Reuters - Asia share indexes and U.S. Treasury yields rose Wednesday, clawing back some of the week's losses as investors reassessed economic worries. But the dollar was firm on concerns over the effects of a fast-spreading coronavirus variant.

Rising COVID-19 infections have rocked world markets this week as investors dumped riskier assets - seeking stability in safe havens like bonds. That sent stock prices down and pushed the benchmark U.S. 10-year yield to five-month lows Tuesday.

But Wednesday MSCI's broadest index of Asia-Pacific shares outside Japan was up 0.17% - trimming its losses for the week to around 2% while Japan's Nikkei rose 0.90% after touching six-month lows a day earlier.

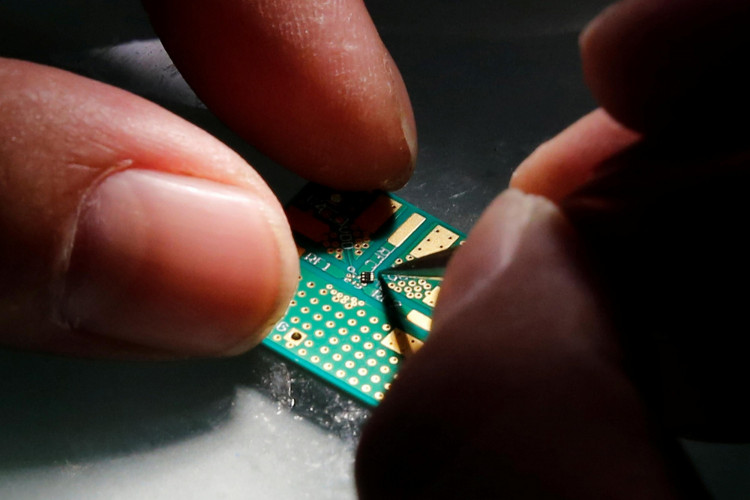

Sentiment in Japan was supported by a jump in exports in June, led by U.S. demand for cars and China-bound shipments of chipmaking equipment, boosting hopes for an export-led recovery.

Australia share prices were up 1.21%, China's blue chips added 0.76% and Taiwan share prices rose 0.27%.

Seoul's KOSPI slipped 0.14% as South Korea reported a daily record of virus cases.

"The level of volumes, the level of sporadic whip-saw price action I think is telling you that there's not a lot of conviction one way or another," said Kay Van-Petersen, a macro strategist at Saxo Capital Markets in Singapore.

But while he said peak world growth had likely passed, easy central bank policies continued to provide support for international asset prices even as they began to flag the tapering of asset purchases.

"The Group of Four central banks' balance sheets have been compounding by 15% since 2008. And my point is that's not going to stop. It's not going to get shut off."

On Tuesday, the Dow Jones Industrial Average rose 1.62% to 34,511.99 points, the S&P 500 gained 1.52% to 4,323.06 and the Nasdaq composite added 1.57% to 14,498.88.

The rise in share market gauges in Asia Wednesday was matched by a fall in U.S. Treasurys prices, with the 10-year yield rising to 1.2202% from the previous day's close of 1.209%. The two-year yield was at 0.2036%, up from a close of 0.194%.

But pointing to persistent worries around the effect of a rise in world Covid infections, the dollar stayed near three-month highs Wednesday.

"While some of the world is shrugging off rising infections as vaccination rates limit the severity of any symptoms of new cases, there are few parts of the world that can totally ignore this," said Rob Carnell, Asia-Pacific chief economist at ING.

The dollar index edged up 0.07% to 93.030, with the euro down 0.07% to $1.1771. The dollar was 0.05% stronger against the yen at 109.90.

Oil prices resumed falls after a rebound Tuesday, with U.S. crude down 0.4% at $66.93 per barrel and Brent at $69.12, down 0.33% on the day.

Spot gold shed 0.21% to $1,806.24 an ounce.