In the annals of chip technology, the invention of the FPGA (Field-Programmable Gate Array) was nothing short of brilliant. In the early 1980s, Ross Freeman, co-founder and engineer at Xilinx, observed that all chips on the market were of fixed specifications. If alterations were required, the chip would be rendered obsolete, leading to a wastage of tens of millions of dollars in redesigns. This sparked an idea: what if chips could be like blank tapes, allowing engineers to design and modify them on the hardware, reusing them through multiple "read-write" cycles?

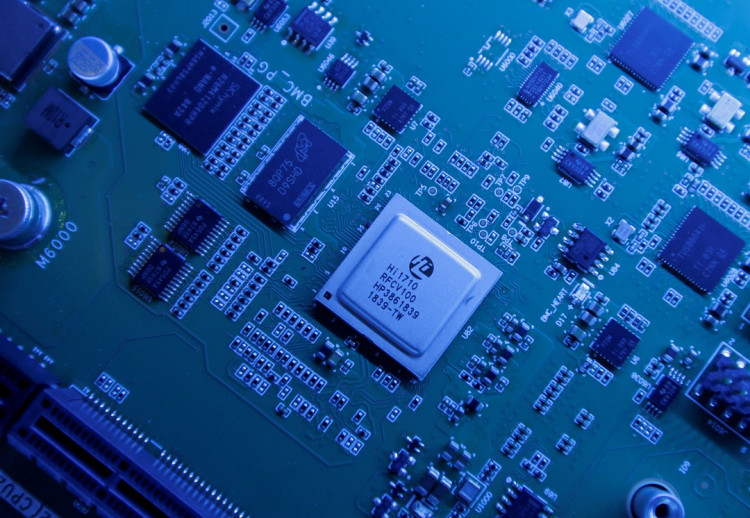

This notion birthed an entirely new industry worth billions of dollars-Programmable Logic Devices (PLD), with FPGA being a subtype. However, unlike the more familiar CPUs and GPUs, FPGAs are versatile and seen as a "jack-of-all-trades" chip. Yet, they often fly under the radar in our daily lives due to their hefty price tag and challenges in mass production. They're typically reserved for "critical tasks" in pricier, large-scale setups like data centers and 5G base stations, silently powering our digital existence.

This market status quo is now shifting. "A few years back, terminal devices might not have incorporated FPGAs, but now they're starting to," Esam Elashmawi, Chief Strategy and Marketing Officer at Lattice Semiconductor, shared with Interface News. From laptops to displays and even cars, the once-exclusive FPGA chips are no longer rarities in consumer electronics.

Lattice's primary business revolves around these chips. Established in 1983, the company has weathered various storms over its 40-year history-from its NASDAQ listing in the late 1980s, followed by a series of mergers, restructurings, and transformations. The 2008 financial crisis saw Lattice grappling with prolonged losses, prompting a business overhaul. A few years ago, there were whispers of a potential acquisition by Chinese investors, but regulatory bodies shot down such prospects. Through all these events, the company has managed to retain its seat at the FPGA market table.

Today, Lattice stands out even more distinctly, emerging as one of the few "survivors" in its domain. With long-standing rivals Altera and Xilinx being snapped up by Intel and AMD respectively, Lattice has become the largest independent FPGA chip firm. According to Gartner's data, in 2021, Xilinx, Intel, and Lattice held market shares of 51%, 29%, and 7% respectively, based on revenue.

While Lattice's relatively independent market status might make some wonder if they feel "lonely," Elashmawi believes that this is the "golden era" for the veteran chip company. He cites the company's strongest-ever product lineup as a significant reason. Lattice has not only launched numerous devices for small FPGA applications but has also rolled out a mid-tier FPGA product line, all while focusing on software solution development. In core sectors like communication, computing, industry, and automotive, the adoption rate of their devices has surged, indicating a growing market share.

Elashmawi provided an example, stating that during an investor day in May 2019, Lattice revealed that their adoption rate in the server market was around 25%. "Four years later, our adoption rate has far exceeded that. This means that in the current market, at least one or multiple devices in any server come from Lattice," he explained. With a rise in key market adoption rates, Lattice has started offering solutions with higher ASPs (Average Selling Prices).

Financial reports indicate that Lattice's total revenue for the fiscal year 2022 stood at $660 million, marking a 28% increase. This growth rate was 26% for the fiscal year 2021. Compared to the first half of the fiscal year 2022, the first half of 2023 saw a total revenue of $374 million, a year-on-year increase of 20%. Lattice's revenue has maintained double-digit growth for several quarters now. An even more critical financial metric is the gross margin, a key indicator reflecting product manufacturing and pricing capabilities. By this measure, Lattice's latest quarterly gross margin was 70.5%, a substantial increase of 140 basis points from the previous year. Elashmawi believes this uptick in gross margin signifies an improvement in Lattice's profitability and is a testament to customers' willingness to purchase their products and solutions.

In reality, as a niche computational chip type, FPGAs are seen as a "market in the cracks." The challenge for all industry players is how to expand in this space. After the top two market players were acquired by giants, the third in line-Lattice-needs to present a credible strategy to counter the scale and synergies of these behemoths post-integration and find its niche.

Historically, Lattice has dominated the low-power programmable chip sector, with products extensively used in communication, computing, industry, and automotive domains. However, compared to competitors, their product lineup leans towards smaller, lower-end markets, resulting in larger shipments but at lower prices. Addressing this, Elashmawi told Interface News reporters that Lattice's primary focus on the small FPGA market doesn't mean they're just a niche player. "Small FPGAs have larger shipments and broader applications. Large FPGAs have very high average selling prices and much smaller volumes due to prices that can soar to thousands of dollars, limiting their applications," he explained.

Typically, small FPGAs have an ASP ranging from $1 to $10; mid-tier FPGAs hover between tens to a hundred dollars, while large FPGAs can command prices from hundreds to thousands of dollars each. In recent years, Lattice has been keen to venture into the more valuable FPGA market segments. They announced the launch of their mid-tier FPGA series "Avant" last year. They anticipate that the introduction of the Avant series will potentially double Lattice's market and start contributing a modest revenue by the end of 2023, with significant contributions post-2024.

FPGAs are usually categorized based on the number of Logic Cells they contain. By current standards, high-end FPGAs possess over 500,000 logic cells, mid-tier ones range from 100,000 to 500,000, and low-end devices have fewer than 100,000.

Elashmawi sees Lattice's foray into the mid-tier FPGA market as a golden opportunity. Customers who previously used their small FPGA products are likely to easily transition to the new offerings. "90% of Avant's target customers are existing clients already using our small FPGAs. We've maintained strong customer relationships," he said. When designing the Avant series, Lattice engaged with over 100 target customers to ensure the products met their needs and that software adaptation for the chips would be a smooth transition. Additionally, the new products boast a power consumption advantage of over 2.5 times compared to competitors, positioning Lattice favorably in the market.

However, categorizing FPGAs based on logic cells primarily highlights differences in chip computational power and market coverage. What's more crucial is identifying broader market opportunities. One option is to continue expanding horizontally in the chip market. Beyond data centers and the communication sector, Lattice can venture into automotive chips, IoT chips, and cater to the booming demand for AI computational power.

This stems from the flexibility of FPGAs. For instance, using Lattice's FPGA for automotive screen control is essentially "transplanting" the consumer market FPGA chip application to the automotive sector. Employing FPGAs for screen display control is common in current MiniLED displays and TVs. Here, FPGAs control the brightness of the backlight beads of the display. Since MiniLEDs can emit light independently, unlike traditional LCD screens, they're termed "zone dimming." This feature enhances display contrast, reduces energy consumption, and is gradually gaining traction in the consumer market. Xu Honglai, President of Lattice Semiconductor's Asia-Pacific region, informed Interface News that besides automotive displays, the versatility of FPGAs also allows them to serve as bridge chips between display screens and image processing chips, offering better redundancy for automotive safety systems.

Meanwhile, the scramble for the AI computation market is intensifying, with nearly every tech giant keen on staking their claim. Major NVIDIA clients like Amazon and Google are developing GPU alternatives, not to mention a plethora of startups directly competing with NVIDIA. Computational chips primarily include GPUs, CPUs, and specialized integrated circuits like Tensor Processing Units (TPUs) and Video Processing Units (VPUs), with GPUs being the most widely used. Market research firm IDC predicts that by 2025, GPUs will still dominate 80% of the AI chip market.

However, as a type of computational chip, FPGAs are poised to play a more significant role. AMD, having integrated Xilinx, considers FPGA central to its AI strategy. Elashmawi believes that Lattice is also well-positioned to ride the current AI wave, be it in data centers or edge computing. This is due to the current landscape where "AI lacks a unified standard, allowing the flexibility of FPGAs to shine," he said. "The advantage of FPGAs is that users can reprogram neural networks or new models into the FPGA, making it a sustainable chip. When a new neural network offers higher efficiency, the FPGA only needs reprogramming, whereas ASIC chips would require a complete redesign."

Whether it's the fierce external market competition or the shift towards mid-tier market product positioning, Lattice feels the urgency of its corporate evolution. This demands heightened internal collaboration: sales and product departments need to be in sync, ensuring every aspect, be it chips, software, or optimization, delivers timely service to clients. If one segment lags, the rest wait.

Elashmawi shared that over the past few years, Lattice's ecosystem has seen significant growth, encompassing numerous IP design firms and semiconductor companies specializing in FPGA solutions and reference designs. This compels Lattice to pay even closer attention to its customers.

Beyond hardware, Lattice aims to step outside the confines of hardware design and manufacturing, participating in the entire supply chain. They're transitioning to offer comprehensive solutions, including chips, IPs, and algorithms. In the past couple of years, Lattice has identified industries like automotive, industrial automation, and embedded vision as focal areas, providing integrated solutions and service management to key clients. For instance, in the third quarter of this year, Lattice launched the automotive software solution suite Lattice Drive, integrating the necessary reference platforms, IP modules, and design tools clients need for development, accelerating automotive application development.