The global technology sector experienced significant turbulence Monday as Chinese AI startup DeepSeek unveiled a cutting-edge artificial intelligence model that undercuts its U.S. competitors in cost and efficiency. The breakthrough sent shares of major AI and semiconductor companies plummeting in premarket trading, raising concerns about the sustainability of U.S. dominance in AI development.

Shares of Nvidia dropped 11%, while Taiwan Semiconductor Manufacturing Company (TSMC) and ASML Holding fell by over 11% and 7%, respectively. The Nasdaq futures index slipped 4%, reflecting widespread investor unease. Even companies not directly tied to semiconductors, such as Constellation Energy and Vistra, saw their stock prices decline by around 11%, as concerns mounted over the broader implications of DeepSeek's advancements.

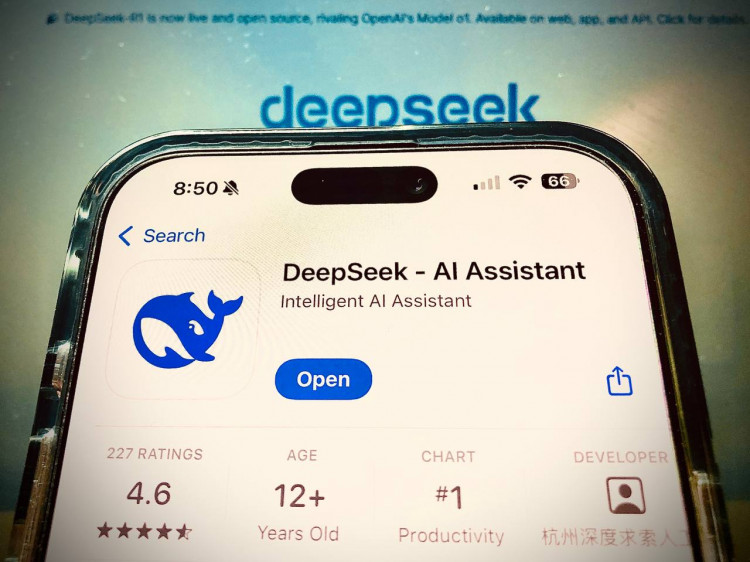

Founded in 2023, DeepSeek has quickly emerged as a formidable competitor in the global AI race. Its new model, DeepSeek R1, claims performance on par with leading chatbots like OpenAI's ChatGPT but at a fraction of the development cost. The model, which powers a mobile app that has surged to the top of iPhone app store charts worldwide, distinguishes itself by articulating its reasoning before delivering responses, a feature aimed at mimicking human thought processes.

DeepSeek's rapid ascent comes despite U.S. export restrictions designed to curb China's access to high-performance semiconductors. These measures were intended to slow Chinese advancements in AI by limiting access to cutting-edge GPUs. However, DeepSeek's success highlights the ability of Chinese companies to innovate within constrained environments, focusing on efficiency rather than brute computational power.

According to reports, DeepSeek's R1 model ranks highly on several leading benchmarks, including AIME 2024 for mathematical tasks and MMLU for general knowledge, positioning it among the most capable AI models globally. The app, which has already been downloaded 1.6 million times as of January 25, has gained significant traction in markets such as the U.S., Canada, Australia, and China.

The launch of DeepSeek's model has raised questions about the long-term strategies of U.S. tech giants, including Meta and Microsoft, which have collectively committed over $65 billion this year to AI infrastructure. Critics argue that DeepSeek's cost-efficient approach could force competitors to reevaluate their capital-intensive investments in AI hardware.

In a note released Monday, Citi analysts reaffirmed their buy rating on Nvidia despite the stock's sharp decline. The analysts questioned whether DeepSeek achieved its results without relying on advanced GPUs for initial model training, emphasizing the ongoing advantage of U.S. companies with access to cutting-edge technology.

DeepSeek's achievements also draw attention to its founder, Liang Wenfeng, a former AI-driven hedge fund leader. Liang, who established the company with a modest initial investment of $1.4 million, has stressed the importance of fostering a domestic AI ecosystem in China to reduce reliance on foreign technologies. "More investment does not necessarily lead to more innovation," Liang said in an interview with Chinese media, advocating for efficiency and resourcefulness over sheer financial power.

However, DeepSeek's rise has not been without challenges. The company briefly experienced a major outage on January 27 due to overwhelming user demand. Its chatbot also self-censors on politically sensitive topics, adhering to Chinese regulations, which could limit its appeal in global markets. For example, the bot deflects questions about the 1989 Tiananmen Square protests or Chinese President Xi Jinping while engaging more freely on other geopolitical topics.