Reuters - Asia stock indexes made a quiet start to the second half of 2021 Thursday on worries about new coronavirus infections and fresh lockdowns while bond and currency markets were nervous ahead of U.S. labor data.

Japan's Nikkei was 0.3% lower while MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.2% in thin trade as Hong Kong markets were shut for a holiday.

The U.S. dollar hit a 15-month high against the yen and Treasury yields held steady.

"The virus is still playing a role...although it's difficult to see much direction in anything at the moment," ING economist Rob Carnell said from Singapore.

"There's a broad sense that the dollar isn't such a bad unit to be holding," he said, as traders turned to U.S. jobs data due Friday for the next clue on the Federal Reserve's rates outlook.

"Everyone's a little bit jittery...and there's so much money around that virtually every bet is covered," he said. "The market is completely divided - I think that's why things are pretty rangey," he added.

U.S. private payrolls beat expectations overnight, although they are an unreliable guide to the broader labor-market data due Friday, which economists forecast will show 700,000 jobs were added in June.

Data in Asia Thursday was mixed with Japan manufacturers' mood at a two-and-a-half year high but factory activity growth there slowed down in the face of difficulty sourcing computer chips.

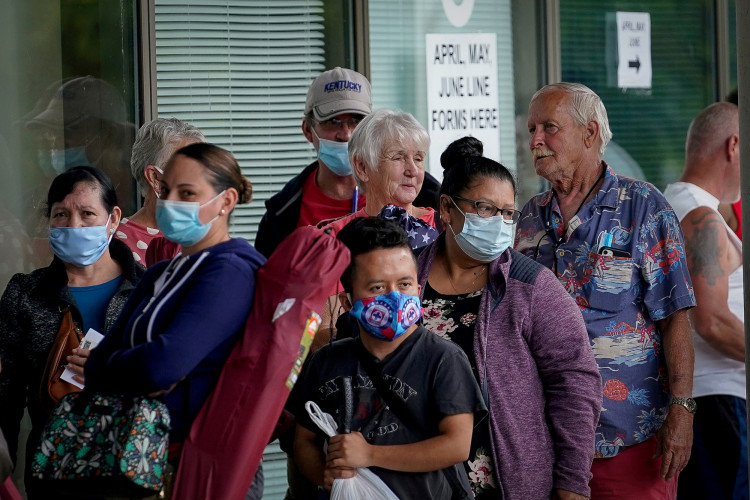

Slower vaccination rates in Asia and the extension of restrictions to curb the spread of the virus as the delta variant spreads - as well as a regulatory crackdown on China technology companies - have hurt regional markets this year.

The MSCI index closed out the first half with a gain of 5.8% compared with world stocks' rise of 11.4% and a gain of 14.4% for the S&P 500, which logged its fifth consecutive closing high to end June.

For bond and currency markets the concentration this week is on the U.S. nonfarm payrolls data and its implication for rates.

Since a shift in tone from the Federal Reserve last month suggesting interest-rate rises, the U.S. dollar has been elevated and bond markets up and down on worries about high inflation and whether it prompts a sooner or swifter than expected end to ultraeasy policy.

Signs of strength in the labor market could add pressure on the Federal Reserve to act, and the prospect of higher rates could lift the dollar, while it is vulnerable if the data misses expectations.

Economists polled by Reuters expect a gain of 700,000 jobs for June, up from 559,000 in May. But variation among the 63 estimates is big, ranging from 376,000 to more than a million.

"Unless the monthly jobs report disappoints, the level to beat for the dollar index is the year's high at 93.4," analysts at DBS Bank in Singapore said.

The U.S. dollar index, which measures the dollar against a basket of six comparative currencies, hit its highest since April overnight and was at 92.406 Thursday.

The dollar also traded near its strongest against the euro since April at $1.1850 and hit its highest since March 2020 at 111.16 yen.

The yield on benchmark 10-year U.S. Treasurys was steady in Asia at 1.4663%.

In commodity markets, prices for metals seem to be stabilizing below May peaks and oil was edging up to retest the multiyear highs touched earlier in the week.

Brent crude futures were last up 0.3% at $74.81 a barrel. Corn extended an overnight rise as lower-than-expected U.S. planting supported prices.