The U.S. economy added 147,000 jobs in June and the unemployment rate fell to 4.1%, signaling continued labor market resilience even as hiring momentum slows and signs of weakness emerge in private-sector employment. The figures, released Thursday by the Bureau of Labor Statistics, surpassed expectations of 117,500 jobs and marked a modest increase from May's revised total of 144,000.

Gains were concentrated in healthcare (+58,600), leisure and hospitality (+20,000), and state and local government jobs (+80,000). However, private-sector hiring, excluding government and healthcare, came in at just 23,000, according to Pantheon Macroeconomics Chief U.S. Economist Samuel Tombs, who called the report "a weak one fundamentally."

"Private payrolls excluding healthcare and education rose by just 23,000, well below the 50,000 average pace in the previous 12 months," Tombs wrote in a client note.

The June gains brought the three-month average to 150,000 jobs. April's figures were also revised up by 11,000, contributing to a net upward revision of 16,000 jobs over the past two months.

Despite headline strength, labor force participation declined and unemployment among Black workers rose sharply by 0.8 percentage points to 6.8%, its highest since January 2022. That jump, captured in the volatile household survey portion of the report, has historically signaled broader labor market stress.

Manufacturing continued to struggle, losing 7,000 jobs for the second straight month. A purchasing manager quoted in the Institute for Supply Management's report said, "The tariff mess has utterly stopped sales globally and domestically. Everyone is on pause. Orders have collapsed."

President Donald Trump's trade policy, including new tariffs, has increased economic uncertainty. Analysts point to this as a drag on hiring and factory activity, with June marking the fourth straight month of contraction in the ISM's manufacturing index.

Federal Reserve Chair Jerome Powell, speaking earlier this week in Portugal, said, "We watch very carefully for signs of unexpected weakness" in the labor market. "We see a gradual cooling but we don't really see that yet."

Markets responded positively to the data. The Dow Jones Industrial Average rose 96 points (0.22%), the S&P 500 added 0.4%, and the Nasdaq gained 0.6%.

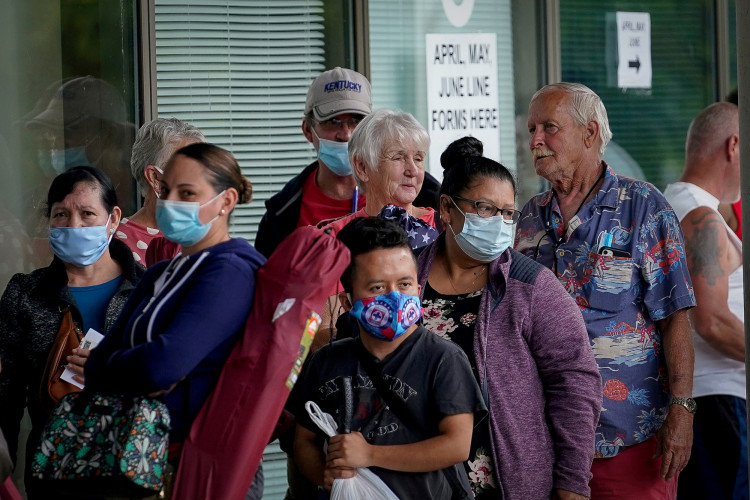

Weekly jobless claims data showed first-time filings fell to 233,000 from 237,000, indicating layoffs remain subdued. But continuing claims held steady at 1.964 million, suggesting that once workers are unemployed, they are struggling to reenter the workforce.