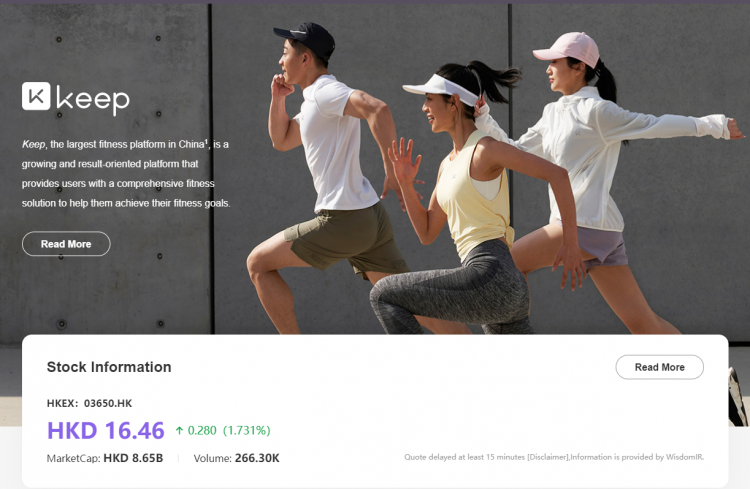

Keep, known as the "first sports tech stock," has seen its share price fall again. As of December 21, 2023, Beijing time, Keep's share price plummeted from the initial public offering price of HK$28.92 to HK$15.44, a drop of over 40%, evaporating about HK$7 billion in market value since its listing, shrinking by more than one-third.

Keep went public on the Hong Kong Stock Exchange on July 12, 2023. At that time, the company's global offering netted approximately HK$192 million. The stock opened with a surge of 4.77%, with a share price exceeding HK$30 and a market value simultaneously increasing to HK$15.9 billion.

However, since late August, Keep's share price has been highly volatile and generally trending downward. On December 4, when the Hong Kong Stock Connect's list of targets was updated, Keep was included. This should have been good news, but the market reacted by heavily selling off the stock, causing Keep's share price to plummet nearly 27% that day. After several days of continuous decline, the price hit a record low of HK$14.02.

Despite securing nine rounds of financing and backing from powerful groups like SoftBank Vision Fund, Hillhouse Capital, GGV Capital, and Tencent, the company still faces a predicament it seems temporarily unable to escape after going public.

Keep, deeply rooted in the online fitness market, faces the dual challenge of significant investment in fitness content and paid courses, along with the loss of active users and sluggish traffic growth.

According to Keep's financial report for the first half of 2023, as of June 30, 2023, the platform had an average of approximately 29.549 million monthly active users, a decrease of 8.129 million compared to the previous year and a reduction of 2.089 million from the end of 2022. The average monthly subscribed users were about 3.017 million, a year-on-year decrease of 17.68% and a drop of 7.71% from the end of 2022.

The decline in both active and subscribed users has raised concerns among advertisers. According to the report, Keep only achieved approximately HK$69.437 million in advertising and other revenues in the first half of 2023, a sharp decrease of 21.4% compared to the same period.

Additionally, during the reporting period, advertising revenue accounted for only 7.05% of total revenue, whereas in 2019, this proportion was 17.46%.

With various metrics declining, Keep, once famous for selling co-branded IP medals, is attempting similar methods to regain users and advertisers.

On October 23, 2023, Keep invited Pamela, one of the world's most famous fitness bloggers, to China. On the afternoon of the 26th, Pamela, who has nearly 60 million followers in China, arrived at Keep's headquarters in Wangjing and directly led her exclusive course "Endorphins" in Keep's live broadcast room.

In fact, China's fitness market is vast and equally competitive. The "2022 China Fitness Industry Data Report" shows that China's fitness population has reached 374 million, ranking first globally.

As offline gyms and outdoor sports industries gradually return to normal post-pandemic, Keep's traffic may struggle to return to previous levels.

According to data from CICC Enterprise Credit, as of April 2023, the number of various offline fitness venues, paid fitness members, average spending, activity levels, and training frequency have all nearly reached the same data as the same period in 2019.

In terms of overall revenue, Keep's total revenue for the first half of 2023 reached approximately HK$985 million, a year-on-year decrease of 2.7%. The operating profit was -HK$261 million, a narrowing of 21.39% compared to the same period in 2022. The adjusted net loss for the reporting period was around HK$223 million, with a net loss rate exceeding 20%, an increase of 8.7 percentage points year-on-year.

With falling share prices, loss of users and traffic, and intense competition in the fitness market, this "first sports tech stock" faces significant challenges post-IPO and is still exploring effective ways to profit.