New Partnership Emerges On the evening of August 28, Baozun E-commerce announced its mid-2023 financial report and declared a new partnership with the American brand management company, Authentic Brands Group (ABG).

Baozun will oversee the operation of ABG's Hunter brand in the Greater China region. In addition, the two companies will form a joint venture, allowing Baozun to acquire 51% of the intellectual property rights of the Hunter brand in both the Greater China and Southeast Asia regions.

This move indicates that after acquiring the GAP business in Greater China, Baozun is taking on another challenged fashion brand, aiming to cultivate its proprietary brand business as an additional pillar of growth.

A Look Back at the GAP Acquisition In November 2022, Baozun acquired GAP's Greater China business for approximately RMB 290 million and finalized several business agreements with GAP, granting them control over GAP's product design, production, and distribution channels in the Greater China region. The acquisition process was formally completed in February 2023.

Though Baozun hasn't been managing GAP for long and the GAP business is still undergoing a transitional loss period, Baozun continues to expand into new ventures, potentially facing multiple challenges.

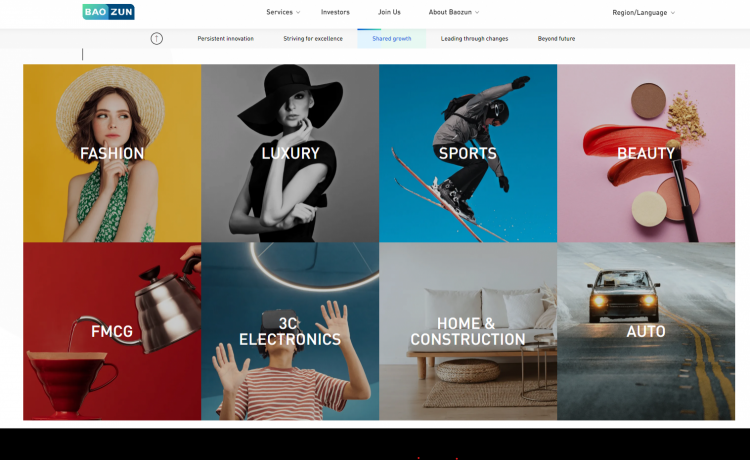

Baozun's current operations span three business lines: Baozun E-commerce (BEC), Baozun Brand Management (BBM), and Baozun International (BZI).

Of these, BEC remains the primary revenue generator, offering e-commerce services for brands. Meanwhile, BBM's main revenue comes from managing acquired brands like GAP and Hunter. BZI, Baozun's new overseas operation initiative, aims to replicate the successful Chinese e-commerce model abroad, establishing operations in locations like Hong Kong, Taiwan, Singapore, Malaysia, the Philippines, and France.

According to Baozun's mid-2023 report, as of June 30, 2023, the company's revenue was RMB 4.2 billion, a 2.5% increase from the previous year. Operating losses grew slightly from RMB 650 million to RMB 770 million, pushing the operating loss rate from 1.6% to 1.8%.

Revenue Breakdown and Diversification Revenues were split between product sales (38%) and e-commerce services (62%). The product sales component, apart from the contribution from GAP under BBM, also includes partnerships with BEC clients.

Pure e-commerce service revenues, a major contributor to Baozun's revenues, decreased by 4%, mainly due to the sale of a loss-making subsidiary in 2022.

It's noteworthy that Baozun is becoming less reliant on Tmall for e-commerce services, moving towards other platforms like JD.com, Douyin, and Vipshop. In the second quarter, revenue from the Tmall channel dropped by 10% to 65.9%, with non-Tmall channels rising to 34.1%.

Although GAP did provide a boost to product sales, this was offset by weaker sales in the small appliance and electronics categories. BEC e-commerce product sales revenue stood at RMB 1.08 billion, a 21.1% year-on-year decline.

GAP's Transition and Future Prospects During its transitional phase, GAP's operating losses were reduced by half compared to the previous year, with an overall gross profit margin reaching 52%. These improvements were primarily attributed to the closure of underperforming physical stores and limitations on discounting.

In the first half of 2023, GAP China generated RMB 513 million in revenue. Despite a 26% decrease in revenue in the second quarter, due to Baozun's closure of 86 stores (a 40% drop in store count), same-store sales grew by 11%.

As of June 30, GAP China had 121 stores, mainly in tier 1 and 2 cities. Baozun has plans for further expansion in other promising cities and regions. For this year, GAP aims to open up to 10 new stores, starting with a flagship store in Guangzhou.

Going forward, GAP China plans to introduce products designed by Baozun and expand its product range in the third and fourth quarters. It remains to be seen if these efforts will steer GAP China back onto a growth trajectory.

Challenges Ahead with the Hunter Brand The Hunter brand, founded in 1857 in Edinburgh and known for its Wellington boots, declared bankruptcy in June 2023. Shortly after, ABG acquired the brand's intellectual property.

Hunter's presence in the Chinese market is minimal, mainly relying on platforms like Taobao and JD.com. Unlike the exclusive operations with GAP China, after forming a joint venture with ABG, Baozun plans to leverage its new BZI division to expand the Hunter brand in Southeast Asia.