The market valuation of American financial technology company Robinhood Markets, Inc. has shot to more than $11.2 billion following its latest funding round. The company, which operates one of the largest free trading apps, said it raised an additional $200 million.

The announced market valuation of the company is an increase of 1.3 times from its $8.6 billion market valuation achieved during a funding round in July. The increase suggests Robinhood continues to grow in the industry in spite of an economic slowing as a result of the coronavirus.

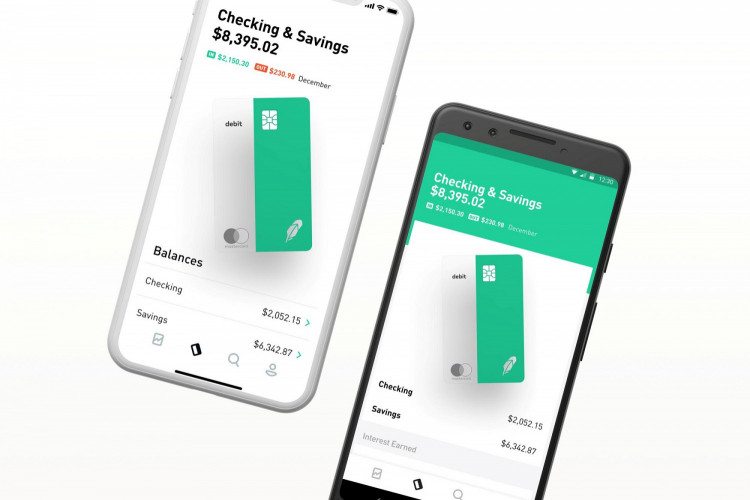

Robinhood transformed online trading and met a need for an easily accessible trading platform and this has helped it to succeed in the current worldwide health and economic crisis.

At the height of the pandemic in May Robinhood said it had added more than 3 million users. Around half of the new users were first-time stock investors attracted by the company's low fees and easy to use app. Between its first and second quarters Robinhood reported revenues generated from commissions and fees more than doubled.

Fintech analysts at PitchBook Data, Inc. said the increase in new Robinhood users could be attributed to a growing need for people to make profits in the current economic climate. The demand validated Robinhood's business model, they said. Robinhood's app has become so popular that traditional investors are now tracking stocks being traded by its users to gauge market response.

At its current private valuation Robinhood is larger than many S&P 500-listed companies. Robinhood has hinted of a possibility of listing its shares but there has been no concrete announcement.

However, Robinhood's success has caught the attention of regulators. They are concerned about the free-trading boom it has inspired in the U.S. Regulators have asked the company to add additional safeguards to discourage speculative trading. Recently a 20-year old student apparently committed suicide after discovering he had a negative $730,000 account balance.