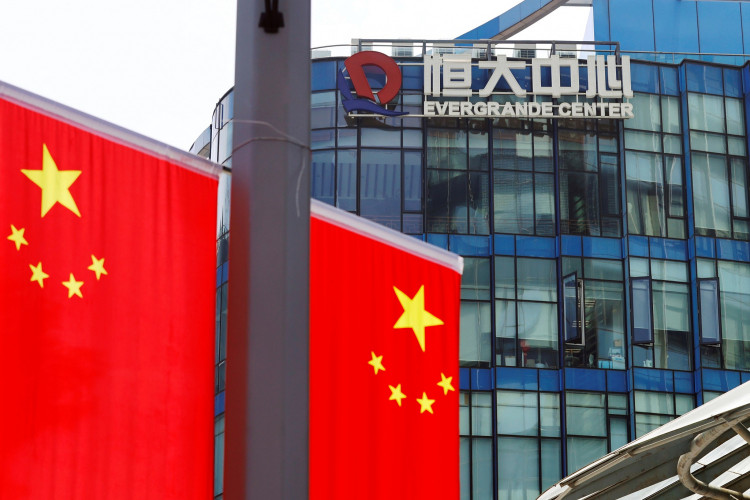

China Evergrande Group founder Hui Ka Yan has been barred from the securities market for life and fined 47 million yuan ($6.53 million) after the China Securities Regulatory Commission (CSRC) accused the group's flagship unit, Hengda Real Estate, of inflating results, engaging in securities fraud, and failing to make timely disclosures. The penalty is the latest setback for Evergrande, the world's most indebted property developer, which defaulted on its offshore debt in late 2021 and was ordered by the Hong Kong High Court to liquidate in January.

According to a filing by Hengda Real Estate, the CSRC's investigation revealed that the company had inflated its revenues by 213.99 billion yuan, or half of the total, in 2019. In 2020, sales were inflated by 350 billion yuan, or 78.5% of the total. The developer also issued bonds based on these falsified statements. The inflated figures accounted for a staggering $78 billion over the two-year period, highlighting the severity of the company's fraudulent practices.

In addition to the revenue inflation, Hengda Real Estate failed to make timely disclosures of annual and mid-term results, lawsuit cases, and outstanding debts. The CSRC found Hui directly responsible for these actions at the time, deeming the misconduct "egregious and grave in nature." Other executives, including Hengda Real Estate's former vice chairman and chief financial officer, were also punished for their involvement in the fraudulent activities.

The CSRC's decision comes just days after the regulator vowed to crack down on securities fraud and protect small investors with "teeth and horns." The move is part of a broader effort by Chinese authorities to address the ongoing real estate crisis and restore confidence in the market. In September 2022, Evergrande announced that its founder was being investigated over suspected crimes, foreshadowing the severe consequences that have now been handed down.

Hui Ka Yan, once Asia's second-richest man with a net worth of $42 billion at his peak in 2017, has seen his wealth plummet to about $1 billion since Evergrande's default and the subsequent suspension of its stock from trading. The developer's downfall began after regulators imposed tight restrictions on borrowing, while an economic slowdown and the pandemic further crimped sales.

The CSRC's findings reveal the extent of Evergrande's fraudulent practices, with the company recognizing sales in advance to boost revenue figures. The regulator also noted that some Hengda bonds issued in 2020 and 2021 cited data from the falsified 2019 and 2020 reports, raising suspicions of fraudulent issuance.

As a result of the CSRC's investigation, Hengda Real Estate will be fined 4.2 billion yuan and ordered to rectify its practices. The hefty fine and lifetime ban imposed on Hui Ka Yan serve as a stark warning to other companies and executives in the Chinese real estate sector, emphasizing the importance of transparency, accurate reporting, and timely disclosures.

The Evergrande scandal has sent shockwaves through the Chinese economy, highlighting the fragility of the country's heavily indebted property sector. As the government works to stabilize the market and prevent a wider economic fallout, the CSRC's decisive action against Evergrande and its founder demonstrates a commitment to enforcing regulations and protecting investors.

Reuters and Bloomberg contributed to this report.