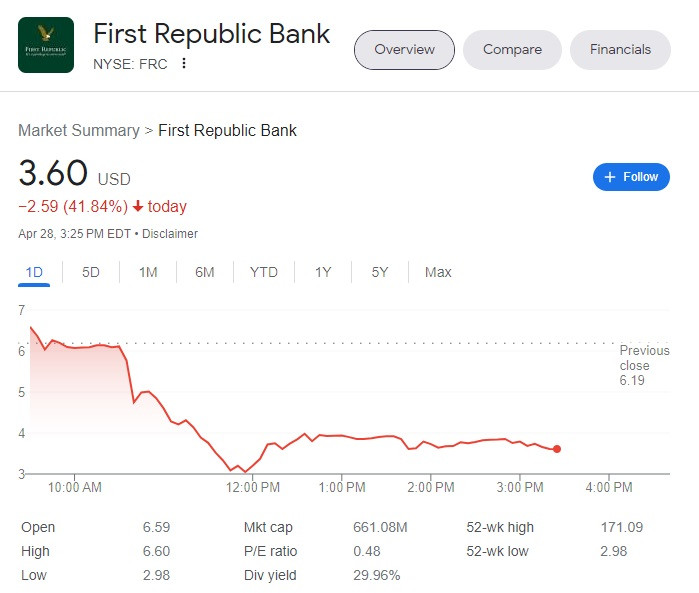

The bank's stock price dropped by more than half on Friday, hitting a record low of $2.99. Trading of the bank's shares was halted multiple times.

At its lowest point, the bank's market capitalization was approximately $557 million, a stark contrast to its peak valuation of over $40 billion in November 2021.

According to Ihor Dusaniwsky, managing director of Predictive Analytics at S3, short sellers, investors who aim to profit from falling stock prices, have increased their bets against the bank by $63 million to $376 million over the past 30 days.

Earlier in the session, a Reuters report about a government-mediated rescue deal for First Republic caused its shares to rise by up to 6.6%.

The report indicated that the FDIC, the Treasury Department, and the Federal Reserve are among the government agencies initiating meetings with financial firms to discuss potential support for the bank.

The government's involvement has reportedly encouraged more parties, including banks and private-equity firms, to join the negotiations.

Mark Haefele, chief investment officer at UBS Global Wealth Management, commented in a note, "The potential worst-case scenario stemming from the collapse of Silicon Valley Bank appears to have been averted."

He added, "But the problems at First Republic are a reminder that further problems remain possible."

The recent decline in First Republic Bank's stock price, intensified by the possibility of FDIC receivership, has raised concerns over the stability of the bank. As government agencies initiate discussions with financial companies to potentially rescue the bank, investors and market participants will be closely monitoring the situation for any further developments.