Shares in Chinese live-streaming service Kuaishou surged in its first day on secondary markets, putting the loss-making company on course to be one of Hong Kong's largest listings to date.

The IPO was oversubscribed more than 1,200 times by retail investors, many of whom borrowed heavily to apply for shares allocated in lots of 100 to individuals. Shares went to HK$345 ($44.5) from HK$115 ($14.8), tripling in value on Friday.

Kuaishou has plowed money into a costly user acquisition strategy that left it $6.9 billion in the red in the first six months of 2020, according to a prospectus filed with Hong Kong's bourse.

"We only need to look at public listings such as JD, which was a relatively early listing and has since worked hard to achieve its profitable position," said Mark Tanner, managing director of consulting group China Skinny, in an interview with Business Times.

Investors will look to the company to leverage its commands over a primarily lower tier audience that is rapidly growing wealthier.

"This segment has been elusive for many of the big tech companies as it presents the most growth and opportunities to diversify incomes as these areas grow wealthier and spend more online," Tanner said.

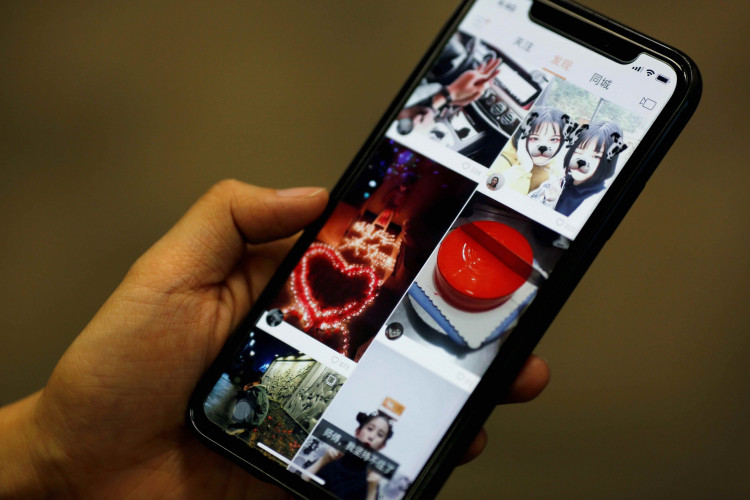

Tencent-backed Kuaishou was founded in 2011 by former Google employee Su Hua and Cheng Yixia as a way to share animated pictures between users before branching into short videos in 2013 and live streaming in 2016.

Kuaishou reported 264 million daily active users as of November 2020, which is less than half of that of main competitor Douyin.

Bank of America, Morgan Stanley and China Renaissance were joint sponsors of the deal.