Chinese chipmaker Semiconductor Manufacturing International Corp (SMIC) is reportedly planning to list its shares in Shanghai; potentially raising up to $3 billion. China will likely be backing the Hong Kong-listed company's bid to list its shares in the mainland, as part of its efforts to reduce the country's reliance on foreign-made semiconductors.

The company's shares in Hong Kong surged by more than 11 percent after news broke out that its board had approved plans to list as much as 1.69 billion new shares in Shanghai. Based on its closing stock price and its current market valuation of $11 billion, the company could raise as much as $3 billion during its listing in mainland China.

SMIC is a key company in China's bid to make its semiconductor industry fully self-reliant. The company had stated that the added funds from the share sale will be used to develop next-generation microchips and to enhance its current manufacturing infrastructure. With the added capital, SMIC hopes to be on equal footing with rivals such as Intel and fellow Chinese chipmaker TSMC and Huawei.

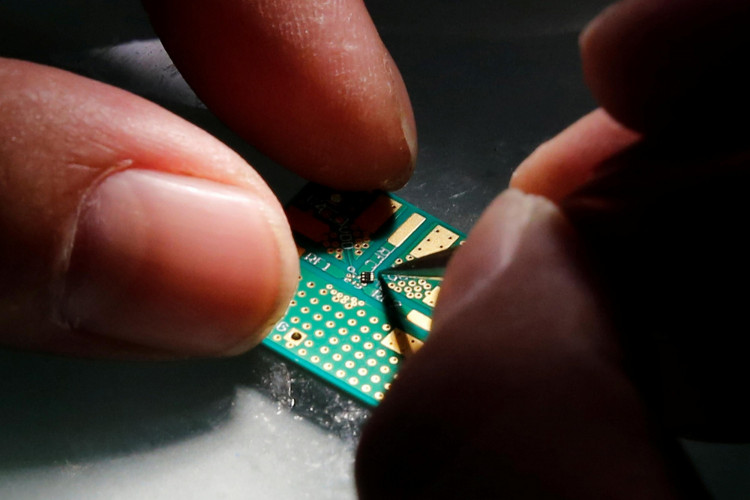

SMIC will use part of the funds into research and development to enhance its capabilities in producing 12-inch wafers. The company currently competes with other chipmakers who manufacture chips larger than 14 nanometers, most of which are used in smartphones and servers. However, the company does lag behind in terms of its capability in producing more advanced chips for high-end computing devices.

The move comes as the US and its allies tighten restrictions on transactions between the US and Chinese tech companies. The restrictions imposed by the Trump Administration have threatened the supply of valuable components to China, forcing companies to find alternative suppliers or to produce their own components and circuitry.

Analysts have stated that companies such as Huawei and SMIC are gradually severing their ties with foreign suppliers to avoid any further disruptions caused by tensions between China and the US. Hastening that process is particularly important given the rising tensions between the two nations due to the ongoing coronavirus pandemic.

SMIC's plans to list in Shanghai follow its decision to voluntarily delist its American depository shares from New York last year. The company's move to stay closer to home may also end up boosting the local equities markets, particularly Shanghai's tech innovation board, which is better known as the Star Market. Since its launch last year, the Star Market has been struggling to attract major tech companies and had mostly been listing smaller startup tech firms.