Exxon Mobil Corporation, the world's largest oil refiner and the ninth largest U.S. firm in terms of revenues, reported earnings of $6 billion in the fourth quarter of 2018.

For the full-year 2018, ExxonMobil's profits amounted to $20.84 billion, slightly higher than 2017 profit of $19.7 billion. ExxonMobil, one of the major Big Oil players, said 2018 was its best year since 2014 when it earned $32.5 billion.

In its earnings report, ExxonMobil's said its refining profits more than doubled to $2.7 billion due to larger margins on processing crude into fuels. The upbeat result was also boosted by the sale of ExxonMobil's 175,000 barrel-per-day Augusta refinery in Sicily, Italy.

Much higher production in the Permian Basin straddling Texas and New Mexico, which is North America's most prolific oil field, helped propel ExxonMobil to Q4 profits ahead of analysts' estimates. In the Permian Basin, ExxonMobil's output soared 90 percent, but despite this was slightly lower than the 4.03 million barrels analysts anticipated.

ExxonMobil exceeded analysts' forecasts by almost one-third due to the biggest refining jump in six years. In addition, shale oil crude output from the Permian Basin almost doubled.

ExxonMobil CEO Darren Woods told CBS his company will see "very good returns" in the Permian all the way down to $35 a barrel. Woods said the results during the volatile fourth quarter showed that ExxonMobil can still generate profits under adverse market conditions.

Analysts noted that oil prices rose through most of 2018 but plummeted in the fourth quarter. This sharp drop was due to a combination of strong production in the U.S. and elsewhere, and rising concern that slowing global economic growth might derail demand for crude oil.

The topsy-turvy ride for oil prices partly explains why ExxonMobil's revenue rose 8 percent to $71.9 billion in Q4 compared to the same quarter in 2017. The Q4 2018 revenue, however, was nearly $5 billion lower compared to the third quarter. Revenue was also well below the $74.18 billion average forecast of three analysts polled by the investment research outfit, Zacks.

ExxonMobil said its production crawled higher by four-tenths of one percent in Q4. It produced somewhat more oil but less natural gas than it did in late 2017. The drop in oil prices curbed ExxonMobil's pace of spending on exploration. As a consequence, capital spending in Q4 was 13 percent lower year-on-year.

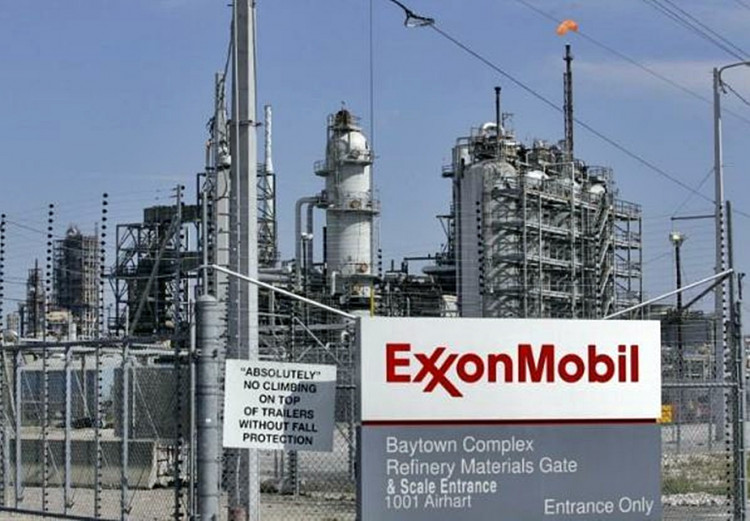

Exxon plans to spend $30 billion on new drilling and refinery expansions this year, up 16 percent from 2018 as part of a plan to boost both spending and asset sales this year. In Texas, ExxonMobil announced plans to expand its Baytown refinery to handle the growing Permian crude output.