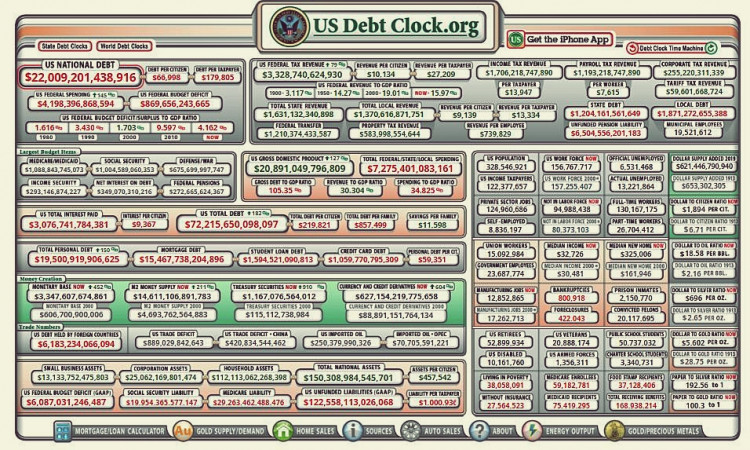

As predicted, the Republican Party's deficit-inducing Tax and Jobs Cut Act of 2017 has ballooned the U.S. national debt, but to a historic and unheard of high of $22 trillion.

The U.S. Department of the Treasury reported the national debt soaring $22.012 trillion, a jump of more than $30 billion just this month. The U.S. added more than $1 trillion in debt in the last 11 months alone. The national debt stood at $19.95 trillion when president Donald Trump took office.

Economists and other experts are now loudly warning this unwarranted debt is irrefutable proof the United States is on an unsustainable financial path that will jeopardize the economic security of every American in decades to come.

The national debt began rising at this breathtaking pace following the passage of president Donald Trump's $1.5 trillion tax cut package in Dec. 2017. The national debt, which is the total of the annual budget deficits, began soaring on account of the Republican's unwise move to increase spending on domestic and military programs.

"Reaching this unfortunate milestone so rapidly is the latest sign that our fiscal situation is not only unsustainable but accelerating," said Michael A. Peterson, CEO of the Peter G. Peterson Foundation, a nonpartisan organization working to address the country's long-term fiscal problems.

Peterson blamed the fast-rising national debt to "a structural mismatch between spending and revenues." The biggest debt drivers are the aging population, far too expensive healthcare costs and growing interest payments.

Peterson's observations were seconded by Judd Gregg and Edward Rendell, co-chairman of the nonpartisan Campaign to Fix the Debt, a project of the nonpartisan Committee for a Responsible Federal Budget. Gregg and Rendell said the debt hitting $22 trillion "is another sad reminder of the inexcusable tab our nation's leaders continue to run up and will leave for the next generation."

"With deficits rising and gross debt scheduled to jump by more than $1 trillion annually, Congress must take action to put the country on a more sustainable path," said Gregg and Rendell.

"The fiscal recklessness over the past years has been shocking, with few willing to step up with a real plan. We need responsible leadership to fix the debt, not a worsening of partisanship."

Experts said the accelerating debt should worry ordinary Americans because a huge and rising debt will increase interest rates for consumers and businesses. The higher rates will have the knock-on effect of boosting interest rates for mortgages, corporate bonds and most types of consumer and business loans.

A mammoth national debt will also make it harder for the federal government to increase spending in the event of a new recession. It will also crimp efforts to devote more money to help the poor and retrain workers, among other things.

The Congressional Budget Office (CBO) estimates this year's deficit at $897 billion, or a 15.1 percent increase over last year's deficit of $779 billion. In the coming years, the CBO forecasts the deficit will keep on rising. The deficit will exceed $1 trillion annually beginning in 2022 and won't drop below $1 trillion through 2029.