Shares of Canadian uranium producers surged on Friday after the world's largest nuclear fuel supplier, Kazatomprom, announced a significant reduction in its 2025 production target. The Kazakhstan state-owned company, which accounts for roughly 20% of global uranium output, attributed the cut to ongoing supply chain issues and construction delays at its newly developed deposits. This announcement has heightened concerns about a potential uranium supply shortfall, adding fuel to an already bullish market for the heavy metal.

Kazatomprom's decision to slash its 2025 production forecast by approximately 17% has reverberated through the market, sending shares of Canadian uranium miners such as Cameco, Denison Mines, and NexGen Energy soaring. Investors are betting that the reduced output will push uranium prices even higher, with some analysts predicting that the price could breach the $100 per pound mark in the near future. As of August 19, the weekly uranium price stood at $81 per pound, according to data from UxC.

The potential for tighter uranium supply comes at a time when demand for nuclear energy is experiencing a resurgence. Governments around the world are increasingly viewing nuclear power as a key component of their strategies to achieve energy security and reduce carbon emissions. Countries like Japan and Germany, which had previously planned to phase out nuclear power, are now reversing course, while the World Nuclear Association projects that demand from nuclear reactors will rise by 28% by 2030 and nearly double by 2040.

Kazatomprom's production woes come despite strong financial performance in the first half of the year. The company reported a 27% increase in net profit to 283.2 billion Kazakhstani tenge (approximately $590.1 million), driven by higher uranium prices. Revenue also climbed 13% to 701.1 billion tenge. However, the company's operating profit fell by 10% to 226.72 billion tenge due to a 38% increase in the cost of sales. This rise in costs was largely attributed to higher production volumes and increased expenses related to uranium purchased from joint ventures and associates.

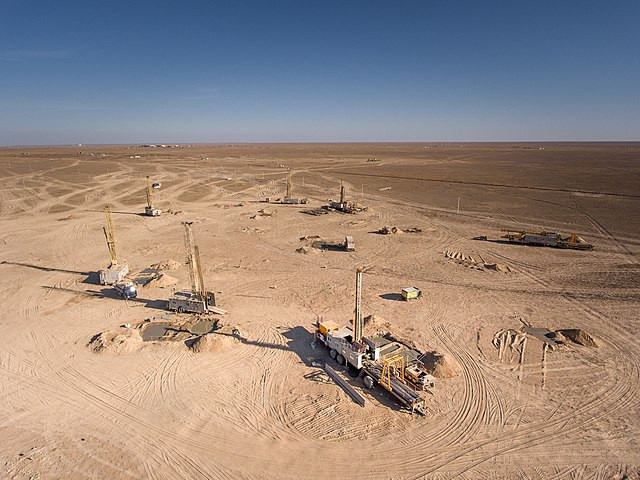

The ongoing challenges at Kazatomprom include delays in construction at new uranium deposits and difficulties in securing sulfuric acid, a critical component in the uranium extraction process. These issues have forced the company to lower its production outlook for 2025 to between 25,000 and 26,500 metric tons of uranium, down from its previous target of 30,500-31,500 tons. The company had earlier raised its 2024 production targets to 22,500-23,500 tons, but the outlook for 2025 underscores the persistent challenges in ramping up production to meet growing global demand.

The market reaction to Kazatomprom's announcement underscores the fragile balance between uranium supply and demand. With uranium prices already at elevated levels, the prospect of further supply constraints could lead to even greater volatility in the market. Analysts at Sprott Asset Management have suggested that prices could soar above $100 per pound if the supply-demand imbalance persists.

Adding to the uncertainty, Kazatomprom also announced the resignation of its Chief Financial Officer, Sultan Temirbayev, who stepped down on August 19 after just a year in the role. He will be succeeded by Marat Tulebayev, a seasoned executive with experience in Kazakhstan's investment and development sectors.

As the world grapples with the dual challenges of energy security and climate change, the role of nuclear power-and by extension, uranium-has never been more critical. For Canadian uranium producers, the supply constraints at Kazatomprom present both an opportunity and a challenge. While higher prices could boost revenues in the short term, the broader industry must navigate the complexities of increasing production to meet the rising demand for nuclear fuel.