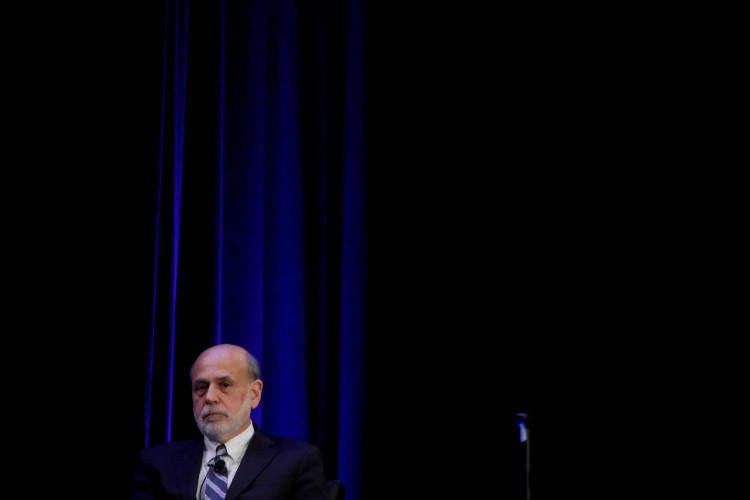

Former U.S. Federal Reserve Chairman Ben Bernanke suggested on Thursday that the Federal Reserve is likely to raise interest rates in July, which may be the final hike in the current cycle. Bernanke implied that it seems quite evident that the Fed will increase rates by 25 basis points at its next meeting, and this July increase might be the last one.

Currently, the market widely expects the Fed to raise interest rates by 25 basis points at the upcoming Federal Open Market Committee (FOMC) meeting. According to data from the federal funds futures market, traders are almost certain of a rate hike at the Fed's July 25-26 meeting, but simultaneously predict limited possibilities for further increases thereafter.

A recent media survey showed that the vast majority of economists expect the Fed to raise rates again next week, thus concluding this round of hikes that has lasted for 16 months. Only one-fifth predict additional hikes before November to curb inflation.

Bernanke predicted that with the easing of rent increases and the decline in car prices, inflation could fall more persistently to the level of 3% - 3.5% in the next six months. By early next year, U.S. inflation is expected to reduce to around 3%. Thereafter, he anticipates the Fed will proceed slowly, aiming to bring inflation down to the 2% target.

Bernanke's optimistic view on inflation aligns with another former Fed leader-former Federal Reserve Chair and current U.S. Treasury Secretary Janet Yellen. Yellen stated this week that a cooling labor market is playing a key role in slowing U.S. inflation, with housing costs and auto price pressures also decreasing. She expects these factors to continue driving price pressures lower and also hinted at a potential decline in corporate profit margins. However, Yellen cautioned against being overly optimistic due to the June CPI.

Last week, the U.S. announced June CPI and PPI data, both of which showed noticeable cooling of the country's inflation. The June CPI increase of 3% year-on-year was below expectations, hitting its lowest since March 2021, and core CPI rose by 4.8% year-on-year, also lower than expected, marking the lowest since October 2021. The June PPI cooled more than expected to 0.1%, reaching a new low since August 2020. The core PPI rose by 2.4% year-on-year, lower than expected, marking the lowest since February 2021.

Bernanke believes the Fed hopes to see a better balance between supply and demand in the labor market before declaring victory against inflation. Regarding the current labor market, Bernanke noted it's still hot. Although the number of JOLTS job vacancies has declined, each unemployed person still corresponds to approximately 1.6 vacant positions.

A previous Wall Street Journal article mentioned that the ratio of job vacancies to the number of unemployed reached a record level of over 2 in March of last year. This ratio was 1.2 before the pandemic and is still significantly higher than this long-term trend level.

Bernanke expects the U.S. economy may slow down as a cost of combating inflation. However, he emphasized that even if any recession occurs, it would likely be mild, marked by a very gentle rise in the unemployment rate and an economic slowdown. He would be quite surprised if the U.S. economy faces a severe recession next year.

Wall Street Journal reporter Nick Timiraos wrote last week that the Fed is likely to raise interest rates by 25 basis points in July. The real debate at the July meeting could center around under what circumstances it would be necessary to raise rates again in September or the fall. Slowing inflation data increases the likelihood that the July rate hike might be the last one.