Jerry Lin

The Latest

-

Yellen Concedes COVID Stimulus Played ‘Little Bit’ Role in Inflation, Defends Biden’s Economic Policies

Outgoing Treasury Secretary Janet Yellen acknowledged on Wednesday that the Biden administration's COVID-19 stimulus spending may have contributed "a little bit" to the inflation that has dogged the U.S. economy. However, she maintained that the primary driver of rising prices was the pandemic's disruption of global supply chains, which left industries struggling to meet demand.

Outgoing Treasury Secretary Janet Yellen acknowledged on Wednesday that the Biden administration's COVID-19 stimulus spending may have contributed "a little bit" to the inflation that has dogged the U.S. economy. However, she maintained that the primary driver of rising prices was the pandemic's disruption of global supply chains, which left industries struggling to meet demand. -

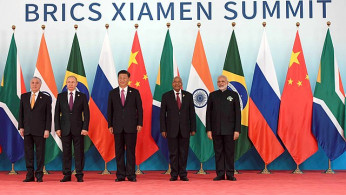

Indonesia Joins BRICS, Strengthening Alliance of Emerging Economies

Indonesia has officially joined the BRICS group of emerging economies, a significant milestone for the Southeast Asian nation and a move that strengthens the bloc's role as a counterweight to Western-dominated institutions. The announcement was made Monday by Brazil, which holds the rotating presidency of BRICS for 2025, and confirmed by Indonesia's Ministry of Foreign Affairs on Tuesday.

Indonesia has officially joined the BRICS group of emerging economies, a significant milestone for the Southeast Asian nation and a move that strengthens the bloc's role as a counterweight to Western-dominated institutions. The announcement was made Monday by Brazil, which holds the rotating presidency of BRICS for 2025, and confirmed by Indonesia's Ministry of Foreign Affairs on Tuesday. -

Dollar Falls as Trump Denies Tariff Policy Shift, Markets Eye Economic Risks

The U.S. dollar faced a turbulent session Monday, dropping sharply against major currencies before paring losses after President-elect Donald Trump denied reports suggesting his administration might pursue a scaled-back tariff strategy. The dollar index, which measures the greenback's performance against six major currencies, fell 0.59% to 108.32, retreating from earlier losses of more than 1%. The session highlighted the market's sensitivity to Trump's economic policies and rhetoric as he prepares to assume office.

The U.S. dollar faced a turbulent session Monday, dropping sharply against major currencies before paring losses after President-elect Donald Trump denied reports suggesting his administration might pursue a scaled-back tariff strategy. The dollar index, which measures the greenback's performance against six major currencies, fell 0.59% to 108.32, retreating from earlier losses of more than 1%. The session highlighted the market's sensitivity to Trump's economic policies and rhetoric as he prepares to assume office. -

Oil Prices Hit Three-Month High as Demand Surges Amid Sanctions and Weather Woes

Oil prices continued their upward trajectory on Monday, reaching their highest levels since October 2024. The rally was driven by colder-than-normal weather, signs of recovering demand in Asia, and market anticipation of stricter sanctions on Russian and Iranian crude exports.

Oil prices continued their upward trajectory on Monday, reaching their highest levels since October 2024. The rally was driven by colder-than-normal weather, signs of recovering demand in Asia, and market anticipation of stricter sanctions on Russian and Iranian crude exports. -

Oil Prices Rally as US Stockpile Decline Balances China Concerns

Oil prices hovered near their highest levels in nearly three months on Friday, buoyed by a sharp decline in U.S. crude stockpiles and optimism about China's economic recovery. However, lingering uncertainties about global supply and geopolitical risks tempered market enthusiasm.

Oil prices hovered near their highest levels in nearly three months on Friday, buoyed by a sharp decline in U.S. crude stockpiles and optimism about China's economic recovery. However, lingering uncertainties about global supply and geopolitical risks tempered market enthusiasm. -

Gold Hits Three-Week High Amid Dollar Pullback and Safe-Haven Demand

Gold prices reached a three-week peak on Friday as a weaker U.S. dollar and safe-haven buying provided support for the precious metal. Spot gold hit $2,654.21 per ounce by mid-morning, marking its highest level since December 13, and was up approximately 1.3% for the week. U.S. gold futures were steady at $2,669.90.

Gold prices reached a three-week peak on Friday as a weaker U.S. dollar and safe-haven buying provided support for the precious metal. Spot gold hit $2,654.21 per ounce by mid-morning, marking its highest level since December 13, and was up approximately 1.3% for the week. U.S. gold futures were steady at $2,669.90. -

U.S. Jobless Claims Fall to Eight-Month Low, Indicating Steady Labor Market

The number of Americans filing for unemployment benefits fell to 211,000 in the week ending December 28, marking the lowest level since March, according to the Labor Department's report released Thursday. This decline of 9,000 claims highlights continued resilience in the U.S. labor market despite broader signs of cooling.

The number of Americans filing for unemployment benefits fell to 211,000 in the week ending December 28, marking the lowest level since March, according to the Labor Department's report released Thursday. This decline of 9,000 claims highlights continued resilience in the U.S. labor market despite broader signs of cooling. -

European Gas Prices Surge as Ukraine Ends Decades-Long Russian Gas Transit

The wholesale price of natural gas in Europe has reached its highest level in over a year following Ukraine's decision to halt the transit of Russian gas into the continent. The move marks a significant shift in Europe's energy landscape, ending decades of reliance on a key pipeline that transported Russian gas across Ukrainian territory.

The wholesale price of natural gas in Europe has reached its highest level in over a year following Ukraine's decision to halt the transit of Russian gas into the continent. The move marks a significant shift in Europe's energy landscape, ending decades of reliance on a key pipeline that transported Russian gas across Ukrainian territory. -

Oil Prices Surge Amid Optimism for China’s Economy and Strong U.S. Demand

Oil prices rose sharply on the first trading day of 2025 as markets reacted to promising signals from China's economic policies and robust demand in the United States. Brent crude futures climbed $1.04, or 1.39%, to $75.68 a barrel by midday trading on Thursday, while U.S. West Texas Intermediate (WTI) crude increased by $1.02, or 1.42%, to $72.74 per barrel.

Oil prices rose sharply on the first trading day of 2025 as markets reacted to promising signals from China's economic policies and robust demand in the United States. Brent crude futures climbed $1.04, or 1.39%, to $75.68 a barrel by midday trading on Thursday, while U.S. West Texas Intermediate (WTI) crude increased by $1.02, or 1.42%, to $72.74 per barrel. -

Chinese Manufacturing Growth Slows as New Trade Threats Loom

China's manufacturing sector ended the year on a tempered note, with fresh data showing a lower-than-expected reading for December's purchasing managers index. According to the National Bureau of Statistics, the PMI stood at 50.1 in December, a figure just above the expansion threshold but below the 50.3 forecast by economists.

China's manufacturing sector ended the year on a tempered note, with fresh data showing a lower-than-expected reading for December's purchasing managers index. According to the National Bureau of Statistics, the PMI stood at 50.1 in December, a figure just above the expansion threshold but below the 50.3 forecast by economists.