The AmInvestment Bank Bhd (AmInvestment Bank) forecasted in its latest Thematic report that Malaysia's economy is bound to recover by the second half of 2019. The news came after it was previously predicted that the country will post its lowest Q12019 GDP.

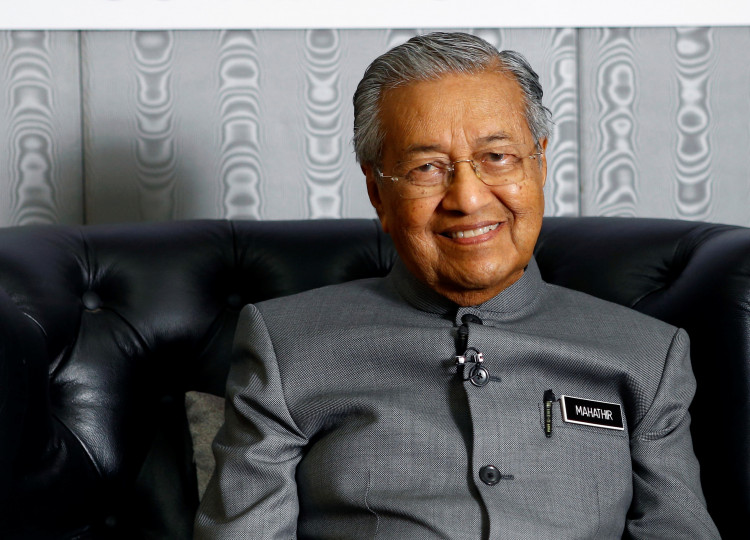

According to the Borneo Post, the AmInvestment Bank said Malaysia's economy will rebound later this year due to higher oil prices and as the Pakatan Harapan (PH) government steps up construction projects. The forecast came amid concerns about an economic slump in the country.

The Malaysian government is set to kickoff a total of 121 projects by the second half of this year. Part of the initiative is the re-opened transport project with China that was seemingly forgotten over the past year ever since it was halted in May 2017.

Aside from increased construction projects, higher oil prices are expected to positively impact the Malaysian economy. "Though our base case oil projection for Brent is US$62 to US$65 a barrel on average, if the current trend persists, it could touch our best case which is US$65 to US$68 a barrel on average for 2019," the report noted.

AmInvestment Bank clarified that while external headwinds such as a slowing global economy could affect the forecast, Malaysia's macro fundamentals such as reserves and current account surplus figures could cushion potential risks to the economy.

Despite more optimistic forecasts on Malaysia's economy for QH2019, the ringgit continues to underperform, triggering talks on the Malay currency possibly depreciating further instead of going stronger against the U.S. dollar.

According to the Straits Times, the latest data revealed that the Malaysian ringgit was the least performing currency in Asia. Adding to the burden is the FTSE Russell announcement that it is planning to remove Malaysian debt from its index.

Analysts said the move could be enhanced further by global concerns about market liquidity as Norway announced earlier this month that it will cut Malaysian securities from its index.

Amid fears over the ringgit's depreciation, the Sun Daily reported that dealers are optimistic of the Malaysian currency this week. Dealers are reportedly expecting to see the ringgit trading higher this week, especially after the Bandar Malaysia project's revival.

One of the dealers said the ringgit will most likely find allies in foreign fund managers as more investors and spectators watch out for the revived Bandar Malaysia project and how it will affect the country's goals of transforming into a global fintech and business hub.