Summer Davos Forum, also known as the 13th Annual Meeting of the New Champions kicked off on July 1st in Dalian City, northeast China's Liaoning Province. The theme of this year's forum is "Leadership 4.0: Succeeding in a New Era of Globalization".

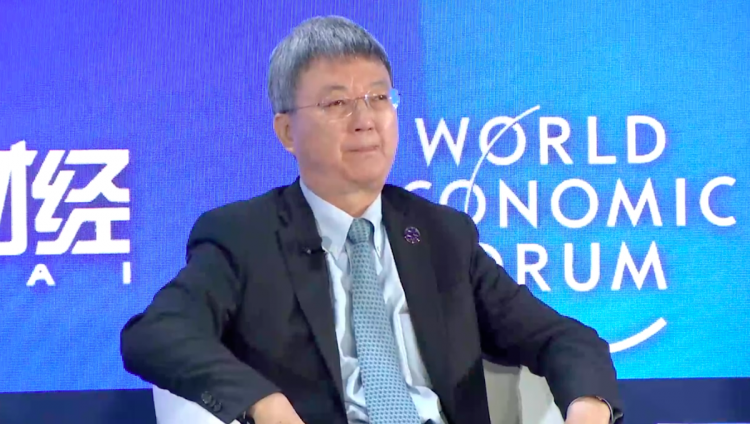

Zhu Min, a leading economist of China, as well as the former deputy managing director of the International Monetary Fund, shared his insight on the trending topics of Facebook's Libra, US-China trade disputes and other international economic issues.

In a forum named "How China shapes the Future of Finance", Zhu Min mentioned Facebook's digital currency Libra.

"The core concept of Libra first is currency, second is cross-border, and thirdly, it combines the policies that the central bank has to consider with the payment function that commercial banks carry out. Its debut will have a big impact on the existing financial system, the monetary system and even the future reserve system." said Zhu Min.

He continually explained that Libra is not like China's Alipay, which is only a payment intermediary, while Libra starts with payment, has reserves, principal and bonds as collateral, and has a basket of currencies for labeling and pricing. Thus, its core concept is currency.

Zhu Min said: "We should not take the birth of Libra lightly."

However, he also mentioned the problems that may be brought by Libra, such as the issues regarding leverage, reserve, and centralized management system and mechanism.

On June 18, Facebook released a white paper on its encrypted digital currency Libra. After the publication of the white paper, it attracted extensive attention as well as raised controversy. According to the white paper, Libra's mission is to create a simple, borderless currency and financial infrastructure that serves billions of people.

The inseparability of the global technology industry chain

Zhu Min responses to the news that US President Trump agreed that US companies could continue to sell products to Huawei, indicating it reflects the inseparability of the global technology industry chain.

He pointed out that the failure of the US companies to supply Huawei seriously damages the credibility of the United States as an open and free technology market, and it is extremely harmful to the US Science and business society.

Zhu Min pointed out that in 2018, the global chip market size was 478 billion US dollars, of which China imported more than 300 billion US dollars. "If China does not import, who are these chips sold to? The factory loses two-thirds of its demand, how its profit and stock price would be affected?"

Zhu Min said that the industrial chain of the technology industry is the most globalized, and it is impossible to be divided. Although Huawei's supply from US may encounter twists and turns in the near future, but we should still strive to promote the globalization of the technology industry chain.

He also encourages Chinese tech companies to invest in building its own core technology of chip industry to avoid similar crisis.