Banks operating in Hong Kong are now ramping up their incentives programs to attract more customers to their platform amid the pending release of the city's HK$71 billion or $9.2 billion stimulus aid to residents. Lenders are offering ridiculous prizes to residents who open an account through their platforms, including gold bars and cash prizes.

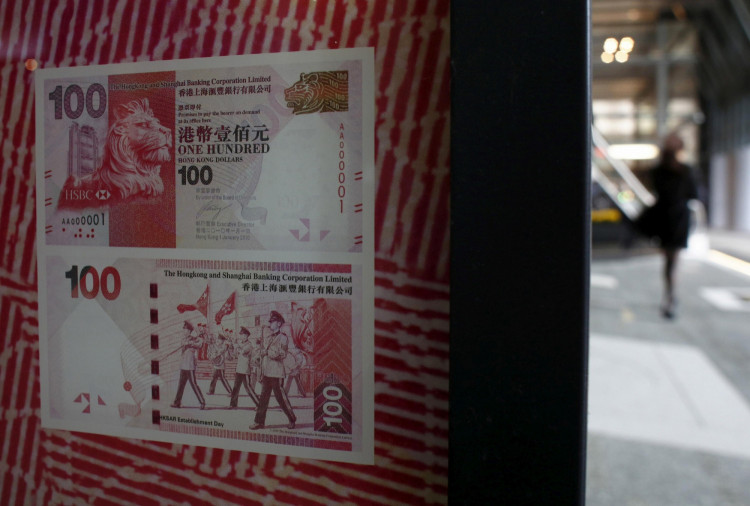

The most expensive prize, in terms of market value, is from Shanghai Commercial Bank. The lender is planning to give a tael of gold bullion, worth an estimated HK$16,146 based on current prices, to one lucky account holder on its platform. Meanwhile, HSBC is offering a HK$10,000 cash prize to a lucky winner through its lucky draw program. Other banks such as China Construction Bank Asia and Standard Chartered are also offering cash prizes along with gadgets such as iPhones and iPads.

HSBC is also offering an attractive 10 percent interest rate for short-term deposits on its platform, subject to caps. The program has since been extended to existing accounts if they register for the handout using its platform.

The offering of the exuberant prizes comes as lenders race to get the accounts of residents who are set to receive a HK$10,000 cash payout on June 21 from the government. The funds will be disbursed to residents electronically as part of the Financial Secretary Paul Chan Mo-Po's budget plan for the year. The stimulus is aimed at jump-starting the city's economy, which had been ravaged by months of social unrest and from the economic effects of the coronavirus pandemic.

Over the last quarter, Hong Kong's economy had contracted by about 8.9 percent, the worst on record. The idea behind the stimulus package is to ease Hong Kong resident's financial burden and to encourage them to spend money. However, experts believe that most who will receive the cash aid will likely preserve the money through deposits and savings accounts.

The chairman of the Hong Kong Securities Association, Gordon Tsui, pointed out that residents are more likely to save the government handout for rainy days. This does give banks an incentive to grab a piece of the pie.

Lenders are banking on this speculation as deposits are one of the cheapest sources of funding. Apart from gaining capital, banks can also cross-sell depositors other products, generating additional revenue. Around 7 million Hong Kong residents are set to receive cash through any one of the 21 participating banks accredited by the government for the program. Given the looming release of the funds, Banks are now scrambling to get as many residents on their platforms as they can.