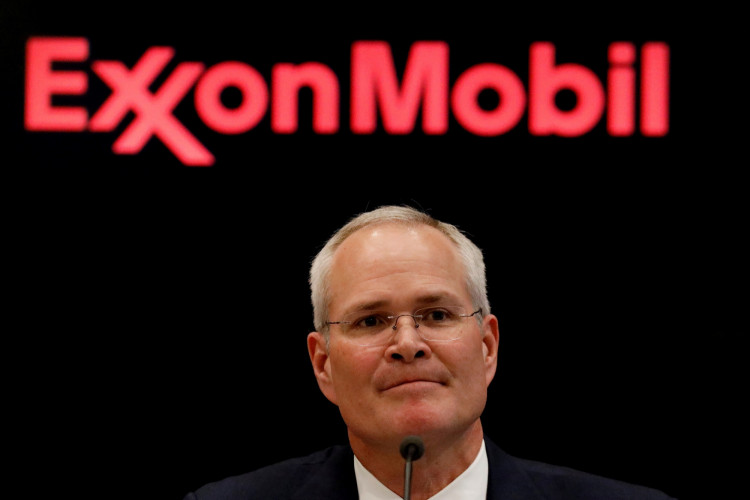

US oil and gas giant ExxonMobil continues its plunge this year, hitting a nine-year low amid its worse-than-expected earnings results. The company, which was once hailed as the most valuable public company during its peak, has now managed to wipe out nearly $184 billion in market value since 2014.

The market value that the company had lost is roughly equivalent to the entire value of companies such as Boeing and Tesla. Exxon reached its lowest point in nearly a decade on Tuesday, immediately following the release of its earnings.

Investors likely lost confidence in a possible turnaround for the company, which has been struggling to keep itself upright over the last few years. Exxon's shares hit $59.97 on Tuesday, recovering slightly on Wednesday's trading session. In 2014, Exxon's shares peaked at above $103 per share.

Exxon's struggles as mainly due to the fact that almost none of its businesses have reported significant growth. In a market with bearish oil prices and even cheaper natural gas, Exxon has found it increasingly hard to keep its shareholders happy. The company's chemical business has all but crumbled in recent years and investors fear that its refining business could suffer the same fate.

Analysts at BP Capital Fund Advisors have pointed out that sentiments towards oil companies are currently at its worst and that most are suffering from a "PR Issue." Concerns over the climate crisis and increasing carbon emissions are eating into oil companies' bottom lines as investors shift to more socially-conscious options.

At its peak in mid-2014, Exxon had a market value of $446 billion. This was during a time when oil prices were well above $100 a barrel. Since then the company market value has dropped by more than 41 percent. Industry experts blamed Exxon's late entry into the shale boom as the main factor for its continued decline. Instead of taking advantage of the boom that was happening in its own backyard, Exxon focused on its more expensive and long-term drilling projects overseas.

Major investment firms mirrored the decline in confidence in the company's stocks this week, with Morgan Stanley telling clients that other oil firms were a better bet than Exxon. Analysts at the bank explained that Exxon is currently the "most exposed" to negative headwinds in the industry. Meanwhile, Goldman Sachs downgraded the company's stock to a "sell" rating this week. At the same time, the investment bank slashed the company's price targets from $72 to $59.

Analysts pointed out that while other oil companies are hunkering down by spending less, Exxon is doing the complete opposite and is spending aggressively on new projects. Last year, the company was forced to cover up to 64 percent of its dividends using funds from loans and asset sales.