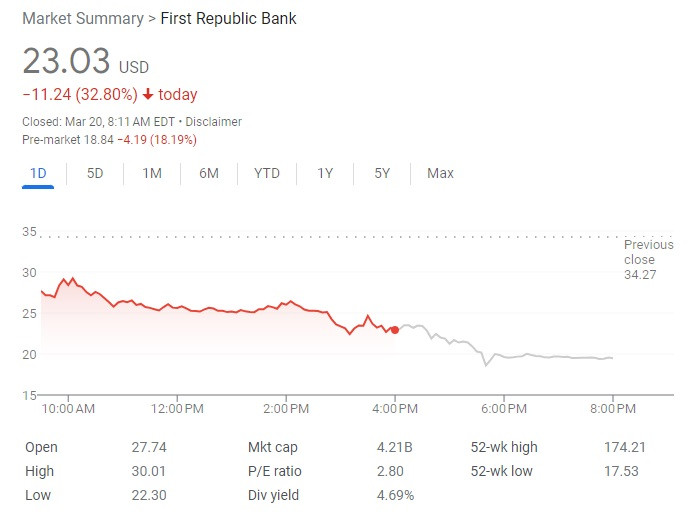

First Republic Bank's shares experienced a significant decline, 17% in premarket trading Monday, as investors reacted to reports of the bank raising capital through a private placement, sparking fresh liquidity fears. Additionally, Standard & Poor's (S&P) downgraded First Republic's credit rating, further impacting the bank's shares.

Reuters reported that First Republic Bank is in the process of raising $300 million in a private placement, which stirred concerns among investors about the bank's liquidity position. The news led to a decline in First Republic's shares, reflecting market apprehension about the bank's financial health.

In a direct quote from the Reuters article, a fixed-income trader said, "The market is taking it as a sign that the bank needs to bolster capital and is trying to raise money in a hurry." This sentiment was echoed by other investors, who viewed the private placement as an indication that the bank might be facing liquidity issues.

Adding to the bank's woes, CNBC reported that S&P downgraded First Republic's credit rating, citing concerns about its capital adequacy and risk management. In a statement, S&P Global Ratings credit analyst Alex Choi explained, "The downgrade reflects our view that First Republic's capital adequacy and risk management practices are less robust than we previously believed." This development further eroded investor confidence in the bank's stability.

The combined impact of the private placement report and the credit rating downgrade has raised concerns about First Republic Bank's financial health. As the market reacts to these developments, it remains to be seen whether the bank can assuage investor fears and stabilize its share prices in the coming days.