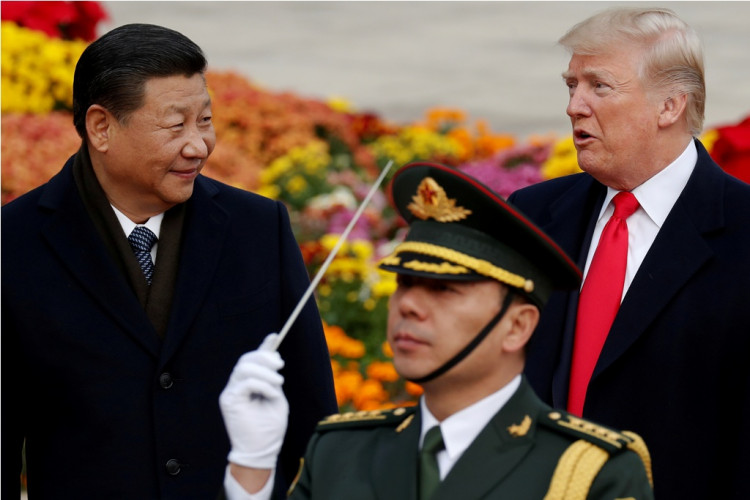

China and the U.S. have reportedly agreed to delay any tariffs expected to be imposed anytime soon as Chinese President Xi Jinping and U.S. President Donald Trump are scheduled to meet later this week at the G20 Summit.

According to the South China Morning Post, two sources from Washington and one from Beijing with knowledge of the situation revealed that the two sides are still laying out details about the temporary truce.

One source further revealed that Trump decided to make the move after Xi agreed to meet him at the sidelines of the Japan summit later this week. However, another source noted that Trump is someone who "could always have a change of heart."

The White House did not comment on the alleged truce but some analysts noted that delaying the threat to slap another batch of tariffs on Chinese goods will play a major role in how Xi and Trump will end their upcoming meeting.

One insider who spoke on condition of anonymity and is familiar with talks between the two sides disclosed that the two governments are also negotiating about press releases after the summit. Instead of a joint statement by Beijing and the White House, separate but coordinated messages will be sent to the media.

On Wednesday, the U.S. president warned that he has a "Plan B" in case talks with Xi at the Osaka summit turn sour. He noted that his scheme involves taking in "billions and billions of dollars a month," Bloomberg reported.

Trump further said in his Wednesday interview with Fox Business Network that part of the plan is to "do less and less business with them." If this plan pushes through, many Chinese companies in partnership with U.S. firms will be blocked just as Huawei was.

Some analysts pointed out that it appears Trump's Plan B is already at play through Chinese tech giant Huawei. The tech equipment provider has been blacklisted from collaborating with American firms last month.

It is unclear what will trigger Trump to haul in the billions he is planning to get from China through tariffs but he hinted that his tariff impositions may be reduced to 10 percent instead of 25 percent if the talks on Saturday morning fall out.

Meanwhile, oil prices retreated after a five-week high in global markets. Some industry analysts blamed Trump's shady comments about Japan ahead of the G20 Summit while others said his confusing remarks on talks with Xi partly affected prices.

Managing Partner at Vanguard Markets, Stephen Innes, noted that Trump's statements before the G20 meet-ups are pushing U.S. inventories down. While the drop "is positive in the longer term," Innes pointed out that oil markets are "very focused on what's more prompt."