Robin Li, the founder of Baidu once said, "Search is all the secrets of Baidu's success." Certainly, there is no shortage of people who covet this secret.

Twenty years ago, Robin Li found Baidu with $1.2 million venture capital, and shortly gain the absolute advantage in the domestic search market. However, Baidu's search-related revenue is growing with a slow pace in recent years; users' attention has been dispersed to individual mobile ports such as personalized recommendations, short videos, and e-commerce platforms. Baidu's revenues from search and related business were also eroded by other different type businesses, technologies, and platforms.

Although Baidu is still the No.1 search engine by the market share in China's domestic search market, the search business is showing a trend of diversification and differentiation behind the increasingly saturated traffic market.

Still Hold the Throne Steadily

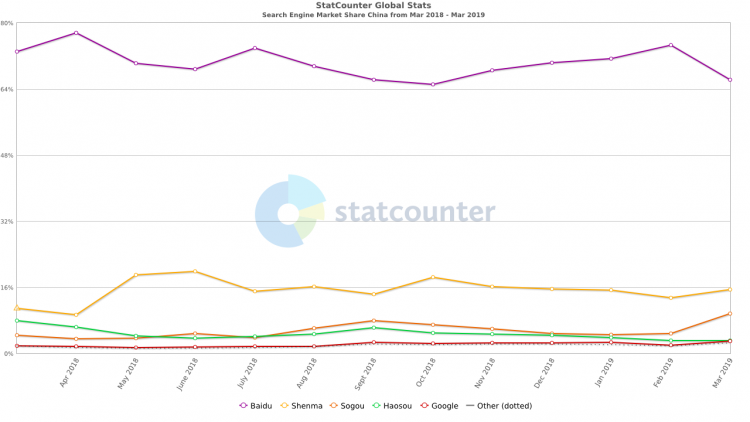

According to the Statcounter's public data, Baidu has 66.25% of search engine market share in China in March 2019. In last 12 months, the company's market share is between 65.06% to 77.53%, still sit at the throne steadily.

No. 2 search engine is Shenma, a mobile search engine launched by a joint venture company established by UC and Ali Group in 2013, which focus on mobile search only. Shenma has 15.5% market share in March, followed by Sougo at 9.62%, Haosou at 3.16% and Google at 2.91%.

Compared with the market share of about 80% in the heyday, Baidu's market share is slowly being eroded.

According to Baidu's unaudited financial report of the fourth quarter of 2018 that released in February, "Baidu Core" (a combination of search services and transaction services) gained revenue of 20.5 billion Yuan (3.05 billion USD), accounting for 75.37% of the overall revenue. its operating profit was 4.4 billion yuan (655.6 million USD), down 26% from the same period of the previous year; operating margin was 22%, down from 33% in the same period last year.

Investment bank Bernstein's analyst David Dai estimates that Baidu's share of the advertising market has fallen to 21% versus Alibaba's 36%. "Revenue growth is slowest among major Chinese internet companies, even with its feed initiative," David said in a report.

CICC analysts said in an analysis report that Baidu's profit margin is shrinking as Baidu increases its spending on content development to attract users to use its news push service, short video platform, Haokan, and another video platform, iQiyi.

Who is Shenma in the Second Tier?

The Shenma search that maintains the growth momentum has its own unique mobile end attribute.

Since its inception, Shenma Search has been positioned as a mobile search engine. According to the local media, Shenma has gradually developed features such as App Search, Shopping Search, and Novel Search that tailored for mobile search. In addition, the company is developing new functions like voice search, image search, and more innovation.

In March 2015, Shenma Search and a tech company Unisound reached a strategic cooperation to explore voice search innovation to meet the needs of intelligent mobile hardware device users. Unisound is a unicorn startup specializing in speech recognition and artificial intelligence services applicable to a variety of industries. When the user's mobile device equipped with Unisound's platform, they can search through speaking the keywords.

At present, the Unisound's cloud platform for identification service has been applied to wearable digital devices and car navigation devices. Shenma search will explore more market space on the mobile and IoT scenarios.

Other players in the second Tier like Sogou or haosou are still struggling with their own problems, seems difficult to rise as strong competitors in a short period.

Differentiated Market

Whether it's image search or voice search, more and more market share is divided by differentiated products.

Wang Wei, general manager of AppsFlyer in China region, said that it is difficult for small and medium-sized platforms to compete in terms of comprehensiveness and user coverage, but they can still win out in a differentiated market. For example, in the current second tier, some video platforms' performance are more stable. As the video adverting has a very good conversion rate and subsequent user quality for the advertiser, the small and medium platform can survive with this unique value and even keep growing.

Bytedance, an upstart IT company that operating several machine learning-enabled content platforms, has installed search technology on multiple sub-categories to support business development. In November 2018, Bytedance launched the commodity search function, to serve its own e-commerce platform "Fangxin Gou", supporting the search of commodity categories and brand names, presenting search results in the form of commodities. Besides, based on the different category, the search will provide different results. For example, If you search for "women's clothing" in the Bytedance's search box, users will see the subordinate categories of women's clothing in "Fangxin Gou".

A source in the field told local media, the search business must have a content pool first to quickly find and recommend what users want. In terms of data, Bytedance's internal article search is completely fine, but in terms of external search, its resource and database have no dominant advantage when compared to Baidu, Tencent, Ali and other platforms, and its technic also needs a lot of improvement.