Hurricane Milton, now bearing down on Florida's Gulf Coast, is poised to become one of the most costly storms in recent history, with analysts forecasting insured losses that could reach as high as $100 billion. The Category 4 hurricane, which is expected to make landfall near Tampa late Wednesday or early Thursday, could significantly alter the landscape of the global insurance and reinsurance markets in the coming years.

Estimates from industry experts suggest that Hurricane Milton could cause insured losses ranging from $25 billion to $100 billion, depending on its exact path and intensity. Analysts at Morningstar DBRS predict that if Milton directly hits the Tampa area, losses could climb to between $60 billion and $100 billion, putting it on par with the devastation caused by Hurricane Katrina in 2005, which remains the most expensive storm in U.S. history. "If Milton makes a direct landfall in a densely populated area like Tampa, the financial impact could be catastrophic," said Morningstar DBRS in a note to investors. They cautioned that while the potential losses are "substantial but not catastrophic," the storm could still rank among the most severe in recent decades.

Goldman Sachs analysts also highlighted the wide range of potential outcomes, noting that while a lower-end estimate stands at $25 billion, there is still significant uncertainty. They emphasized that Hurricane Milton's impact could be substantial enough to shift the reinsurance pricing narrative going into 2025. "We think that a $25 billion-plus storm starts to change the pricing narrative that we had previously laid out for reinsurance property CAT," they stated.

The potential scale of the losses from Milton is expected to have far-reaching implications for the reinsurance market. With insurers already grappling with high catastrophe losses in recent years, industry experts predict that rates could increase significantly during the upcoming policy renewals. Reinsurers such as Swiss Re, Munich Re, and Lloyd's of London players like Beazley and Hiscox have seen their shares dip this week in anticipation of Milton's impact, despite their strong profit performances earlier this year. "Better reinsurance contract terms, broader earnings diversification, and bigger reserve buffers should put the sector in better stead than before," analysts from RBC noted. They also mentioned that reinsurers could see their pricing power strengthen as the market adjusts to accommodate the increased risk posed by natural catastrophes.

Hurricane Milton's looming threat is drawing comparisons to past destructive storms like Hurricane Ian in 2022 and Hurricane Helene, which hit Florida just two weeks ago. Ian, which caused around $60 billion in insured losses, set the benchmark for recent catastrophic events in the region. Analysts believe that Milton could either match or exceed these figures, especially if it maintains its strength as it crosses Florida's densely populated areas.

Catastrophe bond fund managers, including Icosa Investments, have projected a wide range of potential impacts from Milton, with estimates ranging from $15 billion to $150 billion. This range underscores the uncertainty surrounding the storm's path, wind field expansion, and potential storm surge. "The difference between best and worst-case scenarios is stark, and it will ultimately depend on where Milton makes landfall and how it moves inland," noted a representative from Icosa Investments.

Insurers and reinsurers have been adjusting their strategies to manage the rising risks from natural disasters, which are exacerbated by climate change. The industry has been responding by tightening contract terms, raising rates, and building larger financial reserves to weather future losses. Lloyd's of London, for example, has been utilizing its Realistic Disaster Scenarios to stress test the market's ability to handle events like Milton. Analysts from Jefferies commented on the sector's ability to absorb the blow from Milton, suggesting that while the hurricane's impact could be substantial, it should be "manageable" for most insurers. "A 1-in-100 year event is estimated to result in $175 billion in losses for the Tampa region, so even the high-end projections for Milton remain within a conceivable range for the industry," they wrote.

The Florida insurance market, which has been under pressure due to rising premiums and increasing catastrophe losses, could face even more significant challenges post-Milton. "Insurance brokers are likely to benefit from stronger pricing, while insurers could be hit by yet another year of catastrophic losses exceeding $100 billion," noted analysts from Goldman Sachs. With Hurricane Milton still expected to maintain hurricane-force winds as it crosses the state, the storm's path inland will be crucial in determining the final loss figures. The focus will remain on how well insurers and reinsurers can adapt to the rapidly evolving risk landscape as the effects of climate change continue to drive more frequent and severe weather events.

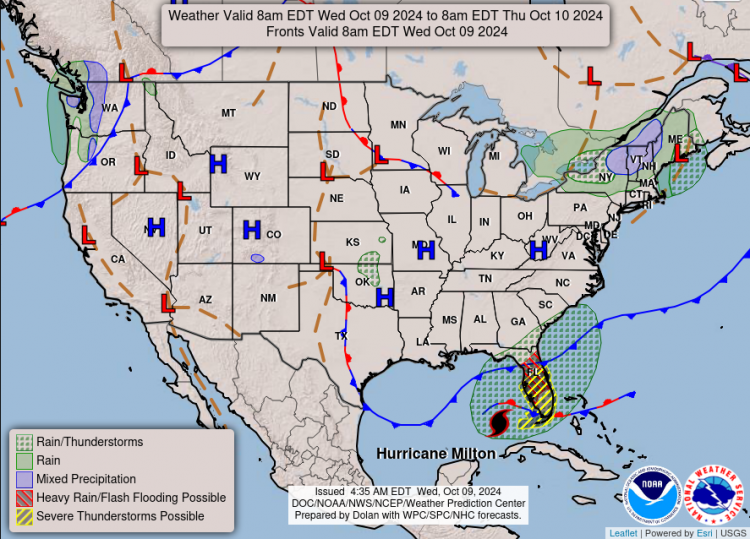

As Milton approaches, evacuation orders have been issued across the Gulf Coast, with millions of residents urged to seek safety. Authorities are particularly concerned about the storm surge, which could reach up to 15 feet in some areas, threatening to inundate low-lying communities along Florida's coastline. "We hope everyone heeds these evacuation orders," said Andrew Siffert of BMS Group. "This is an extremely dangerous storm, and the safety of the people in its path is paramount."

The U.S. National Hurricane Center has also issued warnings about the potential for tornadoes and severe flooding far inland as Milton progresses. The economic fallout from this storm could extend beyond immediate property damage, affecting industries ranging from tourism to agriculture.

Looking ahead, the insurance sector will likely see a reassessment of its risk models and pricing strategies as a direct result of Milton. Reinsurers are expected to become less flexible on pricing and maintain higher attachment points at the January 2025 renewals, counteracting any prior expectations of a softening market. "Hurricane Milton could be a turning point for the reinsurance industry," said RBC analysts. "The storm's impact on Florida and the broader insurance market will set the tone for how the sector prices risk in the face of increasingly volatile weather patterns."