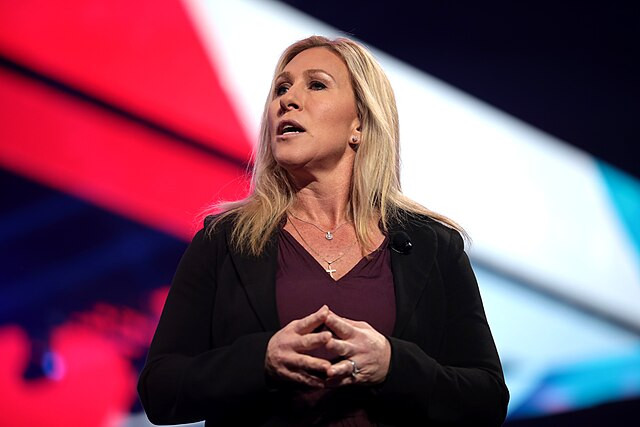

Representative Marjorie Taylor Greene, one of the most active traders in Congress, disclosed a new purchase of Procter & Gamble stock despite the consumer goods company facing mounting legal challenges and tariff-related cost pressures. The filing, submitted under federal financial disclosure rules, shows Greene acquired up to $50,000 worth of P&G shares on November 6.

Greene, who represents Georgia's 14th congressional district and serves on both the Oversight and Homeland Security Committees, has built a portfolio spanning technology, industrials, logistics, finance, and utilities. With an estimated net worth of more than $25 million, she has repeatedly drawn scrutiny from ethics advocates who argue that lawmakers should not be permitted to trade individual stocks while shaping regulatory and fiscal policy affecting publicly traded companies.

The purchase comes months after Greene capitalized on volatility triggered by President Donald Trump's tariff announcements, buying dozens of stocks during a market downswing and later realizing rapid gains. Congressional trading rules require disclosure of transactions but do not prohibit lawmakers from trading on non-public committee insight, a structural gap critics argue enables de facto insider advantages.

Procter & Gamble, the consumer goods giant behind Crest, Gillette, Tide, and Pampers, is currently defending against multiple consumer lawsuits. One case concerns the packaging of Kid's Crest toothpaste. U.S. District Judge Jorge Alonso ruled parents could attempt to prove the company violated consumer protection laws by depicting a full toothpaste strip on packaging, despite U.S. health guidance indicating children under six should use only a small amount of fluoride toothpaste. P&G has argued the product label provides clear usage instructions and sought dismissal, which the court declined.

Financial pressures also loomed in P&G's latest earnings outlook. The company reported that for fiscal 2026 it anticipates:

- ~$100 million in post-tax commodity cost increases

- ~$400 million in tariff impacts

- ~$250 million net earnings headwind after interest and tax adjustments

- ~$0.19 per share earnings impact for the fiscal year

Despite these pressures, P&G maintains its status as a dividend aristocrat with more than 25 consecutive years of payout increases. The company's stock has fallen 13.2% year-to-date and is up only 3.7% over the last five years.

P&G reported fiscal first-quarter net sales of $22.4 billion, a 3% year-over-year increase, with adjusted earnings rising to $1.99 per share, supported by performance in beauty, healthcare, and grooming categories. CEO Jon Moeller said, "We are increasing investment in innovation and demand creation to improve value for consumers and drive category growth."