What Happens After the Final Hike by the Fed? Is a recession imminent for the U.S. economy after the interest rate hike cycle ends? How will the market respond?

At the end of last month's Federal Reserve interest rate meeting, Fed Chairman Powell noted that the current interest rates have reached restrictive levels. However, the full impact of the rate hikes has yet to be seen, so high interest rates are expected to be maintained for a significant period, with no rate cuts anticipated within the year.

Chairman Powell also suggested that the Fed might increase rates again if supported by data.

However, due to the recent moderate performance of U.S. economic data, most of the market still predicts that the likelihood of the Fed's "final hike" in September is low.

Whether the rate is increased in September or not, the market has essentially confirmed that high interest rates will be maintained for some time. As the impact of the rate hike gradually becomes apparent, some economists predict that the U.S. economy will fall into a recession.

Reviewing Past Rate Hike Cycles

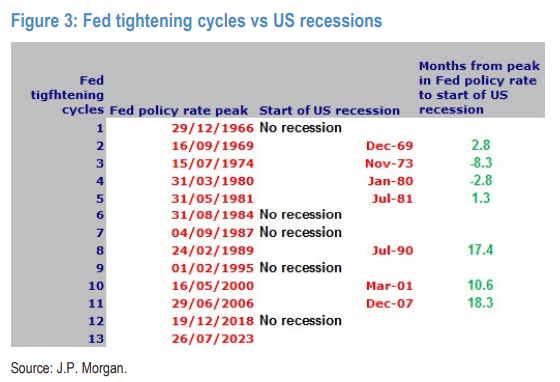

In a report this month, J.P. Morgan's Global Market Strategy MD Nikolaos Panigirtzoglou and others reviewed past Fed rate hike cycles. They pointed out that, out of the last 12 rate hike cycles by the Fed, 7 were closely followed or accompanied by an economic recession. In these 7 cycles, the recession began on average 5-6 months after the final rate hike.

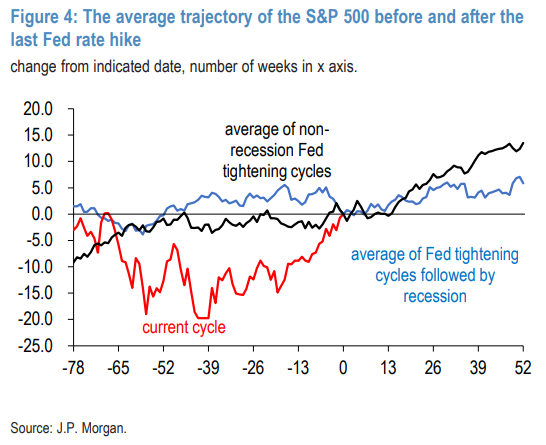

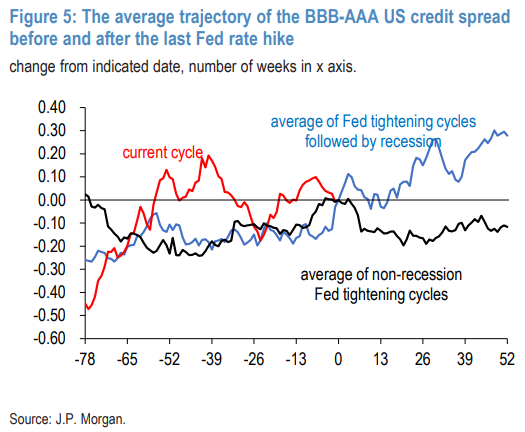

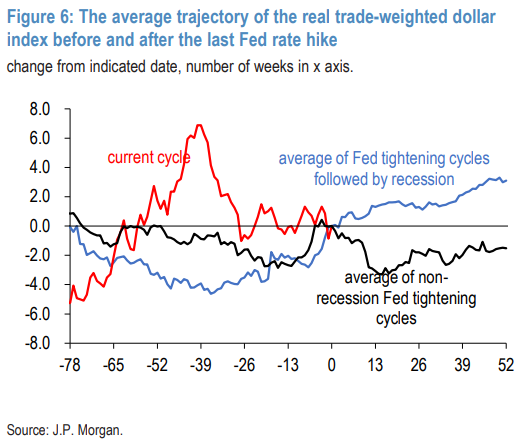

J.P. Morgan found that both stocks and credit face pressure against the backdrop of an economic recession before and after the final hike. In contrast, they significantly increase in a non-recessionary environment. The situation for the dollar is exactly the opposite: it rises in a recessionary environment and falls in a non-recessionary one.

On the other hand, bond performance does not vary much. The final rate hike can decrease U.S. Treasury yields and steepen the yield curve, whether in a recessionary or non-recessionary environment. However, the changes in the yield curve seem more noticeable in a recessionary environment.

Stocks and Credit Spreads: Under Pressure

To compare the impact of rate hikes on asset performance during a recession, J.P. Morgan observed changes in the S&P 500, BBB-AAA credit spreads, 10-year U.S. Treasury yields, the 10Y2Y yield curve, and the dollar trade-weighted index one and a half years before and after tightening ended:

Major differences emerge around and after the final Fed rate hike. Before the final hike, whether for stocks or credit, overall performance tends to be relatively stable, but they often face pressure after the final hike. However, they would significantly increase in a non-recessionary environment.

The Dollar: Rising in Recession

Similarly, the dollar's performance after the final hike differs depending on whether a recession is present. The dollar tends to increase in a recessionary environment and decrease in a non-recessionary one:

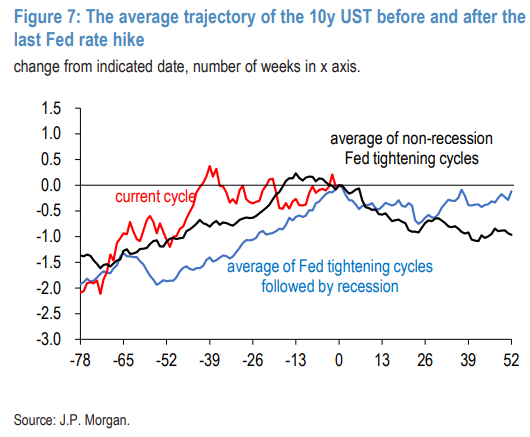

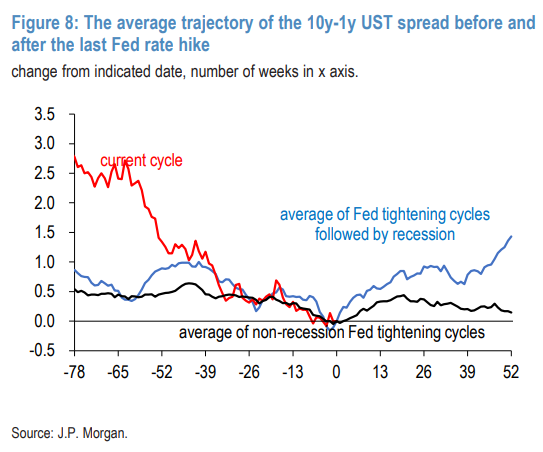

Bonds: Little Relation to Recession

In comparison, whether a recession occurs or not, the tightening policy does not significantly differentiate its impact on bonds:

In both recessionary and non-recessionary Federal Reserve tightening environments, the patterns for bonds look quite similar, both before and after the final Federal Reserve rate hike.

U.S. Treasury yields rise before the final Federal Reserve rate hike, and the yield curve flattens. After the final hike, yields fall, and the curve steepens. However, this flattening/steepening of the curve seems more noticeable in Fed tightening cycles related to economic recessions than those not related to recessions.

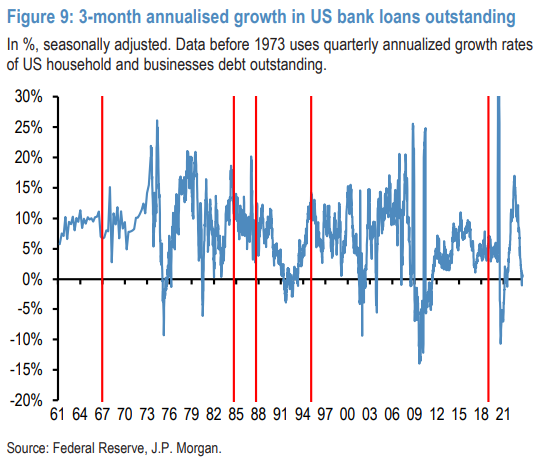

New Loans: Weakness Points to Recession

On the loan front, J.P. Morgan pointed out that in the rate hike cycle, weakness in new loans is more likely to signal an impending recession:

Although loan collapses and recessions often occur together or sequentially, loan collapses do not occur in rate hike cycles that do not trigger a recession.

Overall, J.P. Morgan's historical analysis shows that out of the last 12 Federal Reserve tightening cycles, 7 were closely followed or accompanied by an economic recession. In these 7 Fed tightening cycles, U.S. economic recessions started on average within 5-6 months after the final Fed rate hike.

For stocks, credit, and the dollar, the main differences occur after the final Fed rate hike, not before. In contrast, there is no difference for bonds: whether the Fed's tightening cycle is closely followed or accompanied by an economic recession, bond yields fall after the final Fed rate hike, and the yield curve steepens.