In a seismic shift in the global technology market, Chinese AI startup DeepSeek has ignited a dramatic selloff in tech stocks, erasing billions in value across the industry. The Nasdaq plunged 3.1% on Monday, its sharpest drop in months, as investors reacted to the unexpected debut of DeepSeek's low-cost AI model, R1, which threatens the dominance of established U.S. players like Nvidia and OpenAI.

Leading the fallout was Nvidia, which suffered an unprecedented $593 billion market-cap loss, marking the largest single-day drop for a publicly traded company in Wall Street history. Nvidia's stock fell nearly 17%, dragging down other industry giants such as Broadcom, Microsoft, and Google parent Alphabet, which all recorded significant losses.

Brian Jacobsen, chief economist at Annex Wealth Management, commented on the potential impact of DeepSeek's advancements, saying, "If it's true that DeepSeek is the proverbial 'better mousetrap,' that could disrupt the entire AI narrative that has helped drive the markets over the last two years." He added that such developments "could mean less demand for chips, less need for a massive build-out of power production to fuel the models, and less need for large-scale data centers."

DeepSeek's 'Sputnik Moment'

DeepSeek, a Hangzhou-based startup, unveiled its R1 model last week, touting it as a cost-effective alternative to established AI technologies. The company claimed its model was trained using Nvidia's lower-capability H800 chips, with development costs reportedly totaling just $5.6 million-a stark contrast to the billions spent by U.S. firms.

Marc Andreessen, a prominent Silicon Valley venture capitalist, compared DeepSeek's breakthrough to the Soviet Union's launch of Sputnik, calling it "one of the most amazing and impressive breakthroughs I've ever seen." Andreessen added, DeepSeek R1 is “”a profound gift to the world."

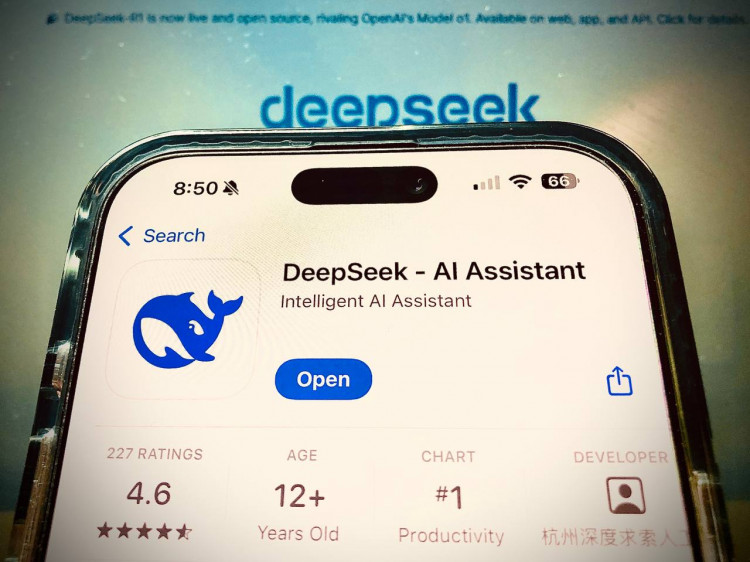

The R1 model quickly gained traction, surpassing OpenAI's ChatGPT in downloads from Apple's app store. Its emergence as a viable competitor has raised concerns about U.S. companies' ability to maintain their technological edge, especially given years of export restrictions on high-performance AI chips to China.

Broader Market Impact

The ripple effects of DeepSeek's debut extended across global markets. The Philadelphia Semiconductor Index saw a staggering 9.2% drop, its largest decline since March 2020. Companies tied to AI infrastructure, including Marvell Technology and Vertiv Holdings, experienced double-digit losses, while energy providers like Constellation Energy and Vistra, which had been banking on the power demands of AI data centers, also faced sharp declines.

Michael Block, market strategist at Third Seven Capital, remarked, "Markets had gotten too complacent on the beginning of the Trump 2.0 era and may have been looking for an excuse to pull back - and they got a great one here." He added that the development was causing a significant reevaluation of AI-related investments.

Futures for natural gas and oil, key components in powering AI infrastructure, also plummeted, reflecting diminished investor confidence in the sector's growth trajectory.

U.S. AI Leadership Under Scrutiny

The U.S. has long dominated the AI landscape, bolstered by robust investments from tech giants and government initiatives. Last week, President Donald Trump announced a $500 billion private-sector AI investment plan, which included contributions from companies like SoftBank and OpenAI. However, DeepSeek's rise has raised questions about whether U.S. firms can maintain their competitive edge.

"DeepSeek's rise could spark renewed investor interest in undervalued Chinese AI companies, providing an alternative growth story," said Charu Chanana, chief investment strategist at Saxo.

Investors Seek Clarity

Amid the upheaval, industry analysts remain divided on the long-term implications of DeepSeek's breakthrough. While some view the selloff as an overreaction, others warn that it could signal a broader shift in the AI industry.

"Time will tell if the DeepSeek threat is real," Block noted. "the race is on as to what technology works and how the big Western players will respond and evolve."

Nvidia, despite Monday's losses, remains a critical player in AI infrastructure, with analysts like Daniel Morgan of Synovus Trust Company viewing the dip as a buying opportunity. "The real money in AI is providing the chips for the data centers from the likes of (Nvidia), Advanced Micro Devices (AMD.O), opens new tab and Broadcom. Overall, I view the AI tech selloff today as an opportunity to add high-quality tech shares on weakness. ," Morgan said.