China's leadership wrapped up its annual economic work conference this week, emphasizing plans to address economic challenges with proactive fiscal policies and moderately loose monetary approaches, according to reports from state-run CCTV. This strategic shift highlights Beijing's determination to stabilize growth amid domestic and global uncertainties.

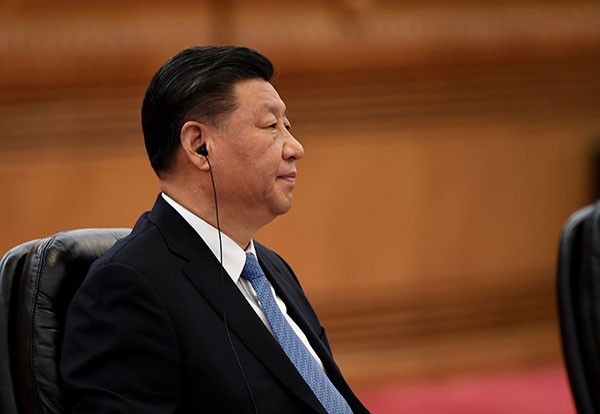

The meeting, chaired by President Xi Jinping, underscored plans to raise the fiscal deficit and issue ultra-long government bonds while continuing interest rate adjustments. These efforts align with earlier commitments made by the Politburo, reflecting a significant pivot toward supporting economic recovery.

State media reported that top leaders recognized the need for a comprehensive approach to bolster the country's economic resilience. Policies will aim to address persistent deflationary pressures while supporting broader goals of sustainable development.

This year, the term "moderately loose" monetary policy was reintroduced during Politburo discussions-a phrase last used during the 2008 global financial crisis. Economists interpret this as a signal of Beijing's readiness to take bolder actions to counter economic headwinds.

Bruce Pang, chief economist for Greater China at JLL, noted that the focus on proactive fiscal measures and domestic demand reflects a strategic shift. "This pivot underscores the pressing need to enhance domestic demand to better navigate external uncertainties," Pang stated in an analysis.

China's economy has faced significant challenges in recent months, including deflationary trends and weaker consumer spending. The country's consumer price inflation dropped to a five-month low in November, and wholesale prices have declined for over two years. To counter these pressures, the government has implemented measures such as subsidies for appliance upgrades and trade-ins for vehicles. The Chinese Association of Automobile Manufacturers reported that passenger car sales jumped 17.5% year-on-year in November, marking a bright spot in the broader economic picture.

Global developments have further complicated China's economic outlook. President-elect Donald Trump's plan to impose 10% tariffs on all Chinese imports in 2025 has raised concerns about trade disruptions. Such measures have heightened Beijing's focus on strengthening domestic demand and reducing reliance on external markets.

While specific targets for 2025 will be unveiled at the National People's Congress in March, analysts expect China to maintain its GDP growth goal at around 5%. This reflects the government's balancing act between managing near-term pressures and ensuring long-term sustainability. Economists also anticipate a fiscal deficit target as high as 4% of GDP to enable greater public spending.

The property market, a key pillar of China's economy, remains a priority for stabilization efforts. While regulatory relaxations have provided some relief, experts caution that sustained interventions will be needed to ensure a full recovery in this critical sector.

Despite challenges, China reiterated its commitment to opening its economy and fostering international cooperation. Recent policy measures, such as relaxed visa rules for residents of select countries, reflect Beijing's intent to attract foreign investment and boost tourism.