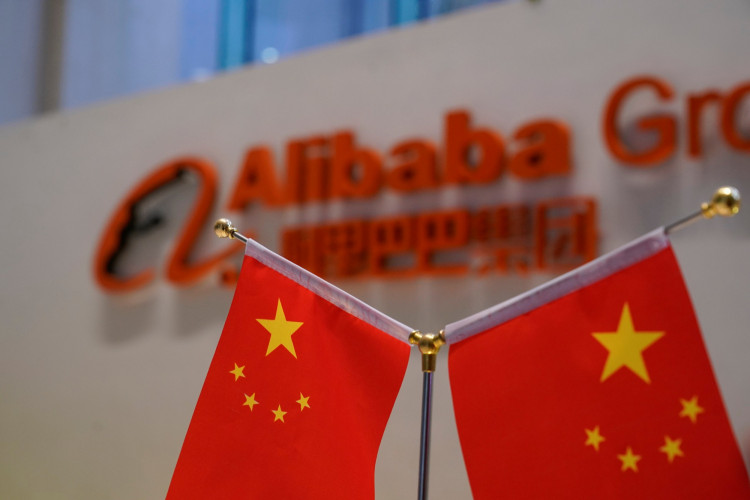

Alibaba Group Holding Ltd.'s healthcare unit Alibaba Health Information Technology Ltd. raised nearly $1.30 billion from the sale of new shares, according to news reports Wednesday. The company will use the proceeds of the follow-on share sale to expand its medical services and pharmaceutical network to meet demand in China, it said.

Alibaba Health offered 499 million new shares, or about 3.8 percent of its outstanding shares, according to the reports. The company priced the shares at HK$20.05, they said. The pricing was an 8 percent discount to the company's Tuesday closing price in Hong Kong of HK$21.80 ($2.71) a share. Alibaba Health shares were down 2.75% at HK$21.20 in the first session since the deal was finalized. The size of the deal was increased by 25% during institutional book-building overnight as a result of demand from investors. This is the largest healthcare follow-on share sale in Hong Kong and the largest internationally since 2015, the news reports said.

There have already been 13 Hong Kong-listed pharmaceutical and biotech offerings since the start of the year, according to data from Refinitiv. These raised more than $4.56 billion compared with $60.2 million last year.

Demand for pharmaceutical and medical technology products has increased because of the spread of the coronavirus pandemic. Alibaba Health's business has boomed during the crisis as a result of its participation in pandemic control efforts and consumer support. Alibaba Health partnered with e-commerce platform T-mall, still owned by Alibaba Group, to provide fast delivery of medications and medical equipment to individuals and hospitals in China.

The company reported a net loss for its first quarter but did see a big drop in losses for its second quarter. The company said much of China had quickly adopted online drug purchases which had resulted in a rise in its overall sales. Alibaba Health plans to use part of the proceeds of its share sale to strengthen its digital business, including entering into partnerships with upstream pharmaceutical companies to expand online direct drug sales.