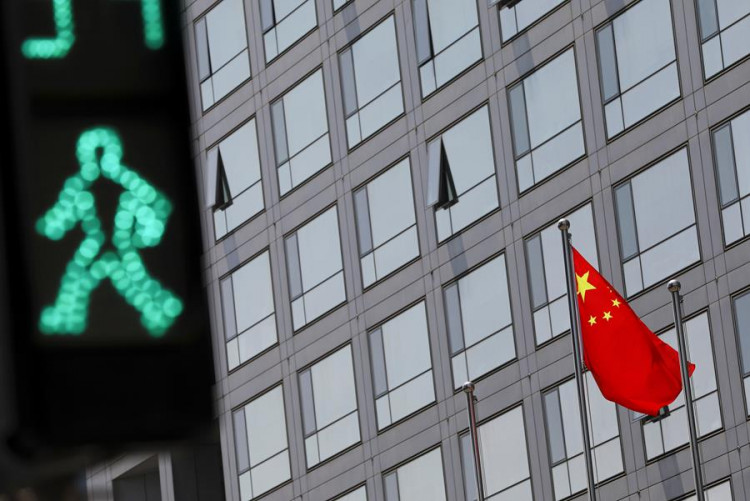

China's securities watchdog has urged for closer collaboration with its American counterpart after American regulators tightened disclosure requirements for Chinese companies and raised concern about China's regulatory policies, Bloomberg and Global Times reported.

Chinese and Hong Kong shares were down Monday following the news. In China, the Shanghai Composite was down 0.4% while the Hang Seng Index declined around 0.2%. Meituan and Tencent Holdings both shed more than 3%, according to Bloomberg.

The U.S. Securities and Exchange Commission said in a statement Friday that initial public offering filings by issuers with connections with China-headquartered operating companies will be nullfied unless they comply with certain disclosure conditions, Global Times said, Sunday.

In response to China's tightening of rules on private industry, SEC Chair Gary Gensler asked personnel to seek additional information from Chinese companies before giving them the clearance to sell stock.

China had earlier presented new policies that make it mandatory for virtually all companies wanting to list in a foreign nation to be subjected to a cybersecurity evaluation, a move that would increase monitoring of its private enterprises, Bloomberg said.

According to Global Times, the move is a solid measure to enhance the regulatory infrastructure in compliance with the changing landscape and to "standardize relevant enterprises' behavior."

The China Securities Regulatory Commission has always welcomed the idea of allowing companies to choose where to go public. According to CSRC, the country's fundamental national mandate of pushing reform and opening up is unswerving.

A CSRC representative said they are always maintained an open-attitude for Chinese firms' selection with regards where the companies will get listed, adding they back the companies' choices between international and domestic markets in conjunction with laws and regulations, the Global Times reported.

The clampdown on foreign listings comes after Didi Global moved ahead to list in the U.S., despite reservations from China over the company's data security, Bloomberg News previously reported.

China's cyberspace monitoring body disclosed any entity with data for more than 1 million users is required to submit a cybersecurity evaluation before they are given the green light to file an IPO overseas. The country's central bank has also stated non-bank payment processors must disclose proposals for international listings.