The Chinese court has ordered Micron Technology Inc. to stop the sale of its microchips in the world's biggest memory chip market. The ban was temporarily imposed after its rival, Taiwan's United Microelectronics Corp (UMC) found that the company violated some patents regulation.

The UMC and its Chinese associate revealed the decision on Tuesday, July 3. The company also criticized shares of the US-based Micron Tech as it earns half of its profits from China when their product designs were allegedly copied from them.

The ban was handed down amid the growing trade tiff between the U.S. and Beijing over the tax on exports. China is also investigating Micron and its South Korean rivals for the increase in chip prices. It was alleged that there could be price fixing involved.

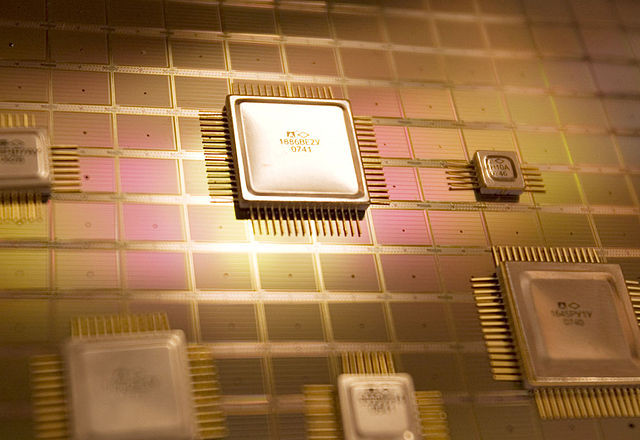

According to South China Morning Post, the Fuzhou Intermediate People's Court of the People's Republic of China has prohibited Micron Technology from selling at least 26 semiconductor products such as dynamic random access memory (DRAM) and NAND flash memory-related chips.

With the ban, the risk on trade came under renewed pressure thus, the economy, techs, and manufacturing businesses were dragged into the overall US stock market results. Moreover, the trade tensions between U.S. and China deepen over various issues including the former's impending enforcement of tariffs on $34 billion worth of goods from China.

The new tariffs are set to take effect on July 6. With this, Beijing is expected to come up and impose its own tariffs as well.

"As the trade war looms, both China and the US are trying to get more cards in their hands for sure. Companies like Micron are right in the middle of the storm," The Strait Times quoted Gartner Inc. analyst Roger Sheng as saying.

In any case, Micron shares which generated half of its $20.3 billion income from China for the fiscal year 2017, closed down with 5.5 percent at $51.48 on Tuesday, the same day the ban was issued. Shares for chipmakers in the U.S. also dropped, with NVIDIA closing at 2 percent lower while Broadcom Inc. and Intel Corp closed at 1 percent lower each.

China is currently the biggest microchip importer and the Chinese semiconductor producers are planning to grow this business more through partnerships and acquisitions. However, achieving this goal proved to be difficult as security concerns raised by other countries, particularly, the U.S., is a big hurdle to overcome.