Chinese chip maker Semiconductor Manufacturing International Corporation (SMIC) is pushing ahead with its planned share sale in Shanghai. The country's largest chip manufacturer is aiming to raise up to 20 billion yuan or roughly $2.8 billion from the planned listing.

The decision to list its shares domestically once again comes as the company looks to expand its production capability and reduce China's dependence on foreign-made components. The company plans to list no more than 1.69 billion shares on Shanghai's tech innovation board, or better known as the Star Market.

The move is also a preemptive strategy to prepare its operations for a possible increase in demand for semiconductors should the US decide to fully cut off Chinese companies from US-made products. In order to achieve its goals, SMIC has decided to launch a secondary listing in Shanghai in addition to its existing listing in Hong Kong. The proceeds it will acquire from the planned listing will be added to the $2.2 billion it had received from two state-owned funds last month.

SMIC's rapid expansion efforts are part of China's much wider push to reduce its dependence on foreign semiconductors, a sector that is lagging behind when compared to countries such as the US and South Korea. The urgency to enhance the publicly held company's capabilities comes as the tensions between China and the US continue to escalate amid the global economic downturn caused by the coronavirus pandemic.

With the US' standing trade restrictions and its targeting of Chinese firms, including Huawei Technologies, China has had to find ways to support its growing tech industry. Last year, the US had placed a number of Chinese firms under its trade blacklist, essentially robbing them of access to key components made by US-based firms such as Intel and Nvidia. The US has allowed some US firms to continue doing business with their Chinese partners but on the condition that they first acquire a license from the government.

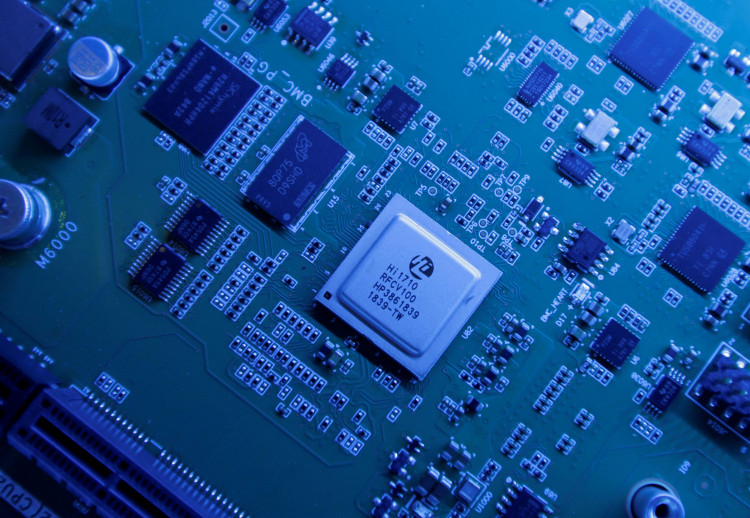

As of the moment, SMIC's semiconductors are still inferior to those being produced by its foreign counterparts. However, the company has laid out plans to install new foundries that are capable of making advanced 12-inch wafers, allowing it to expand beyond the 14-nanometer semiconductor market.

So far the company's efforts to diversify its portfolio have yielded some results. According to its latest earnings report, the company had managed to quadruple its net profits for the first quarter of this year thanks to the continually growing demand for its products from local manufacturers.