Amid a slowdown in Oracle's quarterly performance that exceeded expectations, only its AI-related business saw an unexpected surge. The cloud services and technology licensing business reported a 13% year-over-year increase in revenue for the quarter. To date, Oracle has secured over $4 billion worth of capacity orders for its second-generation cloud from AI development companies, doubling the previous quarter's figures.

Despite the lukewarm quarterly performance, Oracle's stock plummeted by over 9% in after-hours trading, though it's still up by more than 51% this year. To secure a foothold in the global race for generative AI, Oracle announced plans to spend billions on NVIDIA chips this year to accelerate the expansion of its cloud computing services.

As the reigning champion in the AI hardware sector, NVIDIA has been the go-to AI chip supplier for cloud service platforms like Oracle, Amazon AWS, and Microsoft. However, with the soaring demand from AI software development companies for NVIDIA chips, cloud service providers are struggling to meet their needs.

Seizing this opportune moment, NVIDIA identified a new $300 billion revenue opportunity: leveraging its hardware dominance to sell cloud computing services and software directly to AI development companies.

Last year, NVIDIA proposed to major clients that they lease servers powered by NVIDIA chips in their data centers. This would allow NVIDIA to then rent these servers to AI software developers. Reports suggest that Microsoft, Google, and Oracle have accepted NVIDIA's proposal, while AWS has declined.

Analysts believe that by establishing direct relationships with corporate chip users to generate cloud software revenue, this model might not necessarily take away existing revenue from cloud providers. This is because NVIDIA pays them to lease servers and then charges a premium to its own clients. However, this could potentially diminish the influence of cloud providers, enabling NVIDIA to sell its AI software directly to AWS, Microsoft, Google, and Oracle clients.

Joshua Bernstein, a former manager at AWS and Google Cloud, commented that this strategy elevates NVIDIA's brand above that of the cloud providers. It indicates NVIDIA's recognition of its market position and the steps needed to maintain it.

NVIDIA's cloud service, DGX Cloud, is the latest evidence of its ambitions extending beyond just selling chips. NVIDIA has also started selling AI software directly to clients like Adobe, Getty Images, and Shutterstock, who claim to use it to build AI models. Moreover, NVIDIA can leverage its relationships with DGX Cloud clients to sell even more AI software.

A $300 Billion Opportunity

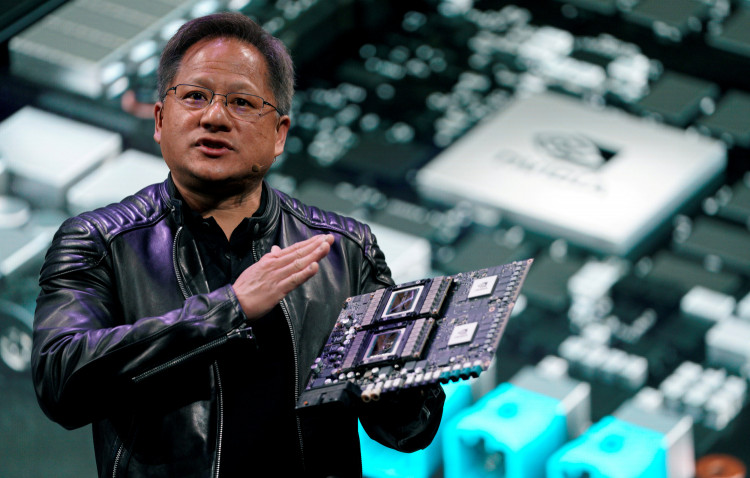

In a recent quarterly earnings call held in August, when asked about this new cloud service, NVIDIA CEO Jensen Huang expressed that cloud providers "really like it." However, reports suggest that cloud providers who accepted the proposal have neither commented nor promoted the service on their official websites, except for a press release from Oracle in March. AWS also declined to comment.

Analyst Stacy Rasgon from Bernstein noted that it's understandable why Amazon would decline the NVIDIA cloud service, as ultimately, NVIDIA is the one truly holding the client relationships.

Rasgon pointed out that the cloud providers who agreed to launch DGX Cloud are smaller in scale compared to Amazon, so theoretically, they could pose competition to Amazon in vying for a share of the cloud computing market.

Contradicting the notion that NVIDIA is competing with traditional cloud providers, NVIDIA's Vice President and General Manager Charlie Boyle stated in an interview that the new cloud service isn't about NVIDIA taking away clients but rather a shared initiative with cloud providers. Regarding Amazon's refusal of NVIDIA's service, he mentioned that AWS has always been a "great partner... but every company has its limits."

NVIDIA's cloud computing service assists clients in developing AI models and offers them customized pre-trained models. These pre-trained models include NVIDIA's Megatron 530B model (similar to ChatGPT) for generating text and the People Net visual model for identifying individuals in video clips.

Currently, NVIDIA's DGX Cloud service has garnered attention from major buyers such as IT software giant ServiceNow, biopharmaceutical company Amgen, and insurance company CCC Intelligence Solutions. Last month, Huang informed analysts that DGX Cloud has achieved "tremendous success," though he did not disclose specific revenue details.

Equally important, the cloud service enables NVIDIA to sell software used to manage large datasets for developing AI models, competing with similar products from Databricks, Snowflake, and Microsoft.

In its August earnings report, NVIDIA informed investors that selling software to companies developing AI or VR applications could present a potential revenue opportunity of $300 billion.

During the August earnings call, Chief Financial Officer Colette Kress told analysts that the software business generates hundreds of millions annually. While this might seem minuscule compared to the chip business, it still holds growth potential.

NVIDIA's Trojan Horse

For traditional cloud providers, DGX Cloud might seem like a Trojan Horse, potentially relegating them to the role of intermediaries for NVIDIA.

For instance, IT software giant ServiceNow uses DGX Cloud to develop AI software that aggregates IT requests and supports robotic customer service. John Sigler, Senior Vice President of ServiceNow, mentioned that NVIDIA's service allows ServiceNow to run its new AI software more easily in its own data centers and across multiple cloud providers. This enables them to utilize a "single software platform" with the entire process managed by NVIDIA.

As a result, ServiceNow doesn't need to track which traditional cloud provider is powering its AI development in the background.

Sigler added that if NVIDIA's cloud service uses data centers from Microsoft or Google, that's perfectly fine.

According to The Information's cloud database, ServiceNow spends at least $75 million annually on Microsoft's cloud services.

From NVIDIA's perspective, launching such a cloud service within the data centers of traditional cloud providers is fair game. While NVIDIA and cloud providers have a mutual dependency, this relationship is becoming increasingly complex and contentious. AWS, Microsoft, and Google are already selling or developing their own AI server chips to reduce reliance on NVIDIA chips, making it natural for NVIDIA to view them as competitors.