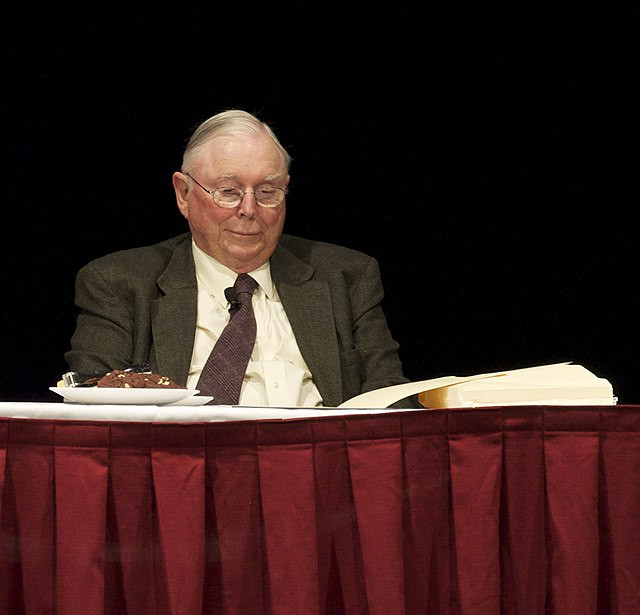

Charlie Munger, the esteemed vice chairman of Berkshire Hathaway and long-time confidant and partner of Warren Buffett, passed away at age 99. His death, confirmed by a press release from Berkshire Hathaway, marks the end of an era for the investment world. Munger died peacefully at a California hospital, just shy of his 100th birthday.

"Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Warren Buffett said, highlighting Munger's critical role in shaping the conglomerate's success.

Munger's journey was not just about accumulating wealth, which stood at an estimated $2.3 billion in early 2023. His multifaceted career spanned roles as a real estate attorney, chairman and publisher of the Daily Journal Corp., Costco board member, philanthropist, and architect. Yet, it was his partnership with Buffett that defined his legacy in the world of finance. Together, they transformed Berkshire Hathaway from a textile manufacturer into a multinational conglomerate with stakes in major companies like Apple and Coca-Cola.

Munger's investment philosophy evolved from focusing on troubled companies at low prices to targeting higher-quality, underpriced businesses. A pivotal moment came in 1972 when Munger persuaded Buffett to purchase See's Candies for $25 million, a decision that has since generated over $2 billion in sales for Berkshire.

Renowned for his investment acumen, Munger was also known for his wit and wisdom. He often played the straight man to Buffett's more jovial demeanor, famously remarking, "I have nothing further to add," after Buffett's lengthy responses at shareholder meetings. Yet, Munger's insights were profound, evidenced by his belief in the "lollapalooza effect," where a confluence of factors drives investment psychology.

Born in Omaha on January 1, 1924, Munger's early life intertwined with Buffett's in many ways. Both worked at Buffett's grandfather's grocery store and grew up in the same neighborhood, though they did not meet until later in life. Munger's military service in the Army Air Corps and studies at the California Institute of Technology in Pasadena led him to California, where he eventually settled. After graduating magna cum laude from Harvard Law School in 1948, he practiced real estate law before venturing into investment management.

Munger's partnership with Buffett began in 1959 when the two were introduced in Omaha. Their shared investment philosophy cemented a partnership that lasted nearly 60 years. As Buffett said, "We think so much alike that it's spooky." This alignment of minds was pivotal in shaping Berkshire Hathaway's investment strategy and success.

Beyond finance, Munger was a generous philanthropist and an untrained but passionate architect. He donated millions to educational institutions and even ensured that his architectural designs were implemented in some of these projects.

Munger's life was not without personal tragedy, including the loss of a son to leukemia and a botched eye surgery that left him blind in one eye. Through it all, he maintained a philosophy of optimism and practical wisdom, which he shared freely, believing that a life well-lived is one of constant learning.