Advanced Micro Devices Inc (AMD) has finalized the deal to acquire Xilinx Inc, one of the largest deals made in the global chip industry. The deal, which is estimated to be valued at around $50 billion, is expected to give AMD the edge it needs to compete in the data center market.

The announcement of the finalized deal comes just days after Nvidia Corp said that it would no longer be pursuing its plans to buy out SoftBank-owned Arm Ltd due to insurmountable regulatory issues. AMD said it has already received all the necessary approval to move ahead with the acquisition.

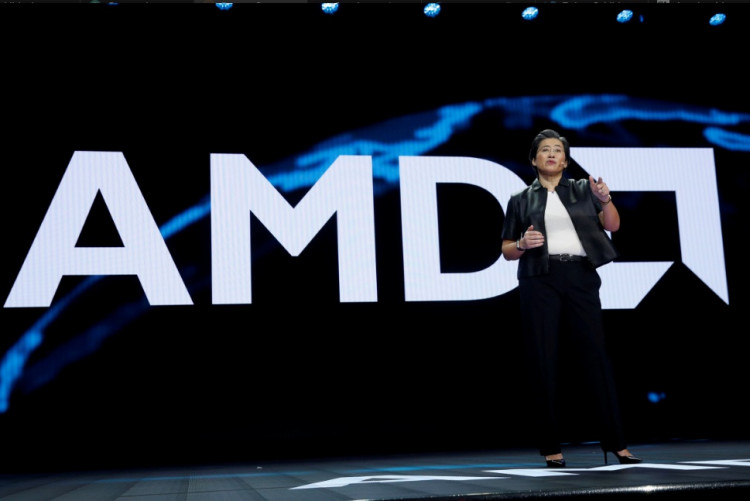

AMD Chief Executive Officer Lisa Su said the company acquisition of Xilinx makes a lot of sense as the two companies' businesses are complementary. Su said Xilinx's system on chips and field-programmable chips greatly complement AMD's advanced processor technology expertise. She explained that the company had used the arguments to convince regulators to approve the acquisition deal.

Su briefly touched on the topic of Nvidia's failed acquisition of Arm. She said that Arm continues to be an important partner for the company. She declined to comment further on Arm's future plans. Su will remain as the CEO of the combined company, while Xilinx's chief executive, Victor Peng, will serve as the president of the newly formed Adaptive and Embedded Computing Group.

AMD originally announced its plans to acquire Xilinx in October 2020. During that time, the deal was estimated to be worth around $35 billion. As AMD's stock value continued to rise, the deal's price tag also increased drastically. AMD's share price surged by more than 4% on Monday following its announcement. Other chip-related stocks also surged following the news.

Su said that the Xilinx merger would allow AMD to expand its reach in critical industries such as data centers, where Xilinx has a strong network and AI footprint. She added that with Xilinx, AMD should also be able to further penetrate sectors such as 5G communications, automotive, industrial, aerospace, and military. AMD only has a small presence in those segments, but with Xilinx, AMD is expected to gain more market share in the coming years.

AMD has been stepping up its competition with Intel Corp. The two companies mainly compete for market share in the personal computer segment, with both supplying their own brand of central processing units (CPUs.) AMD has profited from its more agile strategy in capturing market share from Intel, which has struggled with internal production issues.

With over 15,000 engineers and an outsourced production plan that mainly relies on supplies from Taiwan Semiconductor Manufacturing Co Ltd (TSMC), AMD is expected to have a big advantage over Intel.