On May 22, Alibaba Group Holding Limited ("Ali" or the "Company") (NYSE: BABA) announced its March quarter and full fiscal year 2020 results.

What excited the market was that Pinduoduo Inc. (NASDAQ: PDD) also published its numbers on the same day.

While Ali has been staying steady at the first place on the ranking of e-commerce platform in China for several years, Pinduoduo is the leading "new e-commerce" platform.

Ali's figure in this reporting period was inferior to Pinduoduo judged by the market. Thus, the stock price of Ali dropped by 5.87% at the end of the day while Pinduoduo shot up by 14.50%.

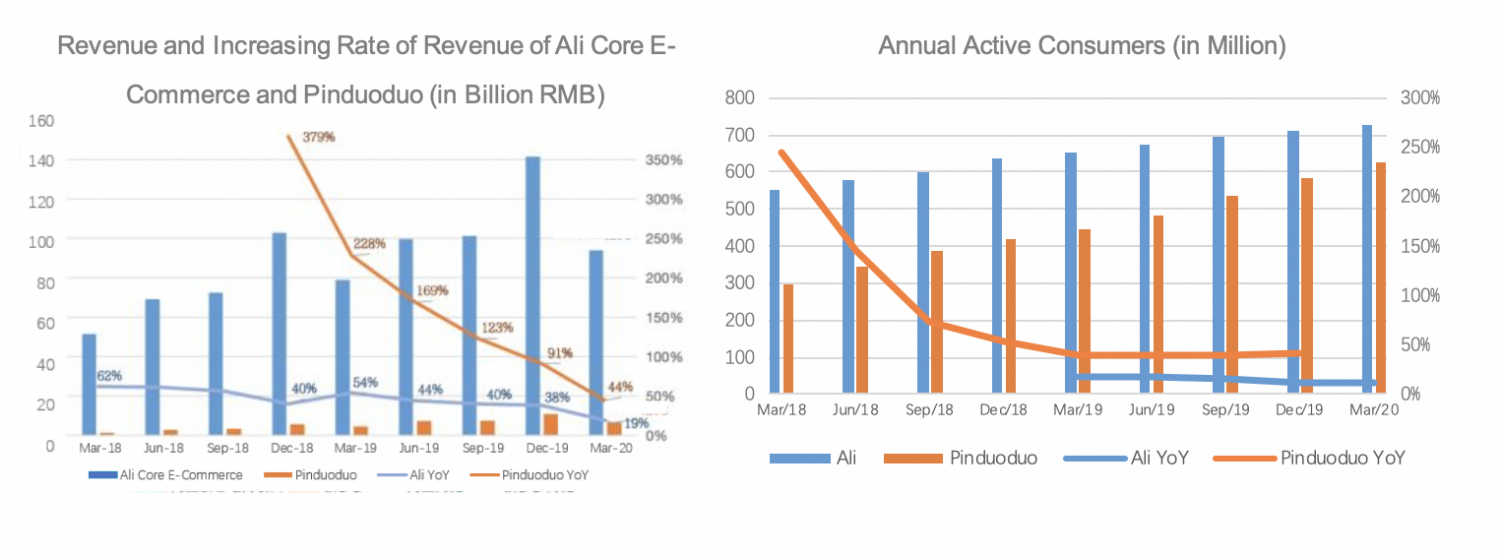

22% year-over-year increase rate of revenue seemed not bad, but for Ali, it was the first time to see the number lower than 30%. Pinduoduo, on the other hand, enjoyed 44% YoY increase. Meanwhile, the number of domestic active consumers of Pinduoduo has been increasing incredibly fast and reached 628 million, only less 100 million compared with Ali's.

Gross Merchandise Volume (GMV) growth rate of Pinduoduo was also eye-catching. It to some degree forced Ali to announce its GMV this time. Jack Ma, the founder of Ali, once said that "GMV should never be a core standard of e-commerce".

"Alibaba achieved the historic milestone of US$1 trillion in GMV" written in the report was both to show that Ali achieved the target it set five years before, and to tell the market that Pinduoduo still had a long way to go before surpassing Ali.

Besides, Ali had 180 million overseas customers, and its revenue is 18 times to Pinduoduo's.

From focusing on getting more active consumers and higher GMV, to adjust SKU and get higher unit price, and then to achieve higher profit. Pinduoduo has been just following the old path of Ali. Not to mention that except for core commerce, Ali has three more business parts - cloud computing, digital media and entertainment, innovation initiatives and others. Pinduoduo at most treats the retail part of core commerce of Ali.

Therefore, it is safe to say that Pinduoduo, at least at this moment, is not the main competitor of Ali.

Technology has become an important engine of the Company.

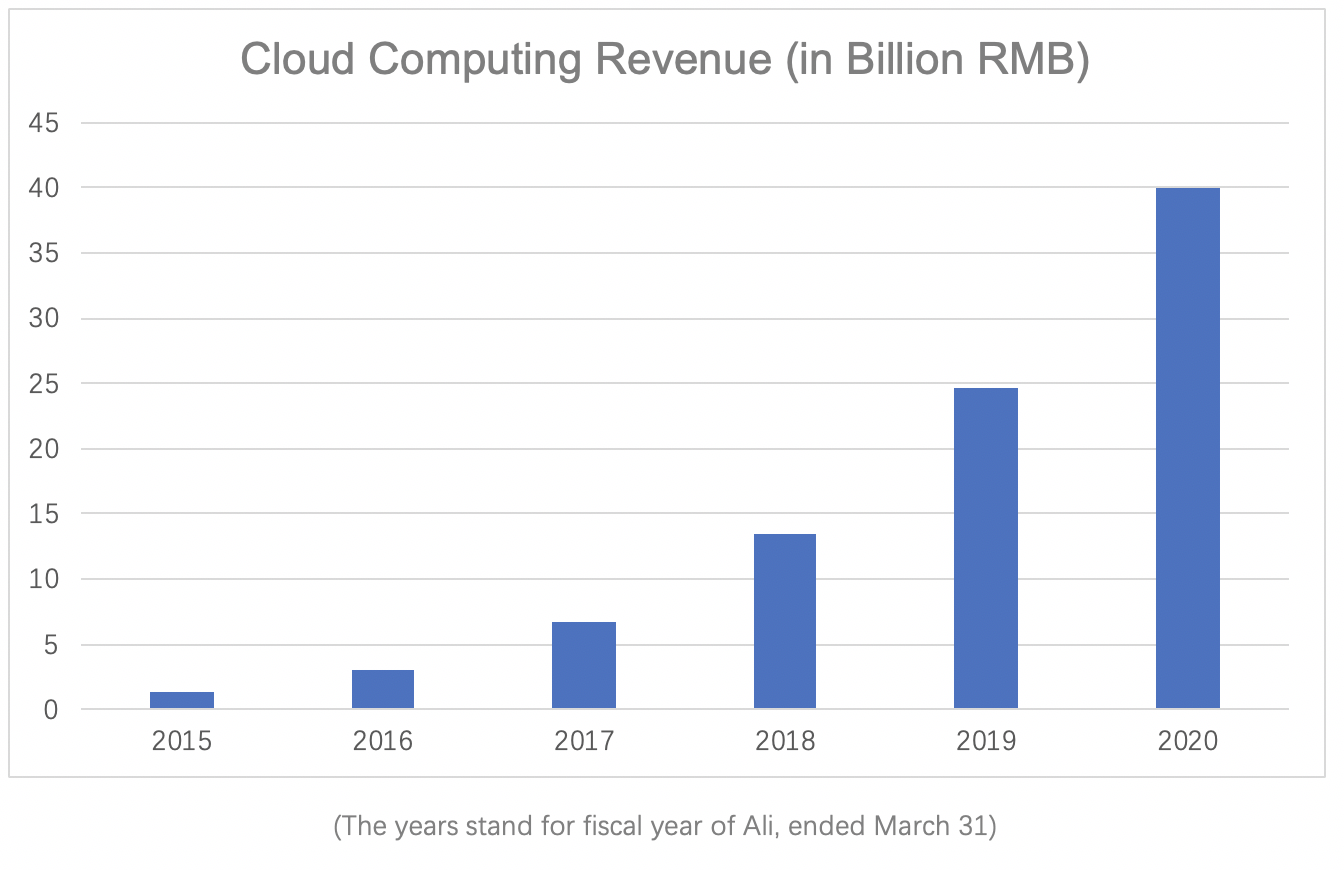

Ten years ago, Jack Ma decided to "continuously invest a billion Yuan annually in cloud computing for at least ten years". Ali won at the beginning.

In fiscal year 2020, Ali Cloud achieved 62% YoY revenue growth, brought over 40 billion RMB to the Company. Revenue of this part had increased over 30 times during the last 6 fiscal years.

(The years stand for fiscal year of Ali, ended March 31)

Gartner, a research and advisory company, published cloud computing market data of 2019. Ali Cloud kept its top position in Asia-Pacific market, taking up 28% market share in 2019. It also took up 9.1% market share in the global market.

Structure Research estimated Ali Cloud to post revenue of US$7.08 billion, but Morgan Stanley was more aggressive in its forecast for the operation, suggesting US$8.72 billion revenue by 2020.

Executive Vice Chairman Joseph C. TSAI said in the conference call that the developer ecosystem in China, including SaaS ecosystem, had just started to be established; Ali was willing to build the ecosystem with developers.

However, revenue and market share of Ali Cloud were notable lower than AWS and AZURE. The profitability of Ali Cloud is still a challenging. In domestic market, with the emerging of other cloud computing platforms, the expand of Ali Cloud will not be as smooth as before.

Ali does not rely on Ali Cloud solely in technical area.

To take IBM minicomputer, Oracle data base and EMC storage device out of Ali's IT frame, the Company established DAMO Academy and PingTouGe Semiconductor Co., Ltd on October 11th, 2017 and in September 2018 respectively.

DAMO Academy was founded to address challenges through the philosophy of "research for solving problems with profit and fun". The Company planned to invest 100 billion RMB in basic science and cutting-edge technology research.

The initial framework was "4+X", which stands for Financial Technology, Robotics, Data Computing, Machine Intelligence, and X Laboratory. Because of the rapid development of 5G and other communicating technology, DAMO founded XG Laboratory this year.

Research groups of DAMO have published over a hundred essays on core journals and have become the leaders in the world in several areas. During the coronavirus pandemic, over 560 hospitals around the world used medical AI developed by DAMO to do computed tomography image diagnosis to suspected cases.

PingTouGe, as introduced on its official website, is "specializing in semiconductor chips, with primary goal of developing the next-generation of cloud integrated chip architecture, data centers and embedded IoT chip products". On September 2019, PingTouGe introduced its first independently developed AI chip - Hanguang 800 NPU.

Chip industry has been a big weakness in Chinese industry area. What PingTouGe is doing will not only benefit the Company, but also Chinese whole industry.

At the end of 2018, Ali joint its complex business with technologies. IaaS, PaaS, DaaS, SaaS and BaaS together formed Ali Business Operation System. The era of "technology drives business" arrived.

While running fast along the technological path, it is important for Ali to keep in mind that its technological part of business still had deficit. The money it needs to invest in researching is generated from other business parts.

Core commerce is still the living base of the Company. Taobao and Tmall together contributed to 60% revenue. This part, unfortunately, has been facing bigger challenges.

Due to the pandemic, revenue of cross-board e-commerce platforms, including AliExpress and Lazada, is still under pressure.

The self-established logistics of Ali is not as developed as JD Logistics, which caused big influence during the lockdown period. Although the Cainiao Network has been improving and Ali has invested in several express companies, the treats from SF Express and JD Logistics are too huge to neglect.

Local customer service is a "cannot afford to loss" area to Ali because E-payment is used in remarkably high frequency in local service scenarios, and E-payment is crucial to Ali.

Alipay, a national level traffic entrance, is the core competitiveness of the Company. But Meituan is still the largest on-demand delivery and local services platform. Along with China Council for the Promotion of International Trade (CCPIT), Meituan initiated Guidelines for Contactless Delivery, which has been approved by ISO International Standard.

Meituan turned to the standard maker form the industry leader. The competition between the two giants will be more fierce in the future.

Ali has been making a lot of effort to develop Digital Media and Entertainment Department. Daniel Zhang, chairman and CEO of the Company, said in 2015, "Ali would be an E-commerce company forever, but with entertainment industry, Ali has opportunities to expand to larger business world".

However, having changed three CEO, tens of core managers and three strategies, Digital Media and Entertainment department still did not create a core IP. It generated 5.94 billion RMB in this report period. iQIYI (NASQAD: IQ), an online entertainment service in China, had over 7 billion RMB revenue during the same period. This department has much wilder business ranges than iQIYI, so whether development of the department has reached the Company's target should be questioned.

Despite all the difficulties and challenges, Ali announced that it would invest 200 billion RMB in three years in researching related to cloud operation system, server, chip, network and other import core technologies, as well as in establishing of data center.

The day before the announcement of financial report, the Company announced another 10 billion investment in AloT and content ecosystem arrangement. Tmall Bot is the core. It will be integrated with Ali Cloud and DAMO and be including in Ali ecosystem to serve in entertainment, health, education, shopping and other areas.

Ali set another "little goal" - serve 2 billion customers, help 10 million SMEs achieve profit, and create 100 million working opportunities by 2036.

To achieve the targets, Ali still needs to focus on three strategies, which are promoting domestic demands, cloud computing and globalization.

Back to the beginning, Pinduoduo is not the major competitor on this road. At least not for now.

Disclaimer: This article is contributed by Yuqin Jiang, a contributor of Business Times, who is responsible for the data and opinion provided.