U.S. investment management company Elliott Management Corp. is seeking to raise more than $1 billion for a special-purpose acquisition company.

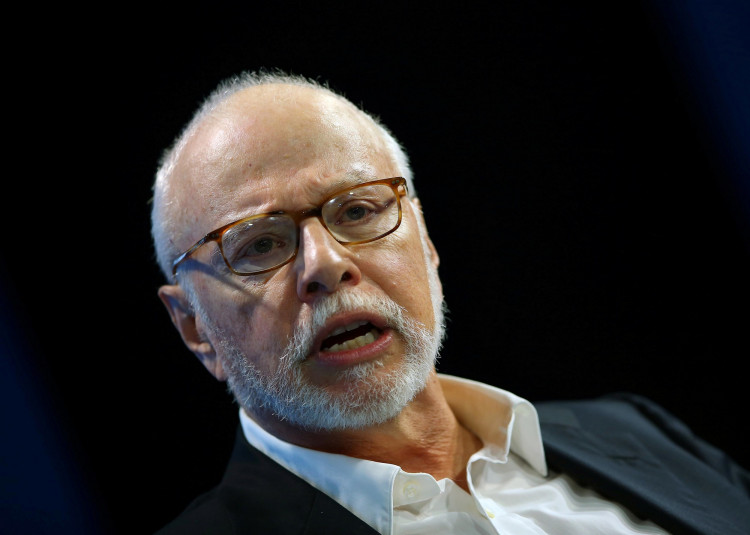

The company - founded by billionaire Paul Singer - is said to be meeting with bankers and investors ahead of creating the SPAC. It is still in the early stages and may not may not come to fruition, sources familiar with the matter.

The same sources said if Elliott gets enough funding it may use the proceeds to acquire a double-digit billion-dollar company.

SPAC public listings are the latest option for companies seeking to raise funds. SPACs are essentially shell companies whose purpose is to raise money from the public for third-party entities.

So far this year, more than 116 SPACs have been listed - raising close to $35 billion. On Friday 10 new SPACs were launched. According to SPAC Research, 2021 is on track to beat last year's record of more than $80 billion.

Of the hundreds of SPACs launched, 12 only have raised more than $1 billion. The largest launch last year was with originator United Wholesale Mortgage Holdings Corp, which raised about $16 billion. A SPAC launched after the merger of Owl Rock Capital Corp. and Dyal Capital Partners was estimated to be worth $12.5 billion.

Big hedge funds have established SPACs but Elliott has yet to do so. Activist hedge funds hunting for target companies include those established by William Ackman's Pershing Square Capital Management, LP, Jeffrey Smith's Starboard Value LP and Pershing Square Tontine Holdings, Ltd.

Sources said Elliott Management hadn't determined which industries it would target. The fund with $42 billion under management has a portfolio which includes investments in technology, health care, media and software.