The figures are humongous: 1 million shares of retail giant Amazon.com being sold for over $3.1 billion. Yet, for the seller Jeff Bezos, it amounts to almost nothing in his total stake of the business empire.

The offload, revealed in Securities and Exchange Commission filings late Wednesday, adds to the multi-billionaire's $4.1 billion divestment earlier this year.

The sales are a mere chunk of the money that Bezos has stacked up for 2020 as the ongoing global health disaster forced consumers to stay in their homes and created massive demand for Amazon's e-commerce products.

The disposals this week bring Bezos' current-year total cash-out to just a little over $7.2 billion. He still owns over 54 million shares, valued at more than $170 billion, making him the wealthiest man alive.

For comparison, Bezos offloaded $2.8 billion worth of shares last year. He has previously announced he was disposing around $1 billion of Amazon stock per year to finance his space exploration program, Blue Origin. Amazon representatives were not immediately available to comment on the latest sale.

Since his $1 billion disposal for Blue Origin, Bezos has made other commitments: a $2 billion pledge in September 2018 for the Bezos Day One Fund, which supports non-profit groups engaged in relief programs for homeless families, and building a national infrastructure of Montessori-inspired pre-schools.

Bezos has already given away almost $200 million to homeless-focused non-profits. He also gave $10 billion in February to the Bezos Earth Fund, dedicated to climate change.

Last week, Amazon reported $89 billion in sales, up 40 percent from the year-ago quarter, with earnings surpassing Wall Street estimates of $5.2 billion.

Bezos owns or has voting rights in 15 percent of Amazon's outstanding stock, the group's latest proxy statement disclosed.

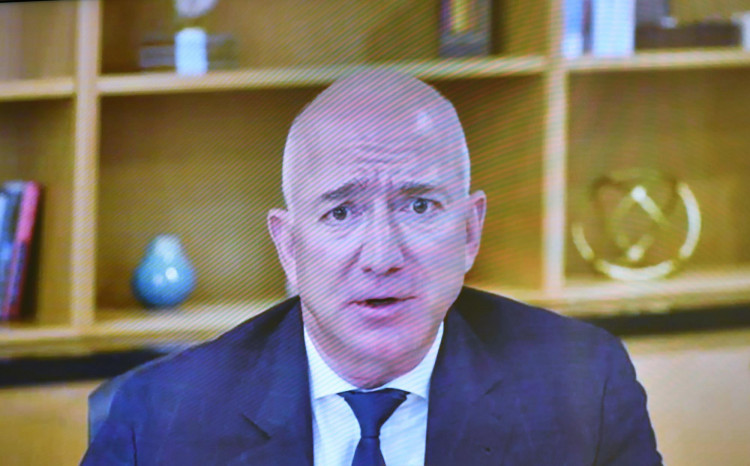

Meanwhile, the eye-popping gains for Bezos and other giants in the industry have placed the so-called Big Tech under U.S. regulators' crosshairs. Bezos testified before Congress last month together with the top honchos of Apple Inc., Facebook and Alphabet Inc. to defend their outsize influence.

Bezos' growing fortune has also put a spotlight on the growing income disparity within the American economy, which is seeing its darkest economic times since the Great Depression.