The past twenty years have witness China making great achievements especially in economic field, and it is not surprise that more and more investors are interested in China's stock markets or Chinese stocks listed here in the States. Sufficient information is necessary for making wise choices during investing. Considering the limited information about China's economy from microcosmic angle, I will select some of China's growth industries to introduce in the next several articles.

In 2018, many people were surprised to find that China's express business exceeded the sum of developed economies such as the United States, Japan and Europe, and it is three times more than the America's. The number of packages handled by Chinese express companies accounts for more than half of the global express packages, which has become the power source and stabilizer for the development of the global express market. By 2019, the parcel delivers of this country increased by 24%, achieving an amazing 63 billion pieces, and the business revenue is expected to reach 745 billion yuan. The growth is continuing. This fast-growing industry contains huge investment opportunities.

Ⅰ. The industry catalyzed by Internet e-commerce.

When it comes to express delivery, many people think of FedEx. The growth of American Express industry benefits from the development of international trade, while the situation in China is totally different.

Private express finally gained its legal status on October 1, 2009 when the revised Postal Law of the people's Republic of China (hereinafter referred to as the "New Postal Law") was officially promulgated and implemented. China's express industry really began to develop since then. At the same time, China's e-commerce industry has also started an explosive growth, which has become a catalyst for the development of the express industry. It is estimated that more than 70% of orders in the express industry are from e-commerce. The development of e-commerce, especially the rapid growth of online retail, requires the express industry to develop at the same speed. According to iResearch, China's express business volume increased from 1.51 billion pieces in 2008 to 50.7 billion pieces in 2018 with an annual compound growth rate of more than 42.1%, in the mean term its online retail market increased from 128.2 billion yuan to 7.6 trillion yuan with an annual compound growth rate of more than 50.4%. China's express industry has experienced a "golden decade" of rapid development.

Figure 1: Market size, growth and penetration rate of online retail of China (Source: iResearch)

Figure 2: Business volume of express and growth rate in China (Source: iResearch)

Express industry not only benefits from the development of e-commerce, but also promotes the development of it. China's express industry plays two important roles in the development of e-commerce industry. On one hand rapid expansion of industry has provided huge express capacity in a short period of time, on the other hand the scale effect helped to reduce costs and to expand the range of products sellable online rapidly. It is with these two important industrial supports that China's scale of e-commerce can surpass that of the US and become the first in the world.

Ⅱ. China's express industry entered the integration period in 2019.

In the 10-year rapid development period of express delivery, the other three changes are also taking place at the same time. All of these have a huge impact on the industry.

1. The transformation of e-commerce industry is underway.

Ordering lunch from favorite restaurant through apps, or buying fruits and vegetables online when doesn't feel like going out is a common life of someone live in China, and that benefit from the widely used of new business models such as new retail. These business methods help countless stores achieve sales beyond imagination, but at the same time, they also have a profound impact on the express industry. In addition to the increase of the deliver range and the quantity of distribution, higher requirements are also put forward for the immediacy and the standardization of services in such circumstances - all of which lead to the pursuit of new technology and the better management system of express enterprises. Generally, large enterprises have more advantages in R&D and technology upgrading, and companies with small scale or focus on low-end market will have even smaller market share due to technical disadvantages.

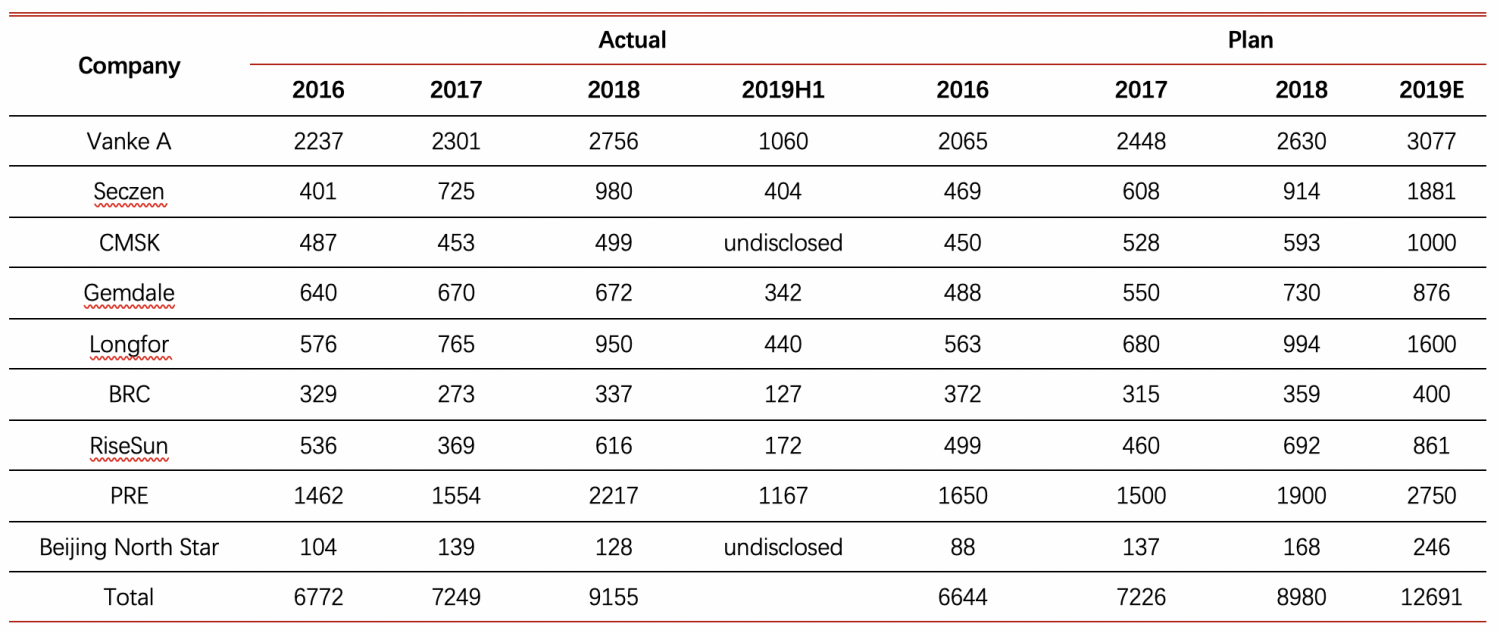

2. E-commerce giants have a huge impact on the downstream industry. Data shows that in 2018, the market share of CR4 in China's e-commerce industry accounted for 82%, which is very rare in China where the industry concentration, especially the nongovernment-dominated industries, is generally low. The leading companies of the e-commerce industry impact on the downstream with their business volume, investment and other resources.

Figure 3: Market share of e-commerce in May 2019 (Source: eMarket)

In 2013, Alibaba, China's e-commerce giant, established CaiNiao Logistics System as the largest shareholder, which included most of China's well-known express enterprises. The most important group of these enterprises is "Three TOs and a DA", which consist of ZTO Express (NYSE: ZTO), YTO Express (SH: 600233), STO express (SZ: 002468) and YUNDA express (SZ: 002120). The other two leading e-commerce enterprises, JD and Pinduoduo, have created a natural cooperation in logistics due to having the same major shareholder Tencent. Most of the parcel delivery of these two companies are undertaken by JD express. " Three TOs and a DA " group and JD express have occupied most of the middle and low-end express market.

3. Price competition caused by homogenization accelerates industry division, and some small enterprises were forced to get out of the industry. Since most of the customers of express companies come from e-commerce enterprises, the industry price is sensitive. And the homogenization of services makes this situation even worse. According to the data published by the State Post Bureau, the monthly year-on-year data of industry's unit price from 2016 to 2019 is roughly down.

Figure 4: Monthly year-on-year data of express industry's unit price (Source: State Post Bureau)

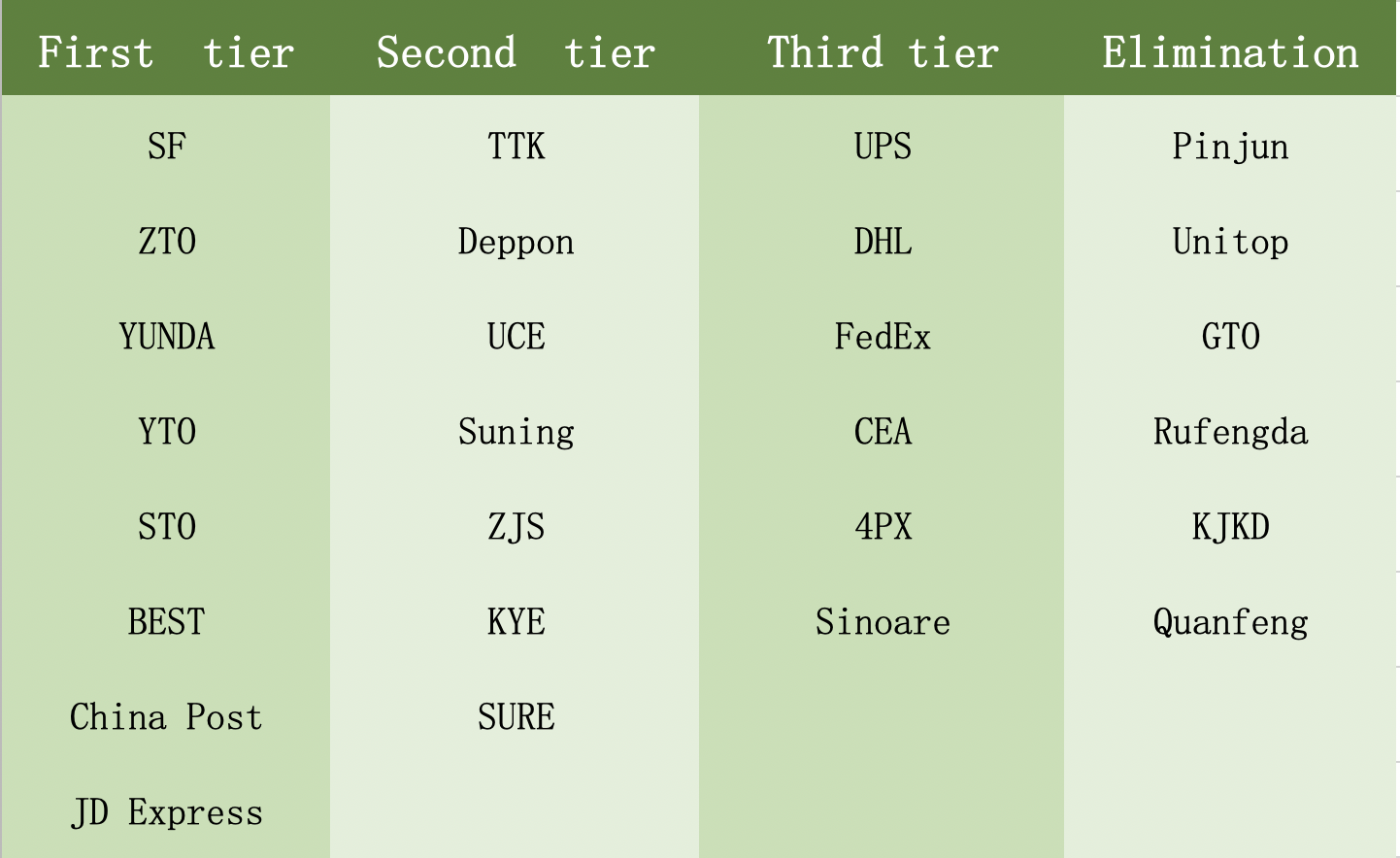

The reduction of absolute income per unit put the small companies in hard place. In fact, the echelon is already have emerged due to the competition, and some enterprises have been eliminated from the industry in 2019.

Figure 5: Echelon of express industry in China (Source: 物流一图)

Ⅲ. The development trend of China's express industry in the near future

1. There is still a lot of room for growth in business volume.

At present, the mainstream users of e-commerce in China are mainly urban residents, which are concentrated in five tier and the better cities. In 2018, the disposable income of rural residents in China is still less than that of urban residents in 2008, but its growth rate is higher than the latter, hence the purchasing power in the future of rural residents is visible. Since the supply of goods in rural areas is limited, a large amount of consumption will be realized through online shopping, which will bring dynamic to the express industry.

Figure 6: User distribution of mainstream e-commerce platform (Source: questmobile)

Figure 7: Growth of rural per capita disposable income exceed that of urban (Source: The National Bureau of Statistics)

2. Price war is still going on, and the monopoly will be formed with the fierce market competition. Price war caused by homogeneous service is inevitable for an industry not yet monopolized, unless there is a disruptive new service. The war brings about two kinds of competitions. One is absolute price competition to obtain more users, and the other is to reduce costs including transfer fees and distribution fees to preserve margins. Behind these competitions will be a large amount of funds and R&D investment, including applications of new technology and equipment, system management upgrading, employment of more professionals, and etc., which are the real battlefields of the head enterprises. The accumulation of capital, technology and market share will eventually promote the formation of monopoly.

Ⅳ. Who will become China's FedEx and UPS?

In addition to China Post and JD express, which is a subsidiary of JD.COM (NASDAQ: JD), six of the eight leading enterprises have been listed, so it is very convenient for us to get information about the companies. The six companies are divided into two factions according to market positioning and investor relations.

1. S.F. Holding Co. Ltd (SZ:002352). SF was established in 1993 and listed on Shenzhen Stock Exchange in 2017. It is a leading integrated express logistics service provider in China. It mainly targeted at high-end customers and has basically established the capabilities of providing integrated comprehensive logistics solutions to customers. Not only does it provide high quality logistics services from the delivery end, it has also extended its services to segments of production, supply, sales and distribution in the front-end of the value-chains, and catered to consumer demand by using data technologies such as big data analysis and cloud computing to provide customers with comprehensive solutions including warehousing management, sales forecasting, big data analysis and financial management. Moreover, SF Holding also provides value-added services such as insurance and Cash on Delivery (COD) to meet the specific needs of customers.

2. "Three TOs and a DA" group and the BEST Express.

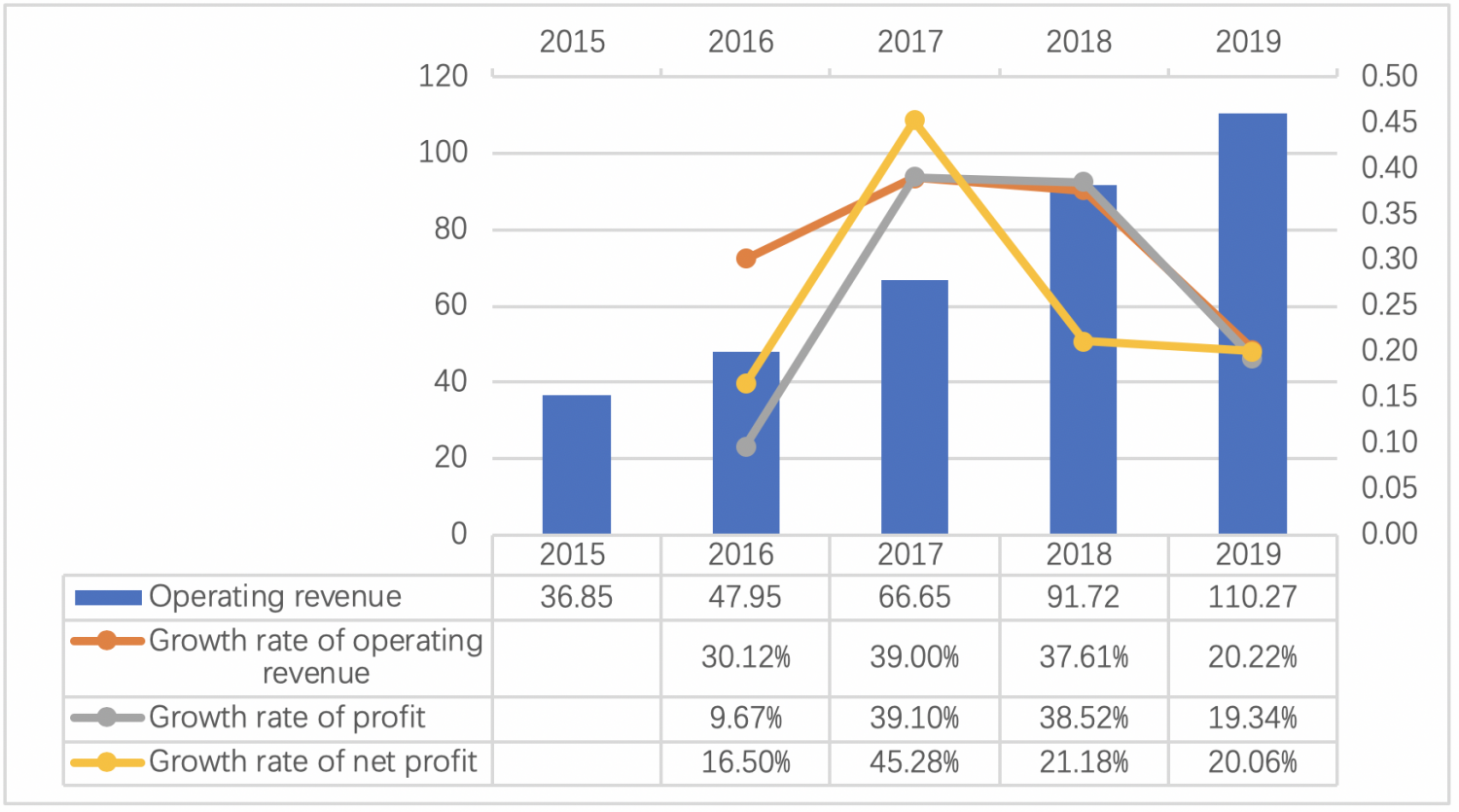

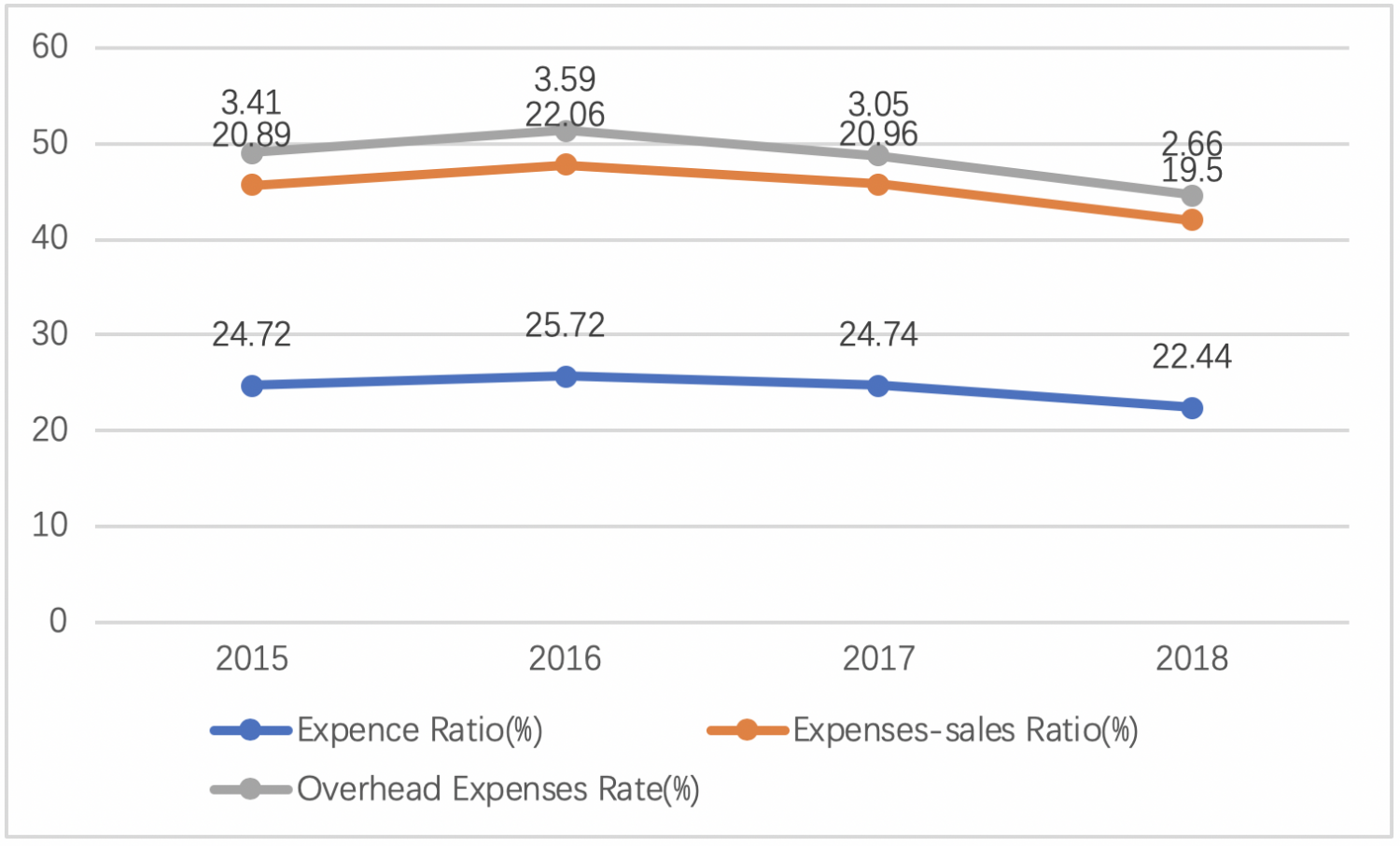

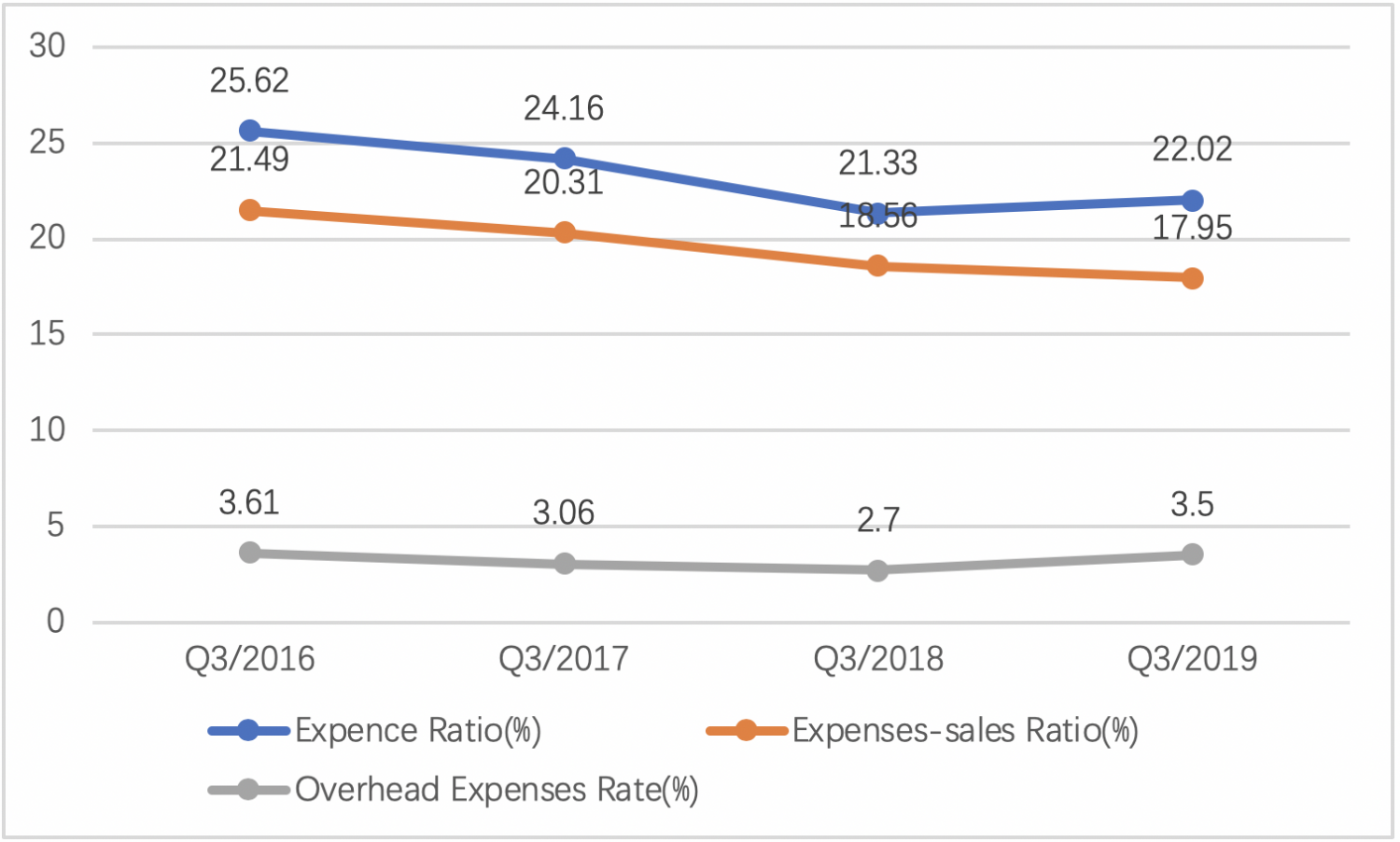

The early 1990s could not imagine that several small express companies who were borned in Tonglu, a small city in Zhejiang Province, would become the giants of the express industry in China. These companies were the later "Three TOs and a DA" group and the BEST Express. These five companies can be collectively referred to as "TODA System" because of this special historical origin. The system is positioned in the middle and low-end market and firmly occupied the first echelon of express industry with the advantages of price and market share. Their operation relies on e-commerce platform headed by Alibaba. Due to the rapid growth of e-commerce market, the business scale of each company in the system has surpassed that of SF Holding since 2015.

3. Comparison of operation data of leading companies

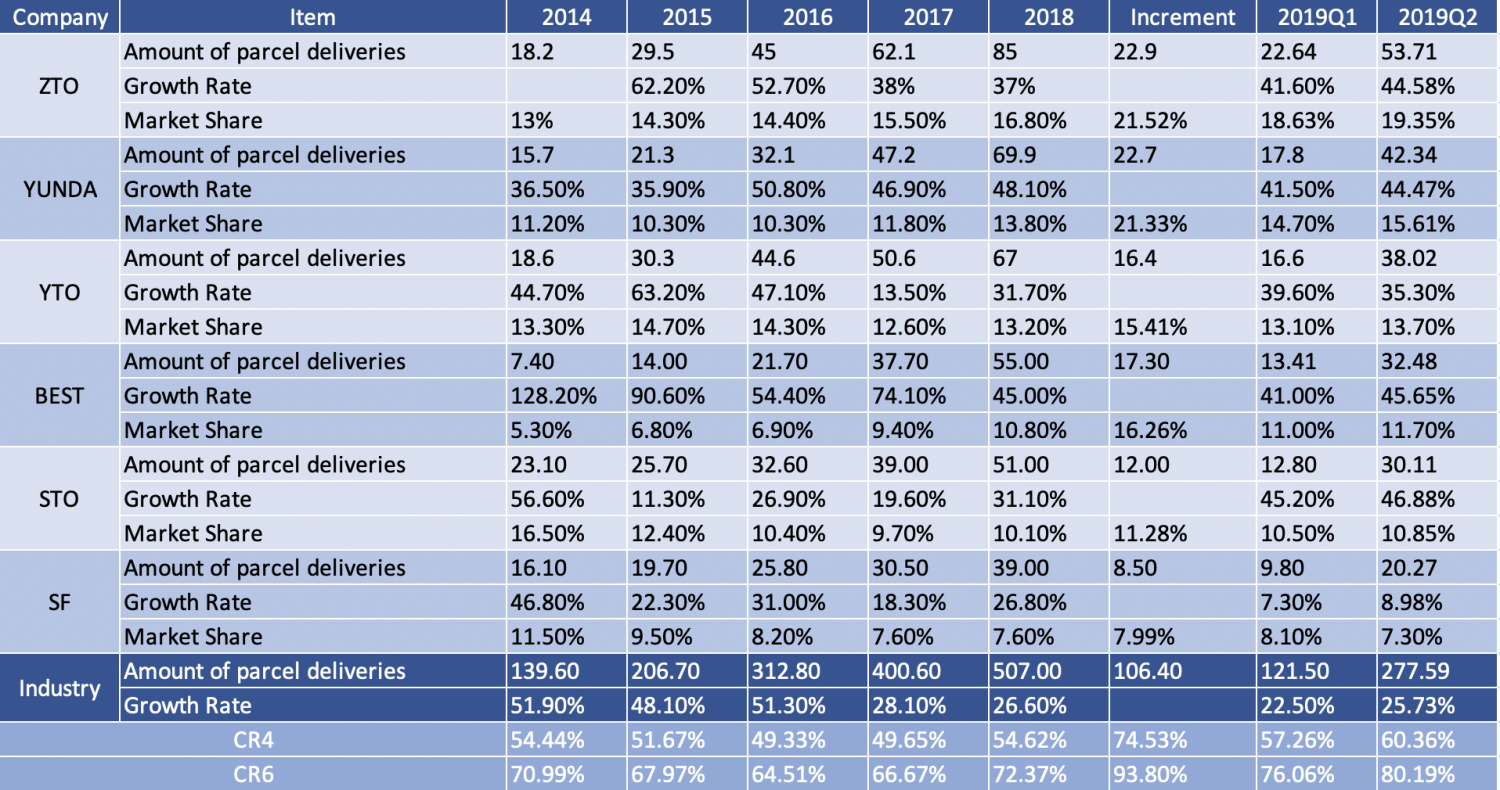

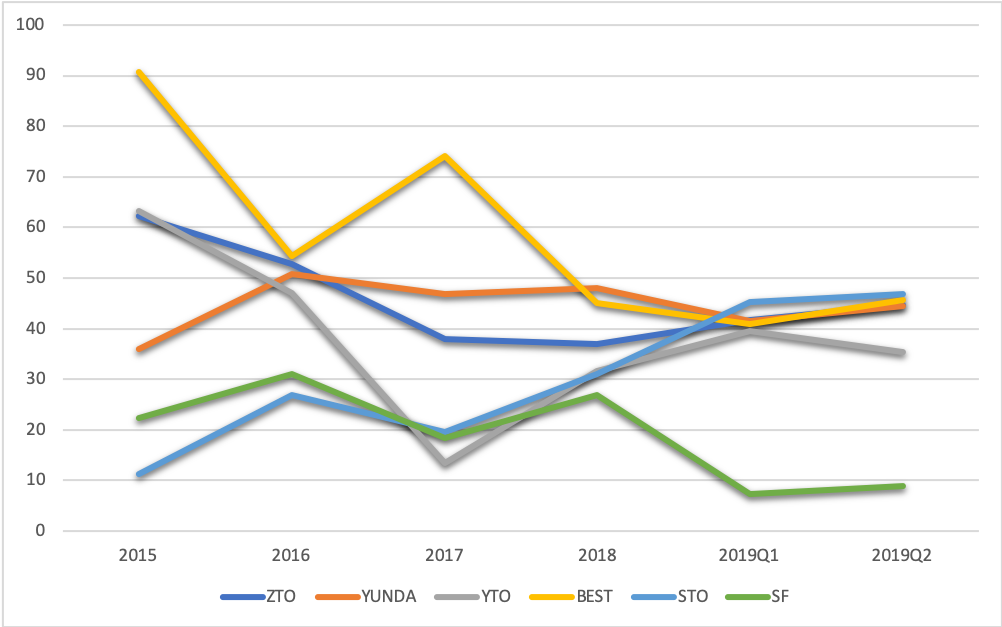

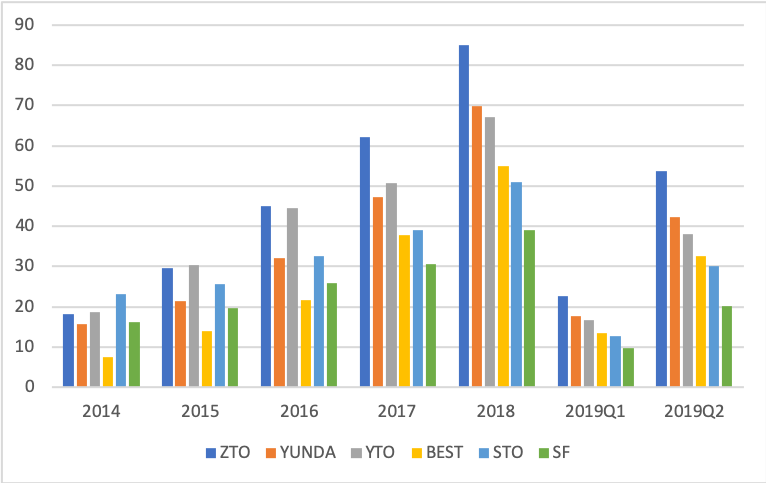

Figure 8: Business volume and growth of industry and leading companies (Source: financial reports; State Postal Bureau)

Figure 9: Market share of leading companies (Source: financial reports; State Postal Bureau)

Figure 10: Growth of leading companies' market share (%) (Source: financial reports; State Postal Bureau)

The table above shows the business volume and growth of six enterprises since 2014. It's clearly that the business volume and market share of the top enterprises in the express industry have been increasing since 2014. In addition, the market share of both CR4 and CR6 has been gradually increasing too. From the corporate level, ZTO's market share has been in the leading position. All enterprises have maintained a market share growth of more than 10% in the past five years except SF, among which STO has the most solid growth.

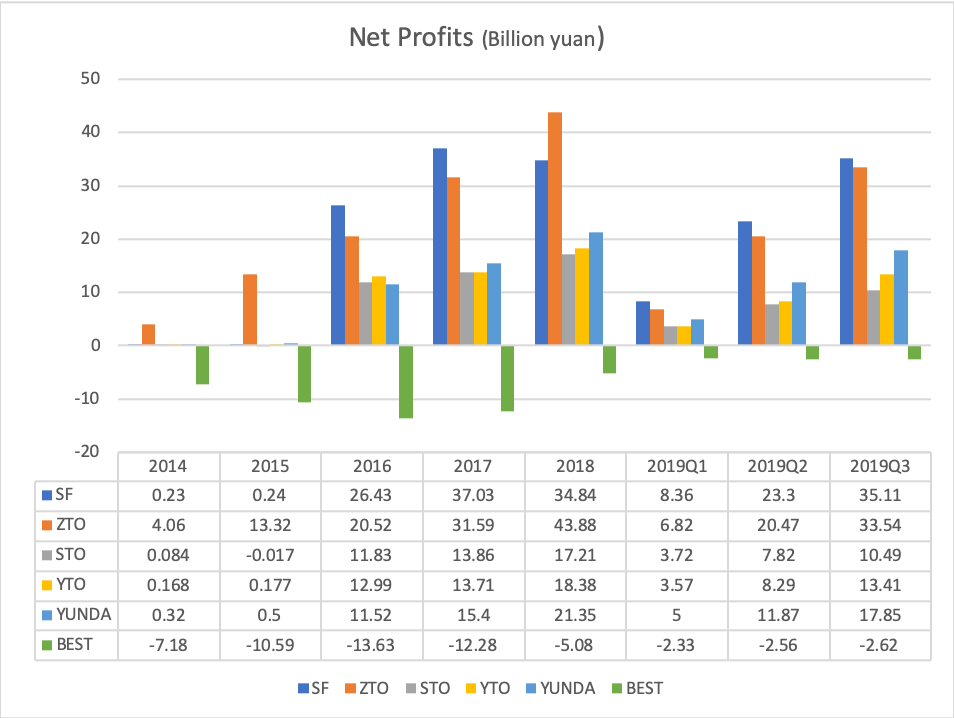

While the market share continues to expand, the profit gap between companies has not been narrowed. From the net profit data of each company, SF and ZTO have always been leading in recent years. Although ZTO's net profit exceeded SF in 2018 to became the first in the industry, but the situation was reversed in 2019. Although BEST has a large market share, it has been struggling with negative profits due to its franchise based business model and cost control problem.

Figure 11: Net profits of leading companies (Source: financial reports)

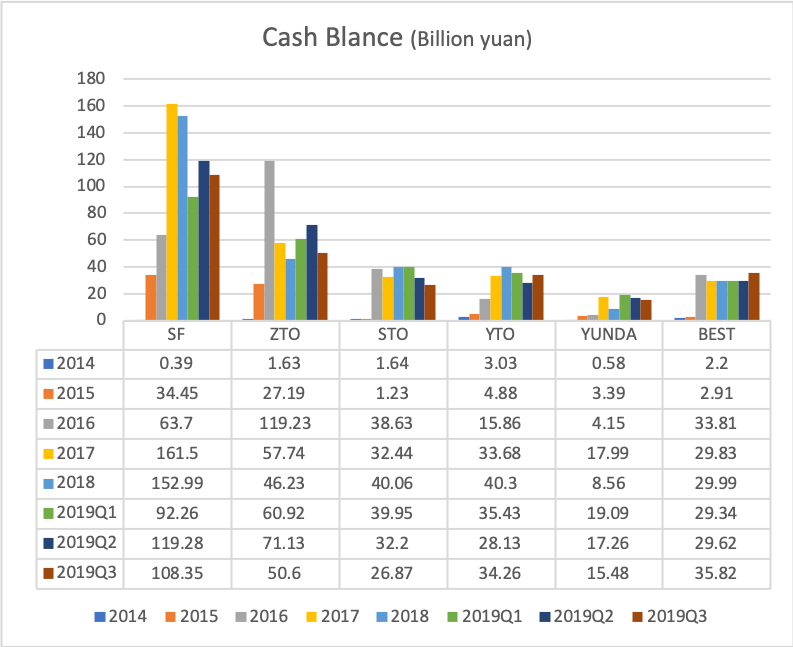

The competition of express head enterprises is largely the competition of price and funding in the future, therefor the capital position of each enterprise is related to whether it can survive in this war. On the one hand, it depends on the financing ability of the enterprise, on the other hand, it depends on the cash management ability of them. From the perspective of cash flow, SF and ZTO are leading, and YUND is relatively weak.

Figure 12: Cash Balance of leading companies (Source: financial reports)

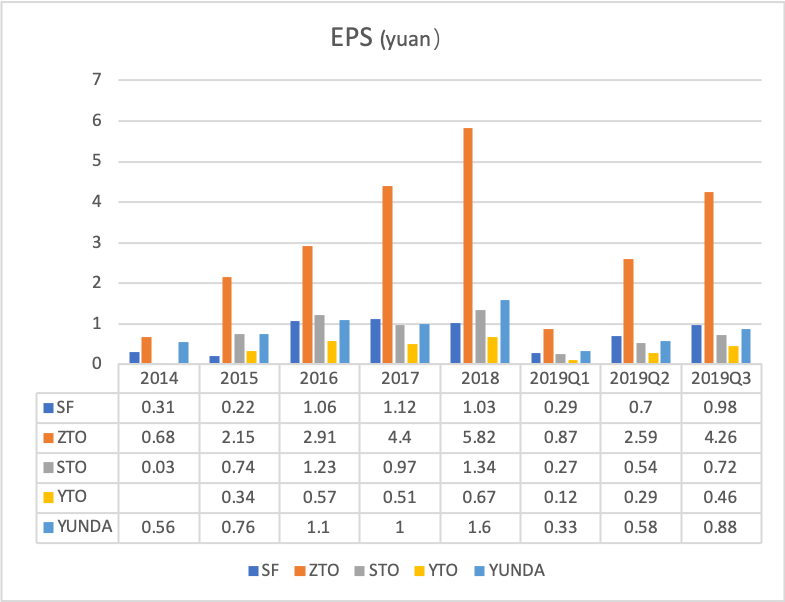

From the per share indicator perspective, ZTO's EPS has been leading for many years, and its leading degree is expanding, which puts a lot of pressure on other companies.

Figure 13: EPS of leading companies (Source: financial reports)

Ⅴ. Risks need to be focused on

While confident about the express industry, some risks should also be noted. The first, the industry is highly dependent on the e-commerce industry, once problems happened in the e-commerce industry downstream may be heavily affected. The second, the labor cost of express delivery industry is very high, especially in the distribution sector. With the gradual disappearance of China's demographic dividend, the labor cost will continue to rise. The fluctuation of the labor cost will have a negative impact on the industry. The third, policy implications is very important when investing in industries or companies abroad, especially in China.