Huawei Technologies is preparing to divest up to 40% of its shares in its newly established smart car software and components firm. The Chinese technology giant's venture into intelligent automotive solutions is setting the stage for a significant reshuffle in the industry, attracting major players and estimated to be valued at a staggering 250 billion yuan ($34.67 billion).

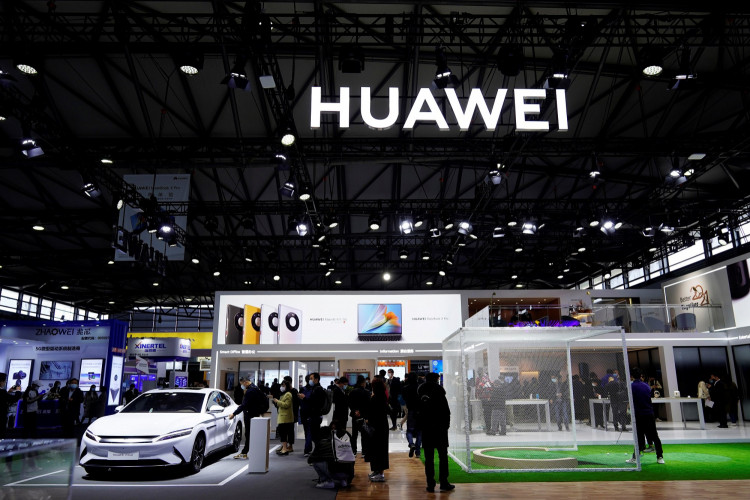

This strategic shift was signaled by Huawei's decision to spin off its four-year-old Intelligent Automotive Solution (IAS) business unit into a separate entity, transferring its core technologies and resources. The new company is expected to embody the aspirations of becoming the Bosch of the intelligent electric vehicle (EV) era.

Chongqing Changan Automobile and China Ordnance Equipment Group, its ultimate parent company, are front-runners in this endeavor, planning to acquire significant stakes in the new firm. Changan Auto aims for about 35%, while China Ordnance Equipment Group looks at a 5% stake. Other potential investors in talks include FAW Group and Dongfeng Motor Group, each vying for up to 5%.

The deal, which is still under finalization and subject to regulatory approval, will see Huawei likely retaining the largest shareholder status with 40% to 50% for at least the next two to three years. The intricacies of the ownership distribution and the company's valuation remain fluid, subject to changes as negotiations progress.

This move by Huawei, a company traditionally known for its employee-owned structure since its founding in 1987, marks a significant turn. The company's decision to part ways with a portion of its smart car venture is attributed to its struggle to grow the business and the necessity to recoup capital for research and development expenditures.

The IAS unit, despite Huawei's investment of $3 billion and an expansive R&D team, emerged as the only loss-making unit among Huawei's six main businesses, underscoring the challenges faced by the tech giant in this domain. With this new direction, Huawei aims to synergize its technologies and resources with industry partners to spur innovation in smart car technology and advance the automotive sector.

The proposed corporate restructuring also opens pathways for the business's future public listing, as originally planned by Huawei. However, Richard Yu, the head of Huawei's consumer business who has overseen the smart car unit for years, is not expected to lead the new firm, indicating a shift in leadership and strategic focus.

Huawei's decision to sell part of its smart car business is a tactical move to navigate the complex landscape of the evolving automotive industry. This strategic divestiture, while signifying a pivot from Huawei's traditional business model, is set to catalyze innovation and growth in the realm of intelligent automotive solutions.